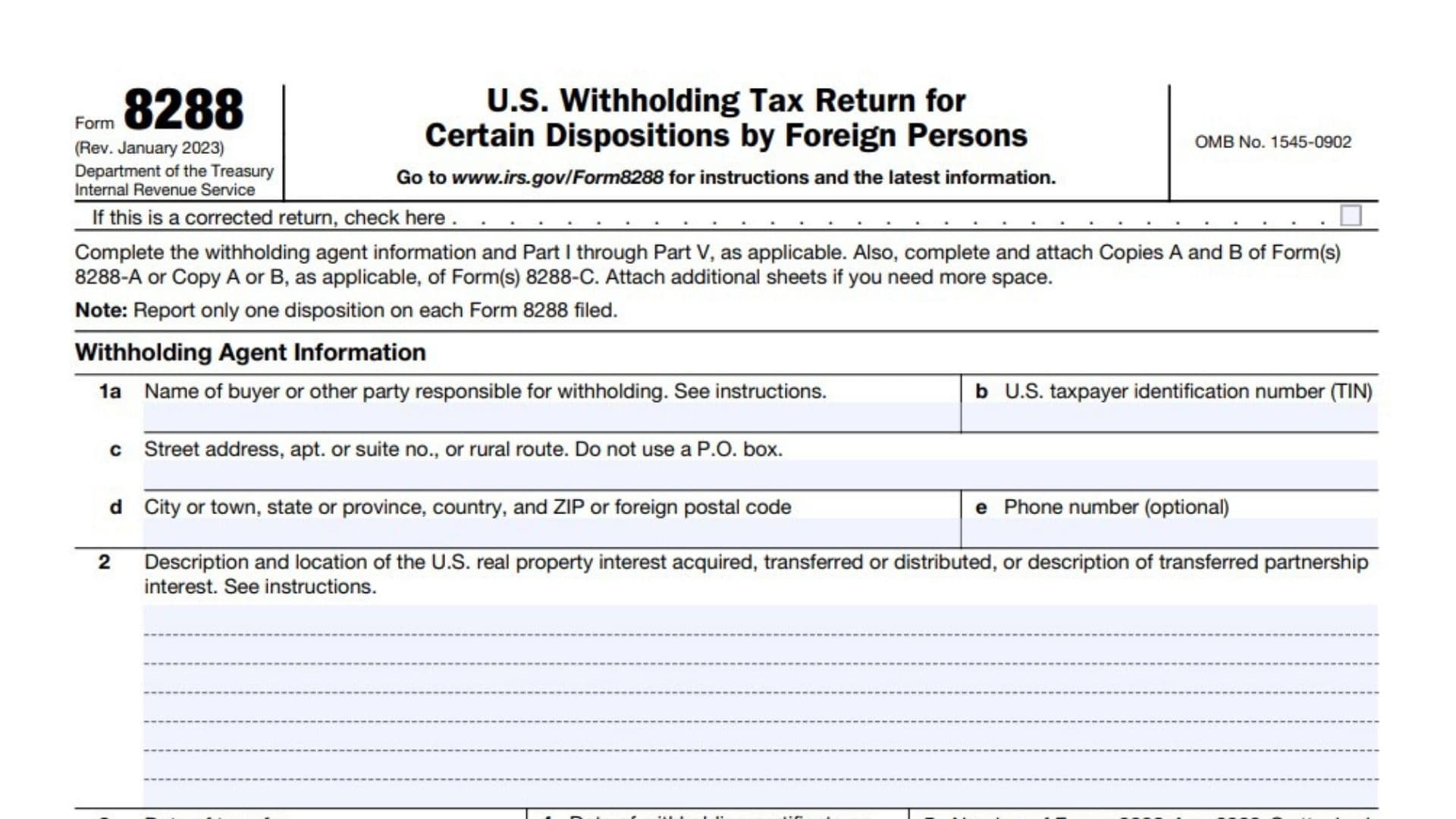

IRS Form 8288, officially titled “U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests,” is used by buyers (withholding agents) to report and remit withholding tax when a foreign person disposes of a U.S. real property interest. Under the Foreign Investment in Real Property Tax Act (FIRPTA), the buyer or other transferee must generally withhold a percentage of the amount realized from the sale or transfer and send it to the IRS. This form ensures compliance with U.S. tax law by documenting the transaction, the amount withheld, and the parties involved. It is also used by certain entities and partnerships for reporting distributions or transfers subject to withholding under sections 1445 and 1446(f). Each Form 8288 should report only one disposition, and it must be filed along with the appropriate payment and any required Forms 8288-A or 8288-C.

How to File IRS Form 8288

- Obtain the most recent version of Form 8288 from the IRS website or your tax professional.

- Complete the form using the line-by-line instructions below.

- Attach the required Forms 8288-A or 8288-C for each transferor or distributee.

- Mail the completed Form 8288, attachments, and payment to the IRS at the address listed in the form instructions.

- Retain copies for your records.

How to Complete Form 8288?

Withholding Agent Information

- 1a. Name of buyer or other party responsible for withholding: Enter the full legal name of the person or entity required to withhold tax.

- 1b. U.S. taxpayer identification number (TIN): Provide the TIN (e.g., SSN, EIN) of the withholding agent.

- 1c. Street address, apt. or suite no., or rural route: Enter the complete street address. Do not use a P.O. box.

- 1d. City or town, state or province, country, and ZIP or foreign postal code: Fill in the city, state/province, country, and postal code.

- 1e. Phone number (optional): You may provide a phone number for contact purposes.

Property and Transaction Information

- 2. Description and location of the U.S. real property interest acquired, transferred or distributed, or description of transferred partnership interest: Describe the property (e.g., address, parcel number) or partnership interest being transferred.

Transaction Dates and Attachments

- 3. Date of transfer: Enter the date the property or interest was transferred.

- 4. Date of withholding certificate or date of distribution: If applicable, provide the date the IRS issued a withholding certificate or the date of the distribution.

- 5. Number of Forms 8288-A or 8288-C attached: Indicate how many Forms 8288-A or 8288-C are included with this filing.

Part I: To Be Completed by the Buyer or Other Transferee Required to Withhold Under Section 1445(a)

- 6. Amount subject to withholding: Enter the total amount realized on the disposition that is subject to withholding.

- 7. Withholding tax liability: Multiply the amount on line 6 by the applicable withholding rate and enter the result on the relevant line:

- 7a. 10% (0.10): Enter the amount if the 10% rate applies.

- 7b. 15% (0.15): Enter the amount if the 15% rate applies.

- 7c. Withholding at an adjusted amount (see instructions): If the IRS approved a reduced withholding amount, check this box and enter the adjusted amount.

- 8. Amount withheld: Enter the total amount actually withheld from the transaction.

Part II: To Be Completed by an Entity Subject to the Provisions of Section 1445(e)

- 9. Large trust election to withhold at distribution: If applicable, check the box to indicate a large trust election.

- 10. Amount subject to withholding: Enter the amount distributed or transferred that is subject to withholding.

- 11. Withholding tax liability: Multiply the amount on line 10 by the applicable withholding rate and enter the result on the relevant line:

- 11a. 10% (0.10): Enter the amount if the 10% rate applies.

- 11b. 15% (0.15): Enter the amount if the 15% rate applies.

- 11c. 21% (0.21) or 35% (0.35) for distributions made before January 1, 2018: Enter the amount if these rates apply.

- 11d. Withholding at an adjusted amount (see instructions): If the IRS approved a reduced amount, check this box and enter the adjusted amount.

- 12. Amount withheld: Enter the total amount withheld by the entity.

Part III: To Be Completed by Buyer/Transferee Required to Withhold Under Section 1446(f)(1)

- 13. Amount subject to withholding: Enter the amount realized on the transfer of a partnership interest subject to section 1446(f)(1).

- 14. Withholding tax liability: Multiply the amount on line 13 by the applicable rate or enter the adjusted amount:

- 14a. 10% (0.10): Enter the amount if the 10% rate applies.

- 14b. Withholding at an adjusted amount (see instructions): If the IRS approved a reduced amount, check this box and enter the adjusted amount.

- 15. Amount withheld: Enter the total amount withheld under section 1446(f)(1).

Part IV: To Be Completed by the Partnership Required to Withhold Under Section 1446(f)(4)

- 16a. Total number of distributions: Enter the total number of distributions made to transferees.

- 16b. Total amount of distributions: Enter the total dollar amount of all distributions.

- 16c. Amount of other withholding: Enter any other withholding amounts related to these distributions.

- 17. Transferee’s liability under section 1446(f)(1) (if known): Enter the transferee’s liability amount, if it is known.

- 18. Total amounts withheld: Enter the total of all amounts withheld by the partnership.

Part V: To Be Completed by Buyer/Transferee Claiming a Refund of Withholding Under Section 1446(f)(4)

- 19. Amount subject to withholding: Enter the amount realized subject to withholding for which a refund is being claimed.

- 20. Amount withheld (see instructions): Enter the amount that was actually withheld.

- 21. Withholding tax liability: Multiply line 19 by the applicable withholding rate or enter the adjusted amount:

- 21a. 10% (0.10): Enter the amount if the 10% rate applies.

- 21b. Withholding at an adjusted amount (see instructions): If the IRS approved a reduced amount, check this box and enter the adjusted amount.

- 22. Amount of refund requested: Enter the amount of refund being requested.

Signature Section

- Sign Here: The withholding agent, partner, fiduciary, or corporate officer must sign the form. Include the title (if applicable) and the date of signing.

Paid Preparer Use Only (if applicable)

- Preparer’s name, signature, date, PTIN: If prepared by a paid preparer, enter the preparer’s name, signature, date, and Preparer Tax Identification Number (PTIN).

- Firm’s name, EIN, address, phone number: Enter the firm’s details if applicable.