Form 8814 is used by parents who want to include their child’s investment income on their tax return. It will prove that the child has some investment income and can be used to compute your child’s deductible investment interest limit. This form must be completed and filed with the parent’s Form 1040 tax return. The IRS will apply the child’s tax rate to the first $2,100 investment income and the parent’s rate to the rest. However, if the child earns more than $10,500 in unearned income, the child must file their own tax return.

When to File Form 8814?

- If your child is receiving a dividend from a business or has received interest from a mutual fund, you may be able to deduct it on your own return if you meet certain requirements. For example, your child must be younger than 18, and his or her gross income must be less than $10,500. If the child receives more than $2,100 in interest from an investment, it is possible to deduct it on your return as well.

- It’s also important to fill out this form for each child you have. For example, if you have five children, fill out a separate form for each child. This way, you won’t have to worry about the children filing separate Forms 8615. The screen will also provide fields for up to five children. However, if you have more than five children, you’ll need to enter their information in additional units.

How to Complete Form 8814?

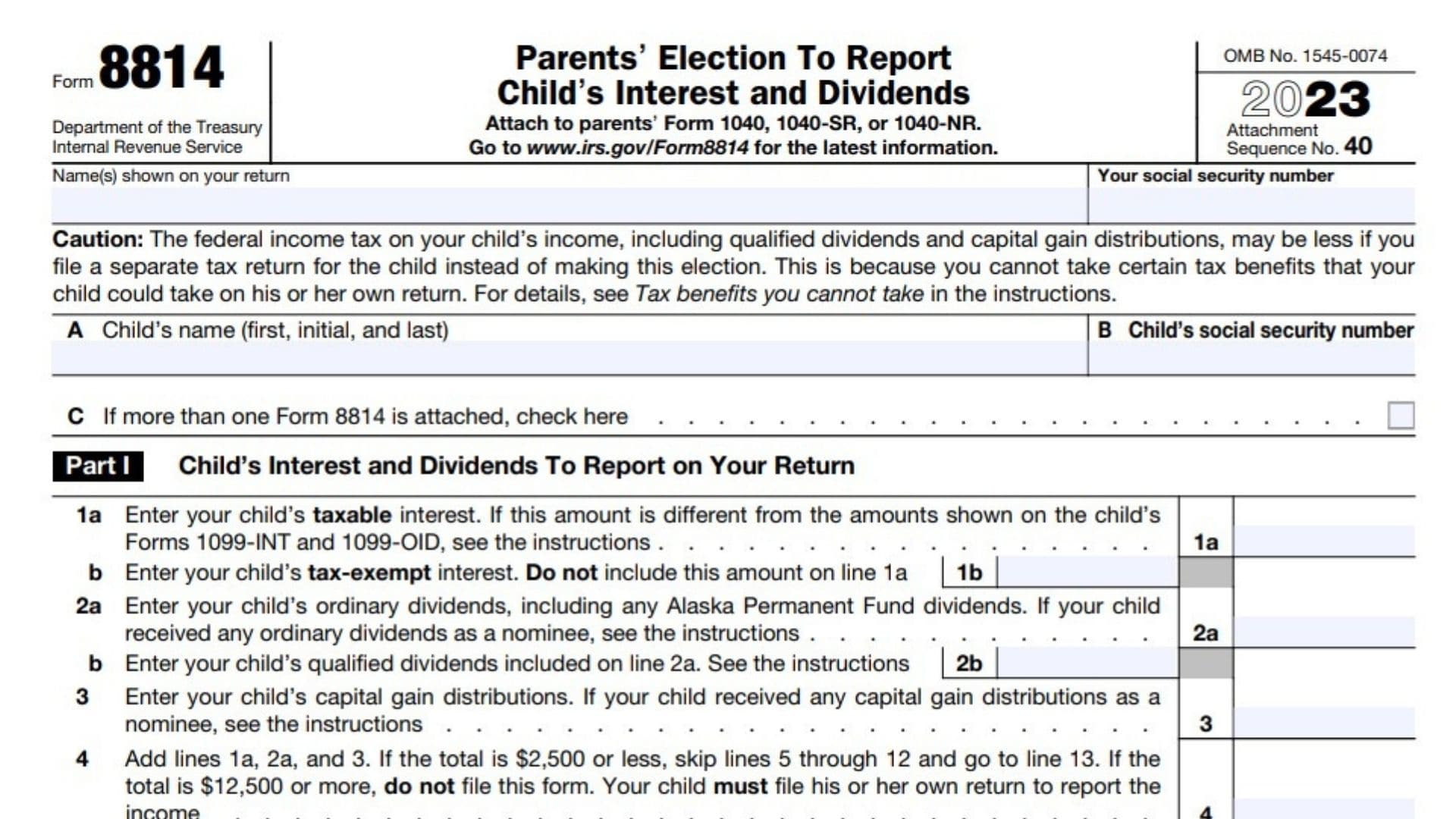

- Enter your social security number

- A: Enter your child’s name

- B: Child’s social security number

- C: Check the C box If more than one Form 8814 is attached.

Part I

- 1a. Enter your child’s taxable interest.

- 1b. Enter your child’s tax-exempt interest

- 2a. Enter your child’s ordinary dividends ( also includes Alaska Permanent Fund dividends )

- 2b. Enter your child’s qualified dividends included on line 2a.

- 3. Enter your child’s capital gain distributions

- Skip lines 5 through 12 and go to line 13 if the total amount in 1a, 2a, and 3 is $2,200 or less.

- 5. Base amount. Enter 2,200.

- 6. Subtract line 5 from line 4

- If 2b and 3 are zero or blank: skip lines 7 through 10,, enter -0- on line 11, and go to line 12. Otherwise, go to line 7.

- 7. Divide line 2b by line 4. Enter the result as a decimal

- 8. Divide line 3 by line 4. Enter the result as a decimal

- 9. Multiply line 6 by line 7. Enter the result here.

- 10. Multiply line 6 by line 8. Enter the result here

- 11. Add lines 9 and 10

- 12. Subtract line 11 from line 6. Include this amount in the total on Schedule 1 ( Form 1040 ), line 8z. In the space next to that line, enter “Form 8814” and show the amount. If you checked the box on line C above, see the instructions. Go to line 13 below . . .

Part II

- 13. Enter 1,100 ( Amount not taxed )

- Subtract line 13 from line 4. If the result is zero or less, enter -0

- 15. Is the tax amount on line 14 less than $1,100?

No. Enter $110 here and see the Note below.

Yes. Multiply line 14 by 10% (0.10). Enter the result here and see the Note below

Note: If you checked the box on line C at the top of the form, see the instructions. Otherwise, include the amount from line 15 in the tax you enter on Form 1040,1040-SR, or 1040-NR, line 16. Don’t forget to check box 1 on Form 1040, 1040-SR, or 1040-NR, line 16.