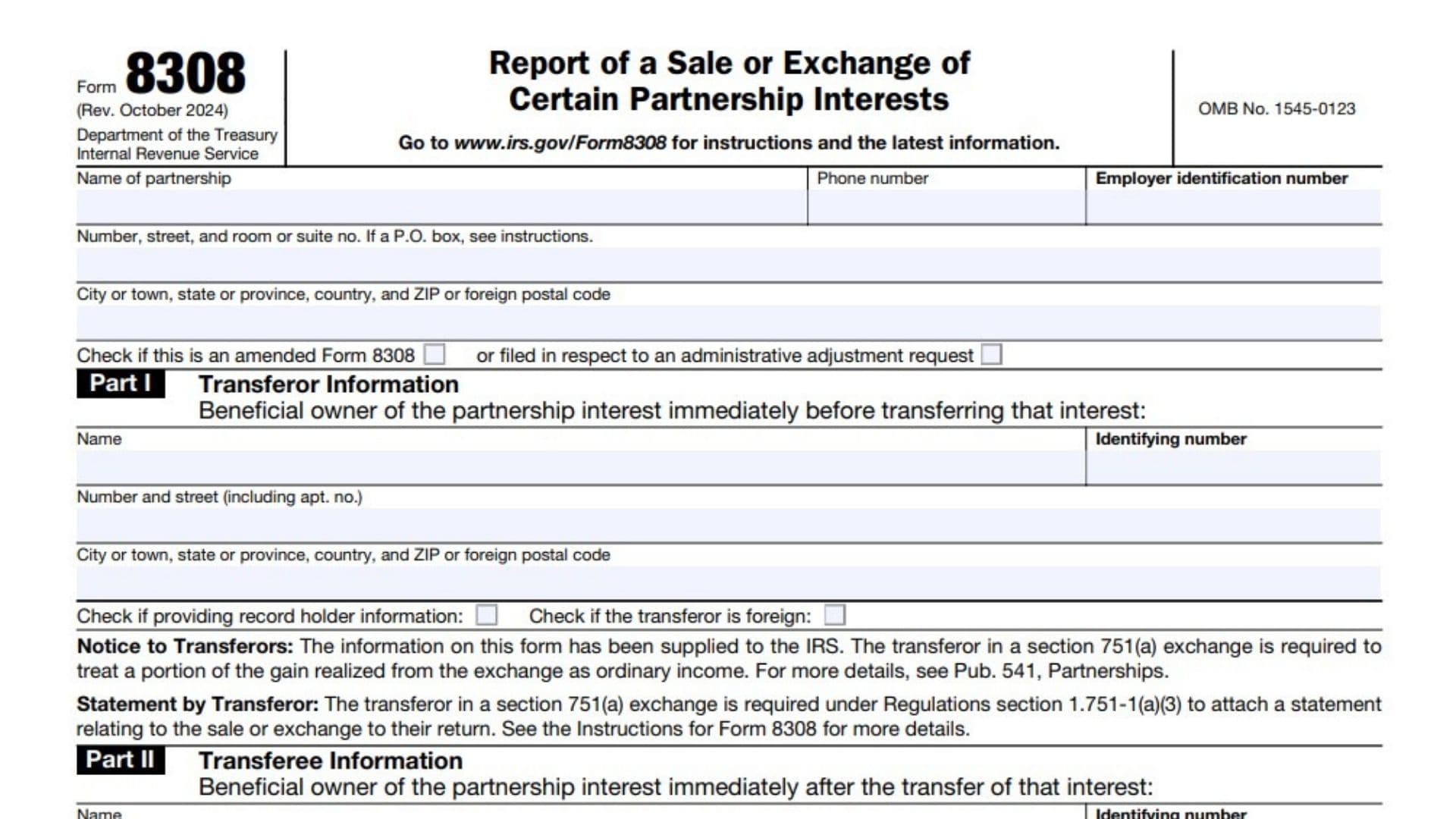

IRS Form 8308, titled “Report of a Sale or Exchange of Certain Partnership Interests,” is a document required by the Internal Revenue Service (IRS) to report the sale or exchange of specific partnership interests. This form is crucial for businesses or individuals who are involved in transactions concerning partnership ownership changes, particularly when it involves the transfer of capital, profits, or preferred interests. The form ensures compliance with tax regulations and helps track the tax implications of such transactions, specifically addressing the treatment of gains or losses under sections such as 751(a) of the Internal Revenue Code.

How to File Form 8308?

To file Form 8308, you need to follow these general steps:

- Obtain the form: You can download the latest version of the form from the IRS website.

- Fill in the partnership details: Complete sections for the partnership involved, including the name, employer identification number (EIN), address, and contact information.

- Provide transferor information: This includes the details of the beneficial owner of the partnership interest before the transfer, such as their name, address, and identifying number.

- Provide transferee information: Complete the details for the new owner of the partnership interest, similar to the transferor’s information.

- Specify the date and type of transfer: Enter the date when the partnership interest was transferred and the type of partnership interest (capital, preferred, profits, or other).

- Declare any gain or loss: In Part IV, the transferor must report the gain or loss under sections 751(a) and other applicable sections, as it relates to the transfer.

How to Complete Form 8308?

- Part I – Transferor Information:

- Line 1: Enter the name of the transferor (the person or entity selling or exchanging the partnership interest).

- Line 2: Provide the identifying number of the transferor, such as their Social Security Number (SSN) or Employer Identification Number (EIN).

- Line 3: Fill in the complete address, including the street, city, state, and ZIP code.

- Line 4: Check the box if the transferor is a foreign individual or entity.

- Line 5: Check if providing record holder information, indicating if the transferor is not the actual beneficial owner of the interest.

- Part II – Transferee Information:

- Line 1: Enter the name of the transferee (the new owner of the partnership interest).

- Line 2: Provide the transferee’s identifying number (SSN or EIN).

- Line 3: Fill in the transferee’s address information.

- Line 4: Check the box if providing record holder information for the transferee.

- Part III – Transfer of Partnership Interest:

- Line 1: Enter the date of the sale or exchange of the partnership interest. This should reflect the actual transaction date.

- Line 2: Select the type of partnership interest transferred. The options are:

- A for Capital

- B for Preferred

- C for Profits

- D for Other (if none of the above apply).

- Part IV – Partner’s Share of Gain (Loss):

- Line 1: Report the partnership-level deemed sale gain or loss under section 751(a).

- Line 2: Enter the percentage of the partnership interest transferred.

- Line 3: Enter the number of units in the partnership transferred.

- Line 4: Report the partner-level deemed sale gain or loss and the corresponding K-1 box 20 code.

- Sign and Date: The form must be signed by the partnership representative or the partner involved in the transaction. This certifies that the information is accurate to the best of their knowledge.