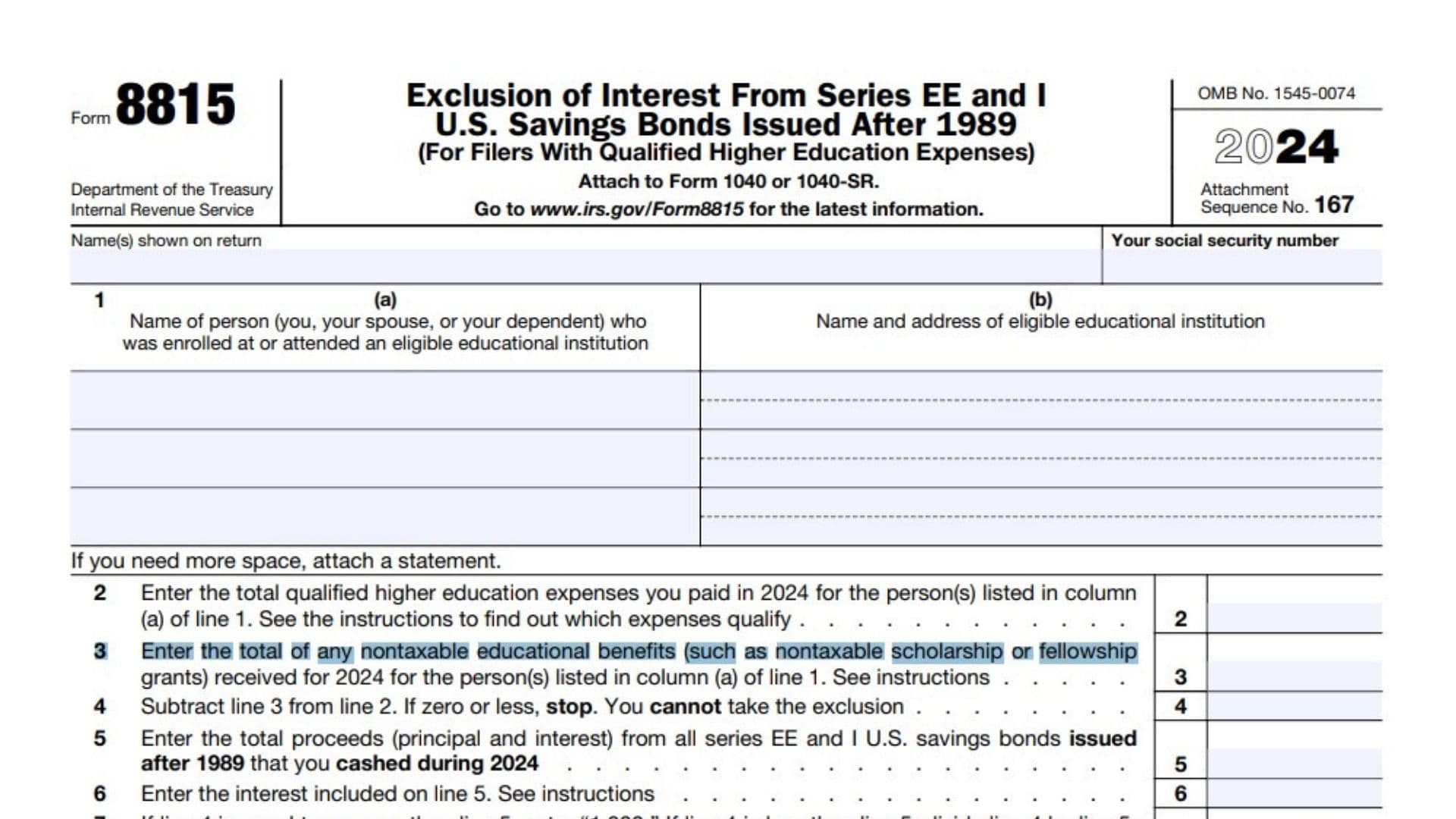

IRS Form 8815, titled “Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989,” is designed for taxpayers who have cashed in U.S. savings bonds and wish to exclude the interest earned from their taxable income, provided that the funds were used for qualified higher education expenses. This form is particularly relevant for those who have cashed series EE or I bonds issued after 1989 and incurred expenses related to higher education for themselves, their spouses, or their dependents. To qualify for this exclusion, certain criteria must be met, including income limits and appropriate filing status. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their overall tax liability.

How to Complete Form 8815?

Step 1: Gather Necessary Information

- Collect all relevant documents, including your U.S. savings bonds redemption statements and records of qualified higher education expenses.

Step 2: Fill in Personal Information

- Line 1:

- Column (a): Enter the name of the individual who was enrolled at or attended an eligible educational institution or for whom you made contributions to a Coverdell Education Savings Account (ESA) or a Qualified Tuition Program (QTP). This individual must be you, your spouse, or your dependent(s) claimed on Form 1040 or 1040-SR.

- Column (b): Enter the name and address of the educational institution. If multiple institutions were attended, list all of them. If you contributed to a Coverdell ESA or QTP, enter “Coverdell ESA” or “QTP” along with the financial institution’s name and address.

Step 3: Report Qualified Higher Education Expenses

- Line 2: Enter the total qualified higher education expenses incurred in 2024 that were not covered by nontaxable educational benefits. These expenses include tuition and fees required for enrollment but exclude room and board and courses not part of a degree program.

Step 4: Report Nontaxable Educational Benefits

- Line 3: Enter the total amount of qualified higher education expenses included on line 2 that were covered by nontaxable educational benefits such as scholarships or veterans’ educational benefits.

Step 5: Calculate Qualified Expenses

- Line 4: Subtract line 3 from line 2 to determine your total qualified higher education expenses eligible for exclusion.

Step 6: Report Total Interest Earned

- Line 5: Enter the total interest earned from the savings bonds you cashed in during the year.

Step 7: Complete Line 6 Worksheet

- Line 6: If you reported any interest from savings bonds in previous years, complete the worksheet provided in the instructions to determine the amount to enter on this line.

Step 8: Calculate Modified Adjusted Gross Income (AGI)

- Line 9: Follow the instructions to calculate your modified AGI based on your income sources as outlined in the worksheet.

Step 9: Final Calculations

- Use the information from lines 4, 5, and your modified AGI to determine the final exclusion amount you can claim on your tax return.

Step 10: Review and Submit

- Review all entries for accuracy before submitting Form 8815 with your tax return. Ensure that you keep copies of all supporting documentation related to your savings bonds and qualified education expenses.

By carefully following these instructions for IRS Form 8815, you can effectively navigate the process of excluding interest from your taxable income associated with U.S. savings bonds used for educational purposes. This attention to detail not only ensures compliance with IRS requirements but also maximizes potential tax benefits related to higher education financing.