Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, is used by taxpayers to transmit supporting documents that are required for an electronically filed tax return. Properly managing this form ensures compliance with IRS regulations and helps complete the e-filing process accurately and efficiently. The primary purpose of Form 8453 is to serve as a transmittal document for specific supporting documents that need to be submitted to the IRS after filing an individual income tax return electronically. These documents may include certain elections, statements, and other forms that cannot be filed electronically. By using Form 8453, taxpayers ensure that all necessary paperwork is transmitted to the IRS to support their e-filed return.

How to Complete Form 8453?

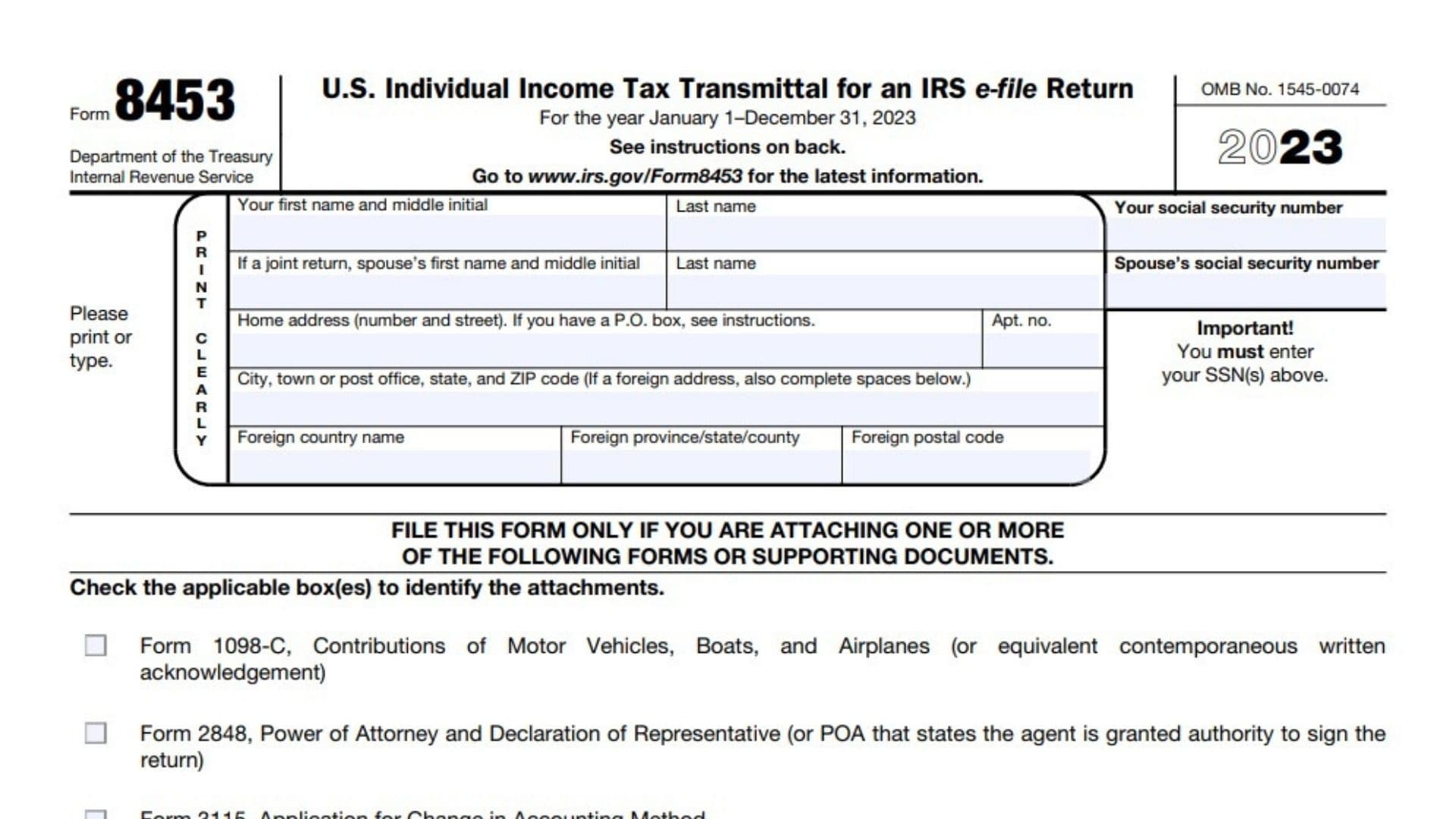

Top section

- Enter your first name, middle initial, last name, and Social Security Number (SSN).

- If filing jointly, enter your spouse’s first name, middle initial, last name, and SSN.

- Fill in your home address, city, state, and ZIP code. If using a foreign address, include the country, province/state, and postal code.

Forms and Supporting Documents Section

- Check the appropriate box to indicate the form or documentation you are attaching. These could include:

- Form 1098-C: Contributions of Motor Vehicles, Boats, and Airplanes.

- Form 2848: Power of Attorney and Declaration of Representative.

- Form 3115: Application for Change in Accounting Method.

- Form 3468: Historic Preservation Certification Application.

- Form 4136: Biodiesel, renewable diesel, and sustainable aviation fuel claims.

- Form 5713: International Boycott Report.

- Form 8283: Noncash Charitable Contributions.

- Form 8332: Release/Revocation of Release of Claim to Exemption for Child.

- Form 8858: Information Return of U.S. Persons With Respect to Foreign Disregarded Entities.

- Form 8864: Biodiesel and renewable diesel claims.

- Form 8949: Sales and Other Dispositions of Capital Assets.

Specific Instructions for Filing

- Name and Address: Enter your information clearly in the spaces provided. If using a foreign address, do not abbreviate the country name.

- P.O. Box: Enter the P.O. box number if the post office does not deliver to your home address.

- Social Security Number (SSN): Be sure to enter the SSN in the space provided.

- Do not attach a payment to Form 8453. Payments should be mailed by April 15, 2024, using Form 1040-V. For those living in Maine or Massachusetts, the deadline is April 17, 2024.

- If you are filing a return signed by an agent, a power of attorney must be attached, specifically authorizing the agent to sign the return.

- If the divorce decree or separation agreement went into effect between 1984 and 2009, specific pages can be attached in place of Form 8332. These pages must include a statement regarding the noncustodial parent’s claim to the child, the other parent’s agreement not to claim the child, and the applicable years.

Where to Mail the Form

- If you are filing using an electronic return originator (ERO) or online provider, you must mail the form to the IRS within three business days after receiving acknowledgment that the IRS has accepted your electronically filed return.

- Mail to:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254.

- Mail to: