Form 8283 is used to report noncash charitable contributions valued at more than $500. This form helps taxpayers claim a deduction for the fair market value of donated property, such as clothing, household items, vehicles, securities, and other assets. Properly filing Form 8283 ensures that taxpayers can take full advantage of the tax benefits of their charitable contributions while maintaining compliance with IRS rules. Taxpayers must file Form 8283 if they:

- Make noncash charitable contributions valued at more than $500 during the tax year.

- Donate property such as clothing, household items, vehicles, securities, art, or other assets.

- Claim a deduction for the fair market value of donated property.

This form is typically filed with the taxpayer’s annual tax return.

How to File Form 8283?

Filing the IRS Form 8283 involves several steps:

- Obtain the Form: Taxpayers can obtain Form 8283 from the IRS website or through tax preparation software.

- Complete the Form: Fill out the form with the required information about the donated property and its fair market value.

- Attach to Tax Return: Attach the completed form to your annual tax return (Form 1040 or Form 1040-SR).

- Submit to the IRS: File your tax return along with Form 8283 by the regular tax filing deadline, typically April 15th for most individuals.

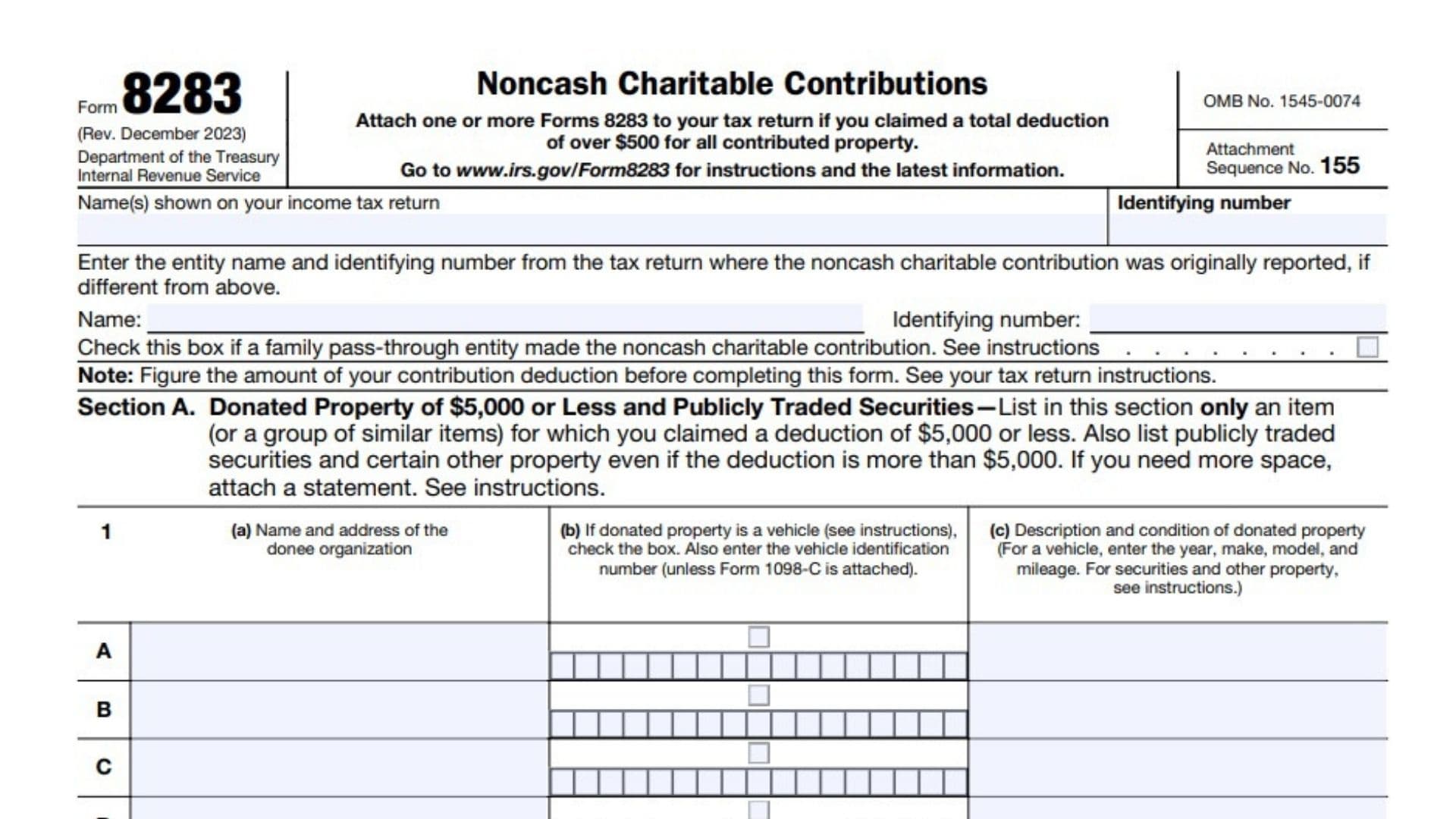

How to Complete Form 8283?

Completing the Form 8283 requires detailed information about the noncash charitable contributions and

Part I: Information on Donated Property

This section is for donations valued at less than $5,000 (per item or group of similar items), or items valued at $5,000 or more for which a qualified appraisal is not required (e.g., publicly traded securities). You must complete Part I for each donated item or group of items.

Section A: Donated Property (Items or Groups Less Than $5,000)

- Name of Donee Organization: Enter the name of the charitable organization that received your donation.

- Employer Identification Number (EIN): Provide the donee organization’s EIN.

- Description of Donated Property: Describe the donated property in detail. Be specific about what was donated (e.g., “10 shares of ABC stock” or “clothing”).

- Date of Contribution: Enter the exact date when the donation was made.

- Date Acquired by Donor: Provide the date when you acquired the donated property. If acquired over time (e.g., stock purchases), enter “Various.”

- How Acquired by Donor: Indicate how you acquired the property, such as by purchase, gift, inheritance, or exchange.

- Donor’s Cost or Adjusted Basis: Enter your original cost or adjusted basis in the property. This is the amount you initially paid for the item or its basis if received as a gift or inheritance.

- Fair Market Value (FMV): Provide the fair market value of the donated property at the time of donation.

- Method Used to Determine FMV: Briefly describe how you determined the FMV (e.g., “comparative market sales,” “appraisal,” or “thrift shop value”).

If you have more than one item or group of items to report, you may attach additional copies of Part I.

Part II: Appraisal Summary (For Items Valued at $5,000 or More)

Section B is for items valued at $5,000 or more that require a qualified appraisal to be attached. This includes art, vehicles, jewelry, or other high-value assets. Follow these instructions to complete Section B.

Section B: Donated Property Requiring Appraisal

- Name of Donee Organization: Provide the name of the charitable organization receiving the donation.

- Employer Identification Number (EIN): Enter the donee’s EIN.

- Description of Donated Property: Provide a detailed description of the item(s) donated. Use specific details to describe high-value property, such as artwork or collectibles.

- Date of Contribution: Indicate the exact date the property was donated.

- Date Acquired by Donor: Provide the date when you acquired the property, or enter “Various” if acquired over a period of time.

- How Acquired by Donor: Indicate how the property was acquired, whether by purchase, gift, inheritance, or other means.

- Donor’s Cost or Adjusted Basis: Provide the cost or adjusted basis of the donated property. If the property was received as a gift or inheritance, provide the adjusted basis.

- Fair Market Value (FMV): State the FMV of the property at the time of the donation.

- Method Used to Determine FMV: Briefly describe the method used to determine the FMV of the donated property (e.g., professional appraisal).

- Signature of Donor: Sign and date this section to certify the information provided about the donated property.

- Donee Acknowledgment: The donee organization must acknowledge receipt of the donated property by signing this section. The date of the donation must also be included.

- Appraiser Information: If required, provide the appraiser’s name, address, identification number, and qualifications. The appraiser must also sign and date this section.

Part III: Declaration of Appraiser (For Items Requiring Appraisal)

If you are claiming a deduction for property valued at $5,000 or more, you will need a qualified appraisal by a qualified appraiser. The appraiser must fill out Part III.

- Appraiser’s Name: Enter the full legal name of the appraiser.

- Business Address: Provide the appraiser’s business address, including city, state, and ZIP code.

- Taxpayer Identification Number: Provide the appraiser’s TIN (EIN or SSN).

- Appraisal Certification: The appraiser must sign and date the form to certify the appraisal was conducted in accordance with IRS regulations.

Filing Requirements and Important Notes

Attach Form 8283 to your tax return if you are claiming deductions for noncash contributions. For items requiring an appraisal, remember to attach the appraisal document.

If your total noncash contributions exceed $500 but no single item is valued at $5,000 or more, complete Section A of Part I.

If you are donating property worth $5,000 or more, you must complete Section B and attach a qualified appraisal to your tax return unless an exception applies (e.g., publicly traded securities).

The fair market value of donated property is the price that the property would sell for on the open market. Accurate valuation is crucial for claiming the correct deduction.

Maintain detailed records and receipts for all noncash charitable contributions, including photographs, appraisals, and acknowledgment letters from the charitable organizations.

Where to Mail Form 8283?

Form 8283 should be attached to your annual tax return and mailed to the appropriate IRS address based on your location. The IRS provides specific addresses for different regions, which are listed in the form’s instructions. Taxpayers can also file electronically using the IRS e-file system.

Due Dates

The Form 8283 must be filed by the regular tax filing deadline for your annual tax return, typically April 15th. If you cannot file by this date, you can request an extension by filing Form 4868, which grants an additional six months to file the return. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Frequently Asked Questions

- Do I need a qualified appraisal for all noncash contributions?A qualified appraisal is generally required for noncash contributions valued over $5,000. For donations valued at $500 or less, detailed records and receipts are sufficient.

- Can I deduct the full value of my noncash contributions?The deduction for noncash contributions is generally limited to the fair market value of the donated property. Specific rules apply for certain types of property, such as vehicles and appreciated assets.

- What types of property can I donate and deduct?You can donate and deduct a wide range of noncash property, including clothing, household items, vehicles, securities, art, and other assets.