Form 8282, Donee Information Return, is used by charitable organizations to report information about the sale, exchange, or other disposition of certain donated property. Properly managing this form ensures compliance with IRS regulations and helps maintain transparency in the handling of donated items, thereby preserving the integrity and trust of charitable activities. The purpose of the form is to provide the IRS with information about the sale, exchange, or other disposition of charitable donations that the donor originally reported on Form 8283. This form helps ensure that the donated property is used for its intended charitable purpose and that any dispositions are properly documented. By using Form 8282, donee organizations can maintain compliance with IRS regulations and contribute to the transparency and accountability of charitable contributions.

Who Must File Form 8282?

Form 8282 must be filed by charitable organizations that sell, exchange, or otherwise dispose of donated property within three years of receiving the donation. This includes:

- Charitable Organizations: Nonprofit organizations that receive donated property and subsequently sell, exchange, or dispose of it within the specified timeframe.

- Other Qualified Donees: Entities such as governmental units and certain non-exempt charitable trusts that receive and dispose of donated property.

How To File Form 8282?

Filing Form 8282 involves several steps and requires detailed information to ensure all necessary information is provided. The form must be filed with the IRS and a copy provided to the donor within 125 days of the disposition of the donated property.

- Obtain Form 8282: The form can be downloaded from the IRS website. Ensure you have the correct version for the reporting year.

- Complete the form: Fill out Form 8282 with the required information, including details about the donee organization, the donor, the donated property, and the disposition.

- Attach supporting documentation: Gather all required documents, such as receipts, appraisals, and records of the disposition, to substantiate the information provided on the form.

- Submit the form: File Form 8282 with the IRS and provide a copy to the donor within 125 days of the disposition of the donated property.

How To Fill Out Form 8282?

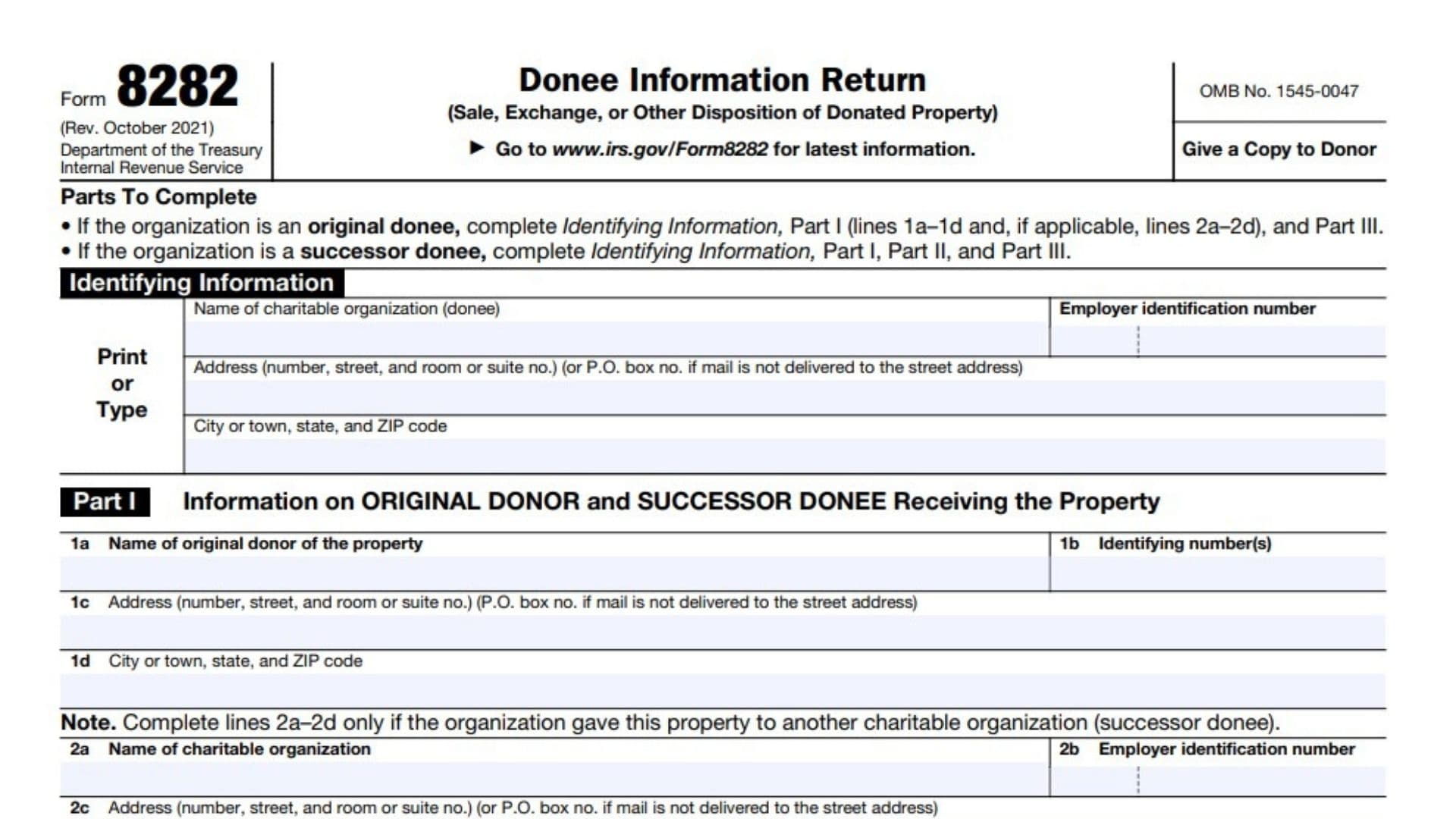

Identifying Information

- Name of Charitable Organization (Donee): Enter the full legal name of the donee organization.

- Employer Identification Number (EIN): Enter the organization’s EIN.

- Address: Provide the complete address of the organization.

- City, State, and ZIP Code: Enter the city, state, and ZIP code where the organization is located.

Part I: Information on Original Donor and Successor Donee

1a. Name of Original Donor: Provide the name of the person or entity that donated the property. 1b. Identifying Number: Enter the original donor’s TIN (SSN or EIN). 1c-d. Address of Donor: Provide the donor’s address, including city, state, and ZIP code.

If the property was transferred to another charitable organization (successor donee), complete lines 2a-2d:

2a. Name of Successor Donee: Provide the name of the organization that received the property from the original donee. 2b. EIN of Successor Donee: Enter the EIN of the successor donee. 2c-d. Address: Provide the complete address of the successor donee.

Part II: Information on Previous Donees

Only complete this section if your organization is not the original donee.

3a-d. Information of Previous Donee: If you are a successor donee, provide the previous donee’s information. 4a-d. Information of Preceding Donee: If applicable, provide details of the donee before the preceding one.

Part III: Information on Donated Property

- Description of Property: Describe the property sold, exchanged, or otherwise disposed of. Include detailed descriptions, such as vehicle identification numbers for cars or hull identification numbers for boats.

- Entire Interest Disposed: Check “Yes” or “No” to indicate if the entire interest in the property was disposed of.

- Related Use: Check “Yes” or “No” if the property was used for the organization’s exempt purpose or function.

- Use of Property: Describe how the property was used to further the organization’s purpose (if applicable).

5-7. Dates: Enter the dates the donee, the original donee received the property, and when the property was sold or disposed of.

- Amount Received Upon Disposition: Report the amount the organization received when the property was sold or exchanged.

Part IV: Certification

If any tangible personal property described in Part III was used for the organization’s purpose, or if the intended use became infeasible, certify by signing and dating the form.

Submission

Send the completed form to the IRS within 125 days of disposition. The original donor and any successor donee must receive copies as well.

Penalties for Non-Compliance

Failure to file can result in a $50 penalty per form. A $10,000 penalty may apply for fraudulent identification of property use.

Ensure all information is accurate and complete. Double-check the details about the donee organization, the donor, the donated property, and the disposition. If needed, seek assistance from a tax professional to ensure the form is filled out correctly and submitted on time.

Things to Consider When Filing Form 8282

Understanding the specific rules and implications of filing Form 8282 is essential for donee organizations to ensure compliance with IRS regulations.

Accurate Reporting: Ensure that all information reported on Form 8282 is accurate. Incorrect or incomplete information can lead to penalties and delays in processing by the IRS.

Supporting Documentation: Provide thorough and detailed supporting documentation to substantiate the disposition of the donated property. This includes receipts, appraisals, and records of the sale or exchange.

Timely Filing: Form 8282 must be filed with the IRS and a copy provided to the donor within 125 days of the disposition of the donated property. Ensure that the form is completed and submitted promptly to avoid penalties.

Coordination with Form 8283: Ensure that the information reported on Form 8282 corresponds with the information originally reported by the donor on Form 8283, Noncash Charitable Contributions. Consistency between these forms is crucial for maintaining compliance.

Record Keeping: Maintain accurate records of all donated property, including details of the disposition. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of charitable contribution reporting and the specific requirements of Form 8282, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 8282 is completed accurately and submitted on time and can provide guidance on the implications of the disposition of donated property.

Legal and Financial Implications: Understand the legal and financial implications of reporting the disposition of donated property. This includes the impact on the donee organization’s financial statements and compliance with IRS regulations.