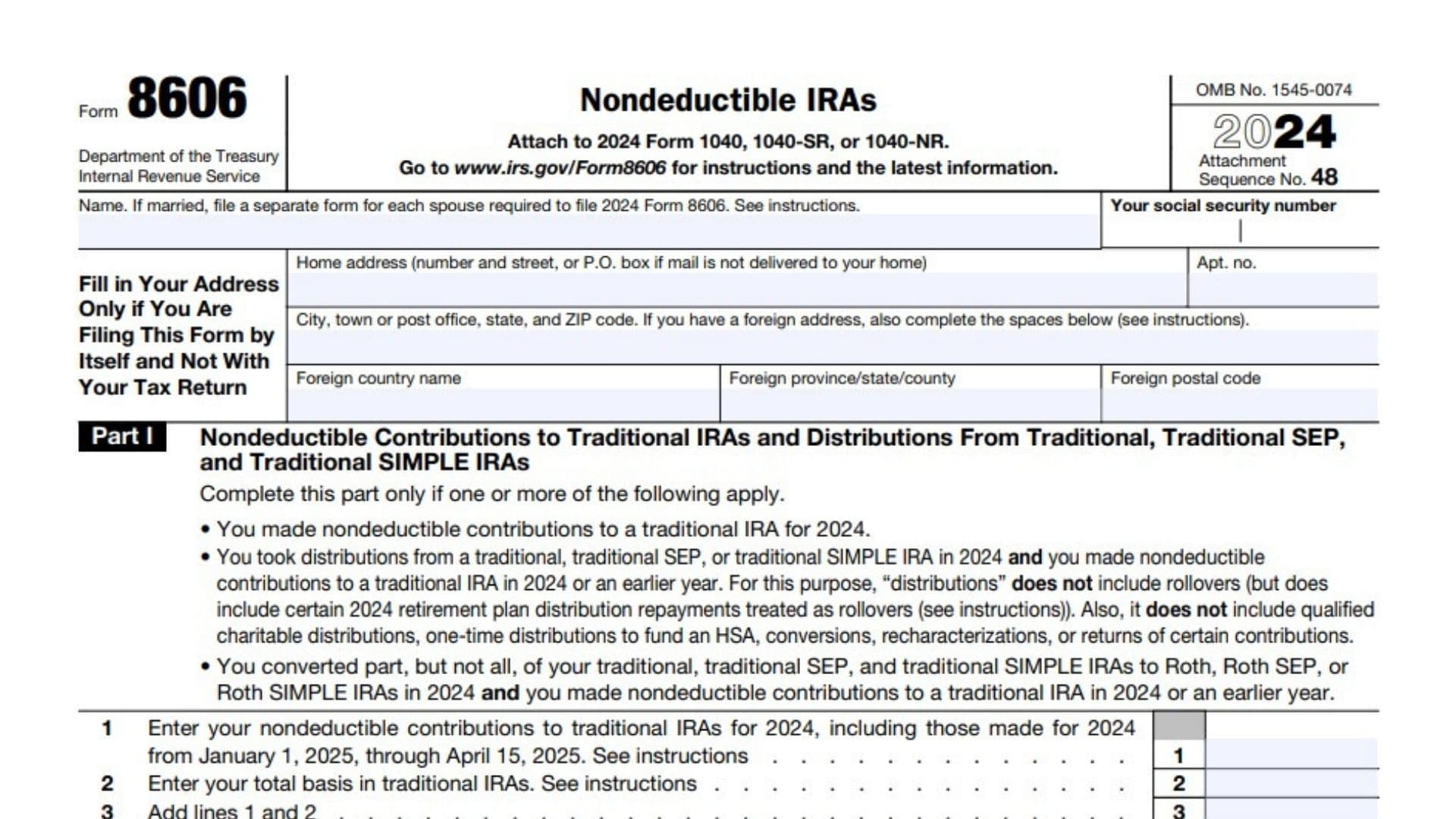

IRS Form 8606, Nondeductible IRAs, is used to report nondeductible contributions to traditional IRAs, distributions from traditional IRAs, and conversions to Roth IRAs. This form is essential for taxpayers who have made after-tax contributions to traditional IRAs or have converted part or all of their traditional IRA assets to a Roth IRA. Form 8606 helps track the basis (after-tax contributions) in a traditional IRA, ensuring that taxable amounts are accurately calculated when withdrawals occur. It also prevents double taxation on distributions by differentiating between taxable and nontaxable portions. The form must be filed with the taxpayer’s federal return if they have made nondeductible contributions, taken distributions, or completed a Roth conversion during the tax year. Failure to file could lead to incorrect tax calculations and potential penalties. Keeping accurate records is crucial, as the information on Form 8606 will be used for future IRA withdrawals and tax filings.

How to File Form 8606?

- Download the form – Obtain the latest version from IRS.gov.

- Complete Part I – Report nondeductible contributions and IRA distributions.

- Complete Part II – Report conversions from traditional IRAs to Roth IRAs.

- Complete Part III – Report Roth IRA distributions (if applicable).

- Attach to Tax Return – Submit Form 8606 with your Form 1040, 1040-SR, or 1040-NR.

- Keep Records – Retain copies to track your IRA basis for future tax years.

How to Complete Form 8606?

Part I: Nondeductible Contributions to Traditional IRAs and IRA Distributions

- Enter your name and Social Security Number (SSN).

- Line 1: Report nondeductible contributions to traditional IRAs for the tax year (including those made between January 1 and April 15 of the following year).

- Line 2: Enter total basis in traditional IRAs from prior years (found on previous Form 8606 filings).

- Line 3: Add lines 1 and 2.

- Did you take a distribution or make a Roth conversion?

- If No, enter the amount from line 3 on line 14 and skip to Part II.

- If Yes, continue to line 4.

- Line 4: Enter contributions made between January 1 and April 15 of the following year.

- Line 5: Subtract line 4 from line 3.

- Line 6: Enter total value of all traditional IRAs (including SEP and SIMPLE IRAs) as of December 31.

- Line 7: Report all distributions taken from traditional IRAs during the year (excluding rollovers, charitable distributions, and certain exceptions).

- Line 8: Report net amount converted from traditional IRAs to Roth IRAs.

- Line 9: Add lines 6, 7, and 8.

- Line 10: Divide line 5 by line 9 (to determine the percentage of nontaxable basis).

- Line 11: Multiply line 8 by line 10 (nontaxable portion of the Roth conversion).

- Line 12: Multiply line 7 by line 10 (nontaxable portion of IRA distributions).

- Line 13: Add lines 11 and 12 (total nontaxable distributions and conversions).

- Line 14: Subtract line 13 from line 3 (remaining basis for future years).

- Line 15: Report the taxable portion of IRA distributions.

- 15a: Subtract line 12 from line 7.

- 15b: Report any portion of line 15a from qualified disaster distributions.

- 15c: Subtract line 15b from 15a (taxable amount to report on Form 1040, line 4b).

Part II: 2024 Conversions from Traditional, SEP, or SIMPLE IRAs to Roth IRAs

- Line 16: Enter the net amount converted to a Roth IRA.

- Line 17: Report the nontaxable portion (from line 11 if Part I was completed).

- Line 18: Subtract line 17 from line 16 (taxable amount of conversion to be reported on Form 1040, line 4b).

Part III: Distributions from Roth IRAs

- Line 19: Enter total nonqualified distributions from Roth IRAs (including first-time homebuyer withdrawals and any taxable distributions).

- Line 20: Report qualified first-time homebuyer expenses (up to $10,000).

- Line 21: Subtract line 20 from line 19.

- Line 22: Enter your total basis in Roth IRA contributions.

- Line 23: Subtract line 22 from line 21 (if zero or less, stop here; otherwise, continue).

- Line 24: Enter basis in Roth conversions (from traditional IRAs or qualified plans).

- Line 25: Determine taxable Roth IRA distributions.

- 25a: Subtract line 24 from line 23.

- 25b: Report any portion of 25a that qualifies as a disaster distribution.

- 25c: Subtract line 25b from line 25a (taxable amount to report on Form 1040, line 4b).

Notes

- Tracking Basis is Essential – Form 8606 helps avoid double taxation on IRA distributions.

- Conversions to Roth IRAs are Taxable – Ensure the correct portion is reported.

- Nondeductible Contributions Reduce Future Taxes – Keeping records of these contributions can minimize future tax burdens.

- Failure to File May Lead to Tax Errors – Not submitting Form 8606 could result in IRS penalties.

- Attach to Tax Return – Form 8606 must be filed with Form 1040, 1040-SR, or 1040-NR if applicable.