IRS Form 8615, known as the “Kiddie Tax” form, applies to children who have unearned income above a certain threshold. The purpose of this form is to tax certain children’s unearned income at their parents’ tax rate rather than the child’s typically lower tax rate. This prevents families from shifting investment income to children to minimize taxes. It generally affects children under age 19, or under 24 if they are full-time students and meet specific income requirements.

Unearned income includes dividends, interest, capital gains, and other investment income. If your child receives this income, IRS form 8615 is necessary to determine how much tax is owed. The form is attached to the child’s Form 1040 or 1040-NR when filing tax returns, and it contains detailed calculations to ensure the proper tax amount is reported.

Filing this form correctly is important to comply with IRS rules and avoid penalties. The form’s calculations are complex, so step-by-step guidance is valuable in understanding how to report the income and compute tax correctly.

How To File Form 8615

Form 8615 must be attached to the child’s annual income tax return (Form 1040 or 1040-NR). Usually, parents or guardians complete this form for children who meet the criteria for unearned income tax. Before filing:

- Gather the child’s tax documents, including statements showing unearned income like dividends and interest.

- Obtain the parent’s tax information, as some of the calculations are based on the parent’s tax returns.

- Verify if the child fits the age and income thresholds to be required to file Form 8615.

After completing the form alongside Form 1040, submit it per IRS filing requirements. Electronic filing software often includes prompts to complete this form if applicable.

How To Complete Form 8615?

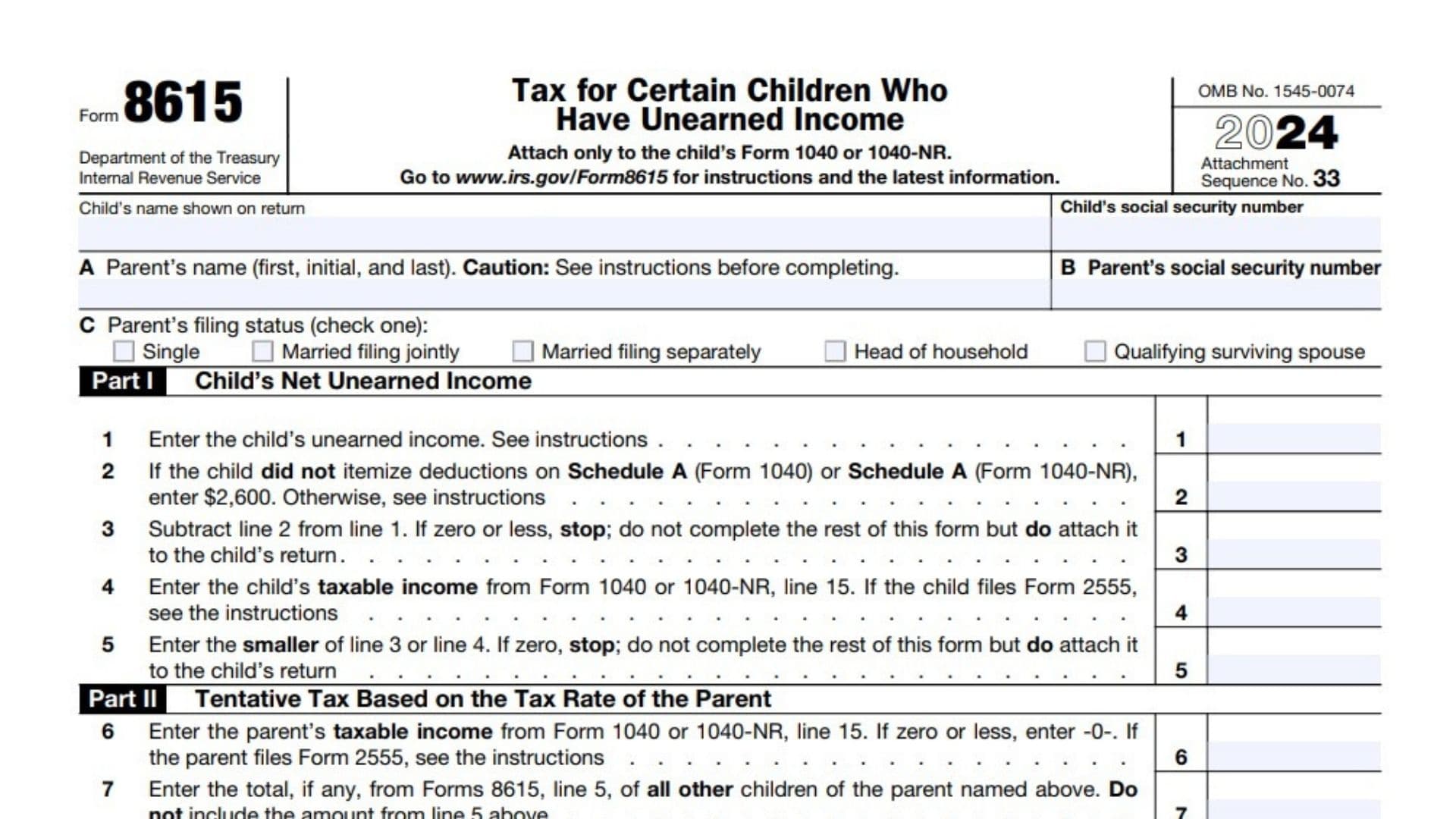

Child’s Name and Social Security Number:

Enter the name and Social Security number of the child whose unearned income is being reported.

Parent’s Name and Social Security Number:

Provide the full name and SSN of the parent or guardian. This information is necessary because the child’s tax is calculated based on the parent’s tax rate.

Parent’s Filing Status:

Check the box that corresponds to the parent’s filing status (Single, Married filing jointly, Married filing separately, Head of household, or Qualifying surviving spouse). This affects tax rate calculations.

Part I — Child’s Net Unearned Income

- Line 1: Enter the child’s total unearned income. This includes dividends, interest, capital gains, rents, royalties, and other investment income.

- Line 2: Enter $2,600 unless the child itemized deductions on Schedule A. See the IRS instructions to confirm.

- Line 3: Subtract line 2 from line 1. If the result is zero or less, you do not need to complete further sections but must attach the form to the tax return.

- Line 4: Enter the child’s taxable income from Form 1040, line 15.

- Line 5: Enter the smaller amount between line 3 or line 4. If zero, stop here and attach the form to the return.

Part II — Tentative Tax Based On The Tax Rate Of The Parent

- Line 6: Enter the parent’s taxable income from their Form 1040, line 15.

- Line 7: Enter total amounts from line 5 of Form 8615 for any other children of the same parent, excluding the current child.

- Line 8: Add lines 5, 6, and 7.

- Line 9: Enter the tax on the amount on line 8, calculated at the parent’s tax rate.

- Line 10: Enter the parent’s tax from their Form 1040, line 16, subtracting any alternative minimum tax.

- Line 11: Subtract line 10 from line 9. If no amount on line 7, also enter this on line 13 and continue to Part III.

- Line 12a: Add lines 5 and 7.

- Line 12b: Divide line 5 by line 12a. Enter result as a decimal.

- Line 13: Multiply line 11 by line 12b.

Part III — Child’s Tax

- Line 14: Subtract line 5 from line 4.

- Line 15: Calculate the child’s tax on the amount on line 14 using their tax rate.

- Line 16: Add lines 13 and 15.

- Line 17: Enter the tax on the amount on line 4 based on the child’s tax rate.

- Line 18: Enter the larger of line 16 or line 17 here and on the child’s Form 1040, line 16.

Following these detailed instructions will help ensure Form 8615 is accurately completed, the correct tax on a child’s unearned income is calculated, and compliance with IRS rules is maintained.

Frequently Asked Questions

What is IRS Form 8615 used for?

It is used to calculate tax on certain children’s unearned income using their parents’ tax rate.

Who must file Form 8615?

Children under certain age and income limits who have unearned income above a threshold must file.

Can Form 8615 be filed electronically?

Yes, many tax filing software programs support Form 8615 electronically.

What happens if I don’t file Form 8615 when required?

You may face penalties and the IRS can reassess your tax liability.