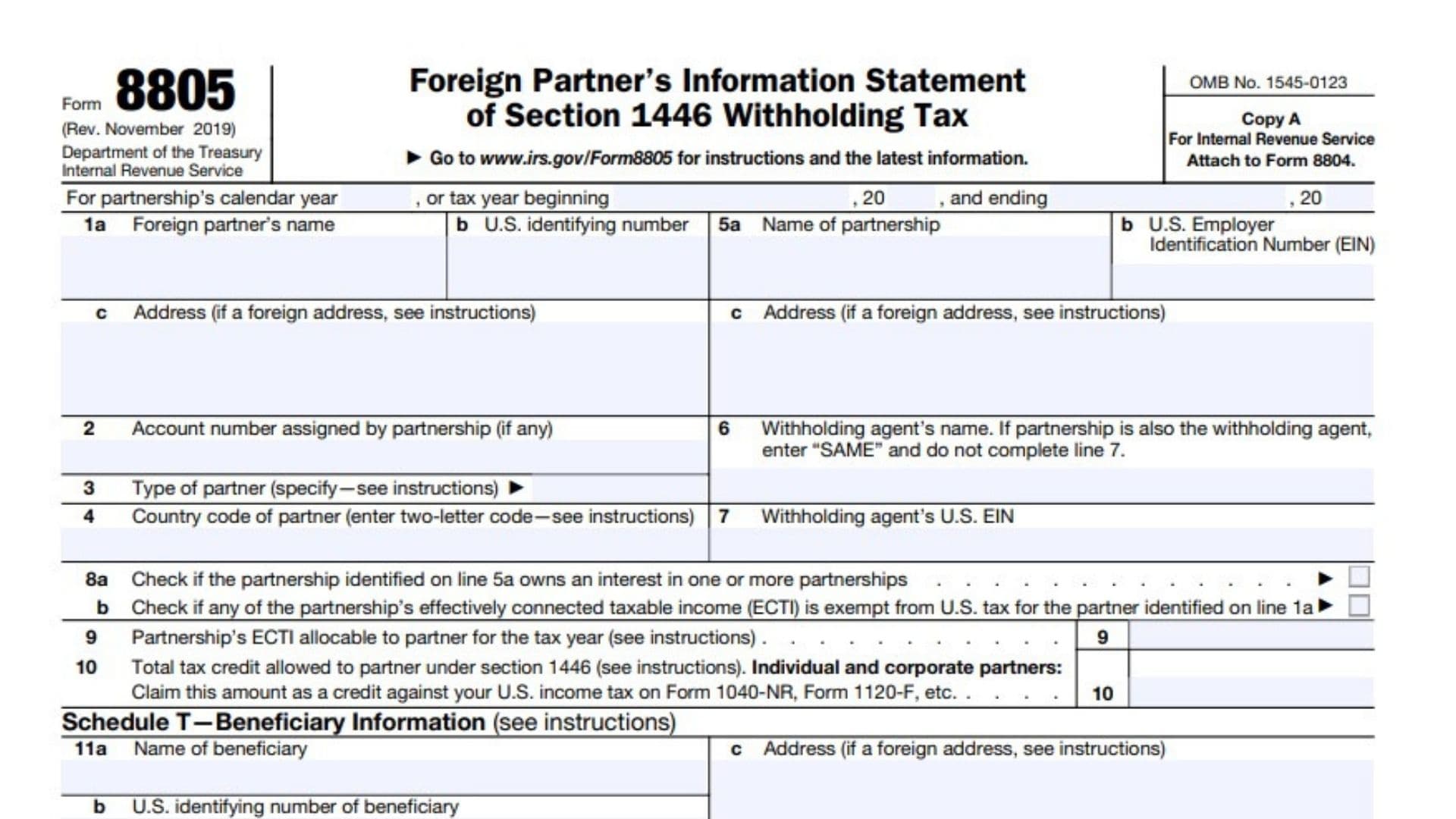

Form 8805, titled “Foreign Partner’s Information Statement of Section 1446 Withholding Tax,” is an IRS form used by partnerships to report the tax withheld on effectively connected taxable income (ECTI) allocable to foreign partners. This form is essential for partnerships as it ensures compliance with Section 1446 of the Internal Revenue Code, which mandates withholding on a foreign partner’s share of ECTI. Each foreign partner listed on Form 8805 receives a copy of the form, which they can use to claim the withheld tax as a credit on their U.S. tax return.

Purpose of Form 8805

The primary purpose of Form 8805 is to report the income allocated to foreign partners and the corresponding withholding tax as required by Section 1446. This regulation requires partnerships with foreign partners to withhold taxes on the income effectively connected with a U.S. trade or business. The form must be attached to Form 8804, which is the annual return for withholding tax, to show each foreign partner’s allocated income and tax withheld.

Who Must File Form 8805?

Any partnership that has foreign partners with income subject to Section 1446 withholding must file Form 8805. This includes foreign and U.S.-based partnerships with partners who are non-resident aliens or foreign corporations. Each foreign partner must receive a separate Form 8805 reflecting their share of income and withheld tax.

How to Complete Form 8805?

Foreign Partner’s Information (Lines 1-4)

- Line 1: Enter the foreign partner’s full name, U.S. identifying number, and foreign address (if applicable). This information confirms the identity and residence of the foreign partner receiving income.

- Line 2: Enter any account number assigned by the partnership if one exists.

- Line 3: Specify the partner’s type (individual, corporation, etc.).

- Line 4: Provide the foreign partner’s country code using the IRS’s designated two-letter codes.

Partnership Information (Lines 5-7)

- Line 5: Include the partnership’s name, U.S. Employer Identification Number (EIN), and address.

- Line 6: Enter the name of the withholding agent. If the partnership itself is the withholding agent, write “SAME” and skip Line 7.

- Line 7: Provide the withholding agent’s U.S. EIN if different from the partnership.

Additional Partnership Details (Line 8)

- Line 8a: Check this box if the partnership holds an interest in other partnerships, which may impact the allocation of income and tax obligations.

- Line 8b: Indicate if any of the partnership’s ECTI is exempt from U.S. tax for the identified foreign partner.

Income and Withholding Information (Lines 9-10)

- Line 9: Report the foreign partner’s share of the partnership’s ECTI for the tax year. This is the portion of income that is subject to U.S. tax.

- Line 10: State the total tax credit allowed to the foreign partner under Section 1446. This amount is used by individual and corporate partners to claim a credit on their U.S. income tax returns.

Schedule T – Beneficiary Information (Lines 11-13)

- For partnerships with beneficiaries, the partnership must complete Schedule T, detailing each beneficiary’s name, identifying number, and address.

- Line 12: Enter the amount of ECTI included in each beneficiary’s gross income.

- Line 13: Specify the amount of tax credit available to each beneficiary, which they can claim on their tax return.

Filing and Record-Keeping Requirements

- Attaching to Form 8804: Form 8805 must be attached to Form 8804, which consolidates the total tax withheld on behalf of all foreign partners. Partnerships submit Form 8804 along with all Form 8805 copies to the IRS.

- Providing Copies to Partners: The partnership is required to provide each foreign partner with a copy of Form 8805. The partner uses this to claim any withheld tax on their tax return, such as Form 1040-NR for individuals or Form 1120-F for corporations.

- Retention of Records: Partnerships must retain copies of Form 8805 and other related tax records for reference in case of IRS inquiries or audits.

Key Considerations and Compliance Tips

- Accurate Information: Ensure all identifying information is accurate. Incorrect names or EINs can lead to processing delays or issues in claiming tax credits.

- Foreign Partner Exemptions: Partnerships should carefully evaluate if a foreign partner qualifies for any tax exemptions, which may reduce the withholding obligations.

- Timely Submission: Partnerships must submit Form 8804 and all related Form 8805 copies by the due date to avoid penalties. Extensions can be requested if additional time is needed.