Form 8302, Application for Electronic Funds Transfer (EFT) of Excise Tax Refund of $1 Million or More, is used by taxpayers to request that excise tax refunds of $1 million or more be electronically transferred to their financial accounts. Properly managing this form ensures a secure and efficient method of receiving large tax refunds. The primary purpose of Form 8302 is to allow taxpayers to request that the IRS electronically transfer excise tax refunds of $1 million or more directly to their financial accounts. This method of transfer provides a faster, safer, and more efficient way to receive large refunds compared to traditional paper checks.

Who Must File Form 8302?

Form 8302 must be filed by:

- Taxpayers Requesting Large Refunds: Any taxpayer, whether an individual, corporation, partnership, or other entity, that is entitled to an excise tax refund of $1 million or more and prefers to receive the refund via electronic funds transfer.

How To File Form 8302?

Filing Form 8302 involves several steps and requires detailed information to ensure all necessary details are provided. The form must be filed with the IRS along with the refund claim.

- Obtain Form 8302: The form can be downloaded from the IRS website. Ensure you have the correct version.

- Complete the form: Fill out the form with details of the taxpayer’s financial account to which the refund will be transferred.

- Attach supporting documentation: Gather all required documents, such as the excise tax return or refund claim form, to substantiate the refund request.

- Submit the form: Mail the completed form and any supporting documentation to the IRS along with the refund claim. Ensure that all information is complete and accurate.

How To Complete Form 8302?

Filling out Form 8302 requires accurate and comprehensive information about the taxpayer’s financial account and the excise tax refund claim. The form is straightforward and includes sections that provide the necessary bank account details.

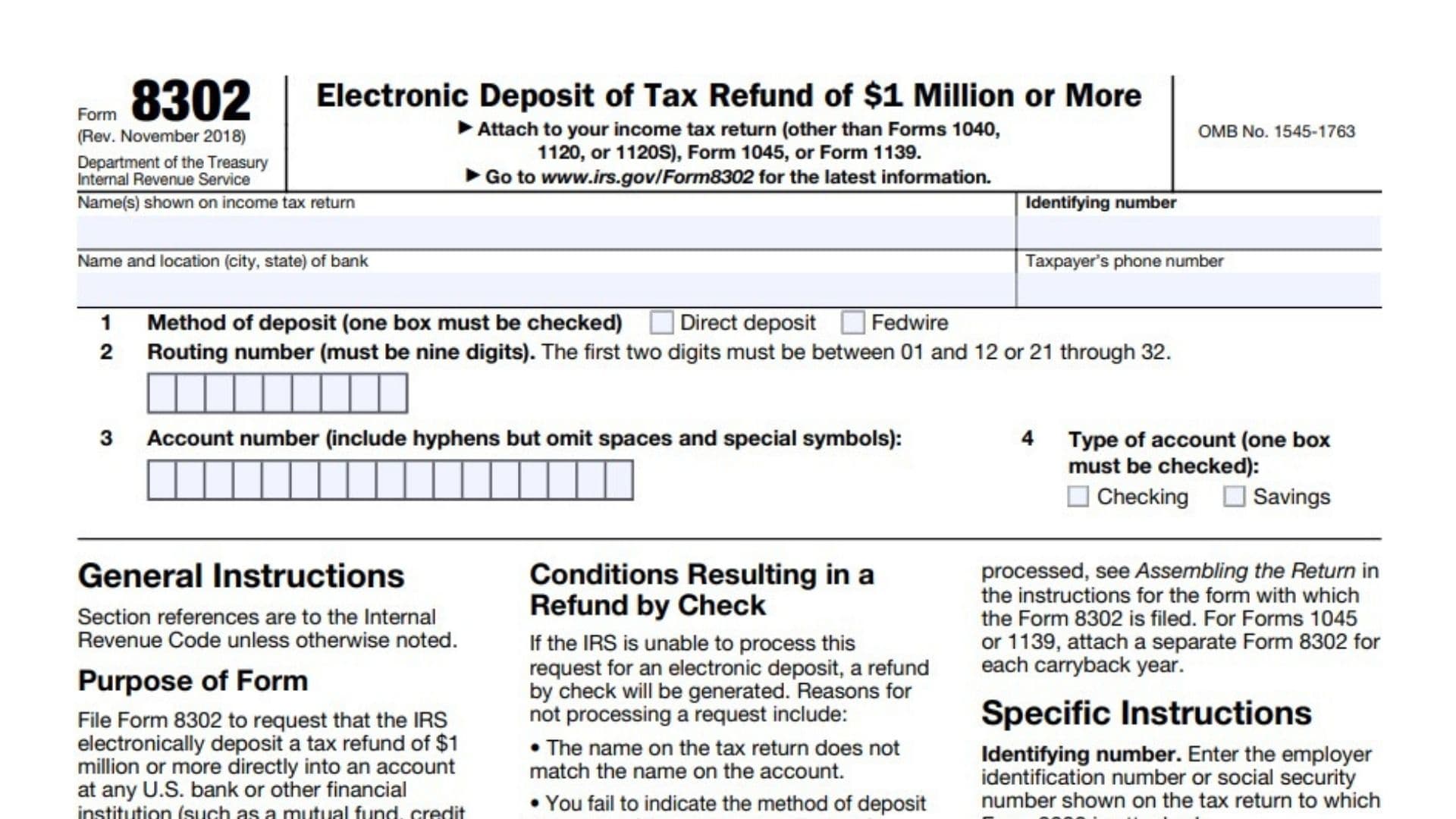

Heading Information

- Name(s) shown on income tax return

Enter the name or names exactly as they appear on your income tax return. - Identifying number

Provide your Employer Identification Number (EIN) or Social Security Number (SSN) as it appears on your tax return. - Name and location (city, state) of bank

Enter the name of the financial institution (bank, credit union, or other institution) where the tax refund will be deposited. Also, provide the city and state of the institution. - Taxpayer’s phone number

Provide your daytime phone number in case the IRS needs to contact you.

Line-By-Line Instructions

Line 1: Method of deposit

You must choose one of the following methods by checking the appropriate box:

- Direct deposit: The refund will be deposited via the Automated Clearing House (ACH) system, which is a batch processing system.

- Fedwire: This is used for same-day transactions. Only select Fedwire if the payment must be received the same day. Note that Fedwire may be rejected if the refund is applied to a debt owed.

Line 2: Routing number

- Enter the 9-digit routing number of your financial institution.

- Ensure the first two digits are between 01-12 or 21-32, which are valid for U.S. financial institutions.

- Important: Check with your bank to verify the correct routing number, especially if it’s payable through another financial institution.

- Do not use a deposit slip to verify the routing number.

Line 3: Account number

- Enter your account number, including hyphens but without spaces or special symbols.

- Make sure to enter it from left to right, leaving any unused boxes blank.

Line 4: Type of account

- Check the appropriate box to specify whether the account is checking or savings.

Conditions Resulting in a Refund by Check

The IRS may issue a refund by check instead of electronic deposit for the following reasons:

- The name on the tax return does not match the name on the account.

- You fail to specify the method of deposit (direct deposit or Fedwire).

- The financial institution rejects the deposit due to an incorrect routing or account number.

- You fail to specify the type of account (checking or savings).

- There is an outstanding liability, and the refund is reduced to less than $1 million.

- You are subject to the Treasury Offset Program (TOP), and you did not select direct deposit.