IRS Form 8609-A is a crucial document for taxpayers who own buildings that qualify for the Low-Income Housing Credit (LIHTC) under Section 42 of the Internal Revenue Code. This form acts as an annual statement that reports the ongoing compliance and credit calculations for each eligible low-income housing building. If you have received approval for the LIHTC through IRS Form 8609, you must file Form 8609-A every year for the entire 15-year compliance period to ensure continued eligibility for tax credits.

The Low-Income Housing Credit is an essential federal tax incentive aimed at encouraging affordable housing development, allowing owners to claim tax credits based on the property’s eligible and qualified basis. Form 8609-A calculates the credit allowed for the year, ensures compliance with housing requirements, and helps the IRS verify that the property meets the program’s strict regulations. Failure to file Form 8609-A correctly or failing to meet the LIHTC requirements could lead to loss of tax credits or even recapture of previously claimed credits.

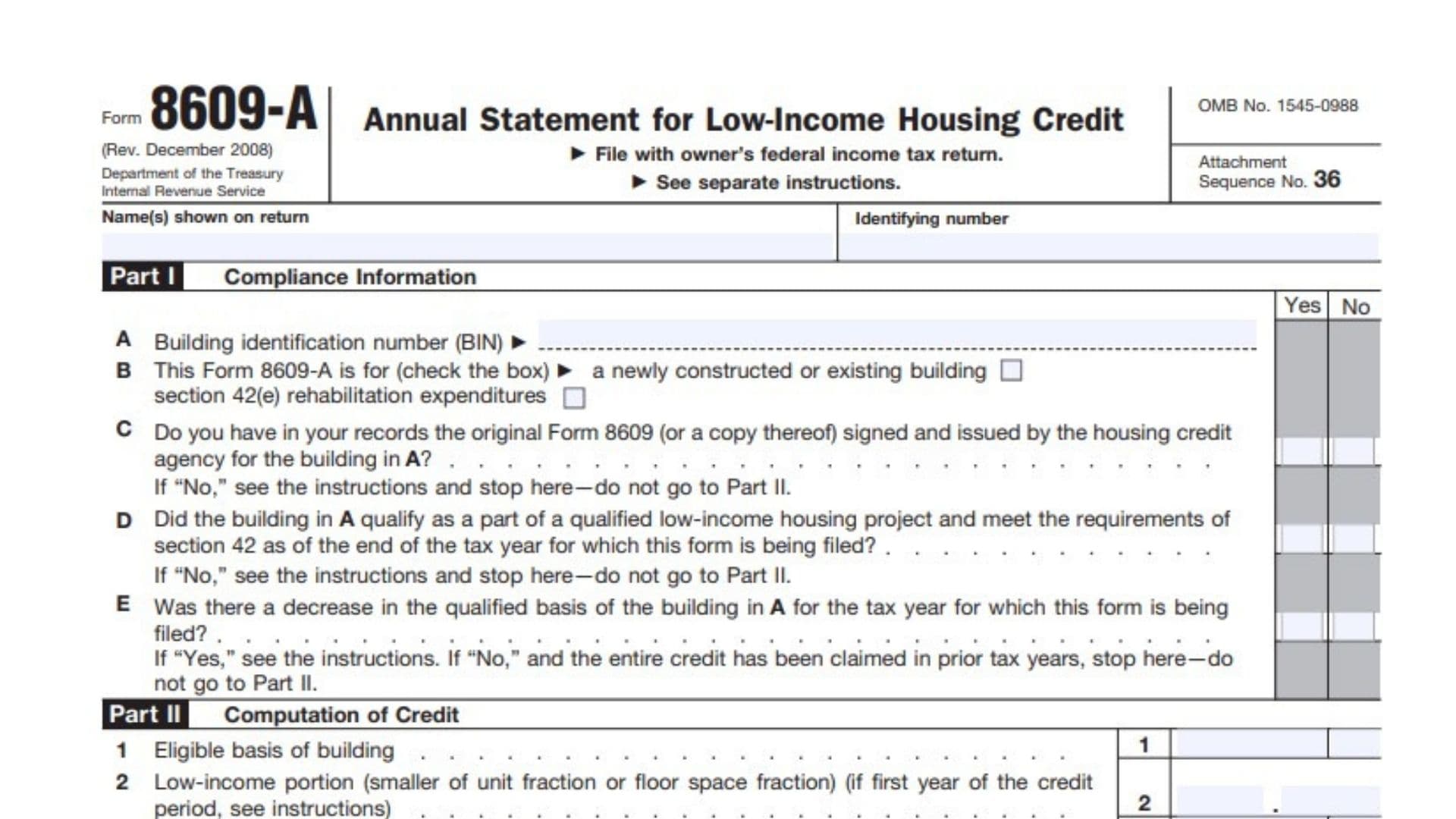

How to Complete Form 8609-A?

Part I: Compliance Information

Line A: Building Identification Number (BIN)

- Enter the Building Identification Number (BIN) assigned by the housing credit agency.

- This number is unique to each low-income housing project and is required for IRS tracking.

Line B: Type of Property

- Check the box that applies:

- Newly constructed or existing building

- Building with Section 42(e) rehabilitation expenditures

- This helps the IRS determine the eligibility criteria for the property.

Line C: Do You Have the Original Form 8609?

- You must have the original signed Form 8609 issued by the housing credit agency.

- If you do not have this form, stop here—you cannot claim the credit.

Line D: Did the Building Qualify as a Low-Income Housing Project?

- If the building did not meet LIHTC eligibility requirements, you cannot claim the credit.

- If it qualifies, proceed to the next section.

Line E: Was There a Decrease in the Qualified Basis?

- If the qualified basis of the building decreased in the current tax year, refer to IRS instructions for adjustments.

- If the entire LIHTC credit was claimed in previous years, stop here—you do not need to complete Part II.

Part II: Computation of Credit

Line 1: Eligible Basis of the Building

- Enter the total eligible basis of the building.

- This is the total cost of the building that qualifies for the LIHTC credit (excluding land).

Line 2: Low-Income Portion

- Determine the low-income portion by using the smaller value between:

- The unit fraction (low-income units ÷ total units).

- The floor space fraction (low-income square footage ÷ total square footage).

Line 3: Qualified Basis of Low-Income Building

- Multiply Line 1 (eligible basis) by Line 2 (low-income portion).

- This calculation determines how much of the property qualifies for LIHTC credits.

Line 4: Part-Year Adjustment for Disposition or Acquisition

- If you acquired or sold the building within the tax year, adjust the qualified basis accordingly.

- The LIHTC credit amount is based on how long you owned the property during the tax year.

Line 5: Credit Percentage

- Enter the credit percentage assigned to the project in Form 8609.

- This percentage determines the amount of credit you can claim.

Line 6: Multiply Line 3 or Line 4 by the Percentage on Line 5

- Multiply the qualified basis (Line 3 or adjusted Line 4) by the credit percentage (Line 5).

- This gives the preliminary annual credit amount.

Line 7: Additions to Qualified Basis

- If the building’s qualified basis increased, enter the amount of the increase.

Line 8: Adjusted Qualified Basis

- If applicable, enter any other adjustments to the qualified basis of the building.

Line 9: Credit Percentage (One-Third Rule for First-Year Credit)

- If this is the first year of credit eligibility, enter one-third of the percentage from Line 5.

Line 10: Multiply Line 7 or Line 8 by the Percentage on Line 9

- If applicable, calculate any adjustments due to increases in qualified basis.

Line 11: Section 42(f)(3)(B) Modification

- If a modification under Section 42(f)(3)(B) applies, enter the adjustment amount.

- This applies to specific credit allocation scenarios.

Line 12: Add Lines 10 and 11

- Combine the values from Line 10 and Line 11 to get the adjusted credit amount.

Line 13: Credit for Building Before Line 14 Reduction

- Subtract Line 12 from Line 6 to determine the final credit before adjustments.

Line 14: Disallowed Credit Due to Federal Grants

- If federal grants were used for the property, reduce the credit amount accordingly.

- LIHTC credits cannot be claimed on federally funded portions of the project.

Line 15: Credit Allowed for the Building for the Tax Year

- Subtract Line 14 from Line 13.

- The credit amount cannot exceed the amount listed on Form 8609, Part I, Line 1b.

- If multiple taxpayers own the property, divide the credit proportionally based on ownership percentage.

Line 17: Adjustments for Deferred First-Year Credit

- If you deferred part of the first-year credit, enter the adjustment here.

Line 18: Total Taxpayer’s Credit for the Year

- Add Line 16 and Line 17 to determine the total credit you can claim.

- Enter this amount on Form 8586 (Low-Income Housing Credit Form).