IRS Form 8275, titled “Disclosure Statement,” is a critical form used by taxpayers to disclose items or positions on a tax return that are not contrary to Treasury regulations but may lack clear authority or could be challenged by the IRS. Unlike Form 8275-R, which is used for positions that directly contradict Treasury regulations, Form 8275 is your safeguard when you’re operating in the gray areas of tax law—especially when guidance is ambiguous, incomplete, or untested. By filing this form, you reduce the risk of penalties for underpayment due to tax positions the IRS might later dispute. It shows that you’ve made a good-faith effort to report accurately and transparently.

Form 8275 is typically used by individuals, businesses, and tax professionals to disclose positions related to deductions, income inclusions, credits, or valuation methods that might otherwise raise red flags. The form must be attached to your tax return and provides an avenue to fully explain and document the reasoning and legal support behind such positions.

How to File Form 8275?

- Attach the form to your tax return when you file it—electronically or by mail.

- Only use Form 8275 when your position is not contrary to Treasury regulations. If it is, use Form 8275-R.

- Include all relevant documentation to support your position.

- Submit a separate Form 8275 for each tax return where disclosure is necessary.

- Go to www.irs.gov/Form8275 for the latest version and instructions.

How to Complete Form 8275?

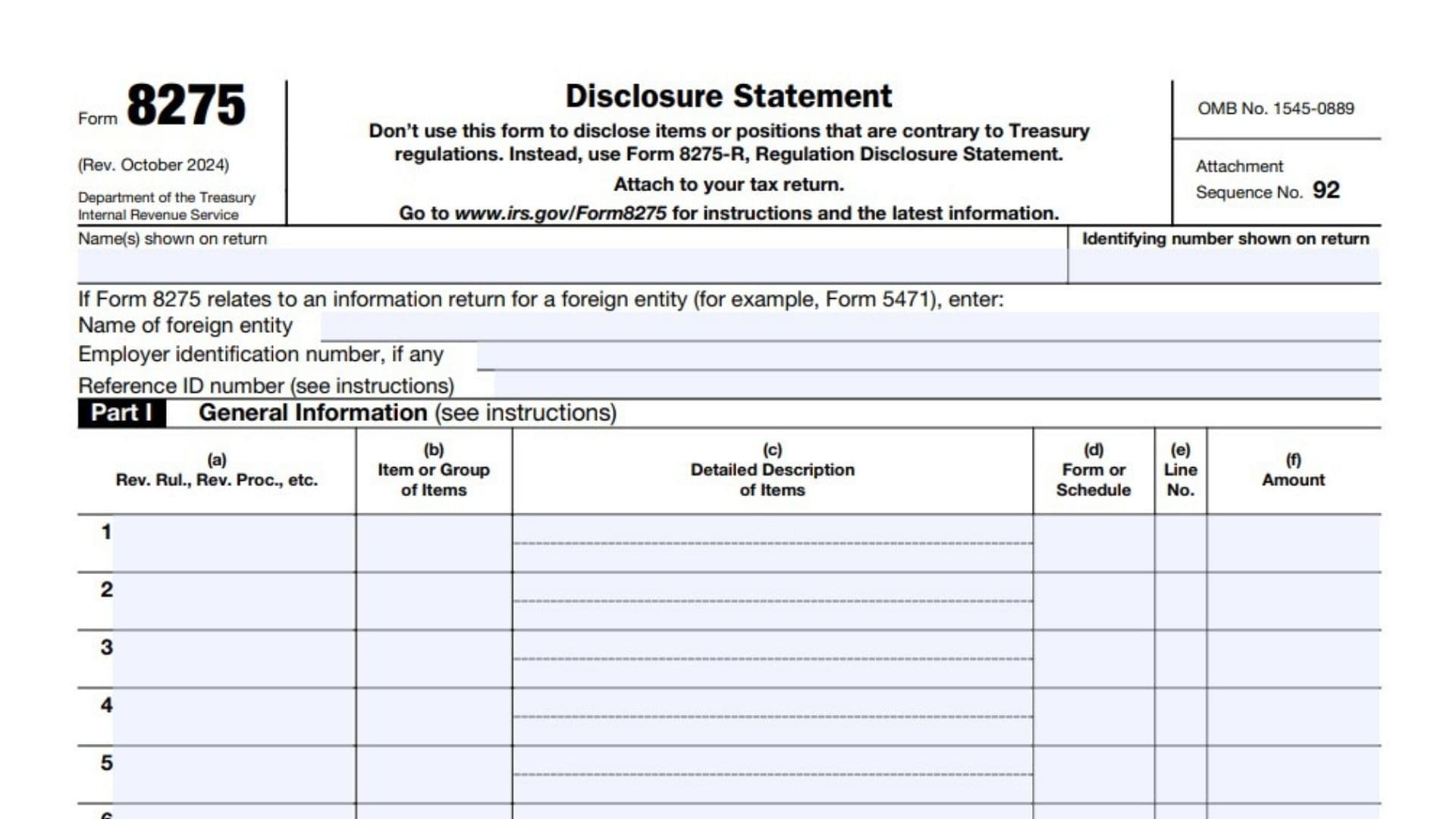

Top Section (Header)

- Name(s) shown on return: Enter the same name(s) that appear on the related tax return.

- Identifying number shown on return: Use your SSN, EIN, or other relevant tax ID.

- If Form 8275 relates to an information return for a foreign entity (e.g., Form 5471):

- Name of foreign entity: Enter the full name.

- Employer Identification Number (EIN), if any: Provide it if applicable.

- Reference ID number: This is required if no EIN is available; refer to IRS instructions for formatting.

Part I – General Information

This section discloses the tax position you are taking.

| Column | Description |

|---|---|

| (a) Rev. Rul., Rev. Proc., etc. | Reference the legal authority supporting your position (e.g., IRS Revenue Rulings, Procedures, Notices). |

| (b) Item or Group of Items | Identify what is being disclosed (e.g., “Research Credit” or “Charitable Contribution Deduction”). |

| (c) Detailed Description of Items | Describe the item(s) in detail, including facts, computations, or transactions involved. |

| (d) Form or Schedule | Enter the specific form or schedule on which the item appears (e.g., Schedule C, Form 1120). |

| (e) Line No. | Indicate the exact line number of the item within the form or schedule. |

| (f) Amount | Report the dollar amount associated with the disclosure. |

📝 You can disclose up to six items in Part I. If more are needed, attach additional pages or use multiple forms.

Part II – Detailed Explanation

This section allows for a narrative explanation supporting your tax position. Each line corresponds to the items from Part I.

- Lines 1 through 6: Provide a full explanation for each item listed. Include:

- Relevant facts and context

- Legal arguments or citations

- How and why your interpretation applies

- Any court cases or tax code sections that support your claim

Be thorough and concise. The IRS will use this to evaluate the adequacy of your disclosure.

Part III – Information About Pass-Through Entity

Only complete this part if the disclosure relates to an item from a pass-through entity like a partnership, S corporation, trust, estate, REIT, RIC, or REMIC.

| Line | What to Enter |

|---|---|

| 1 | Name, address, and ZIP code of the pass-through entity. |

| 2 | Identifying number (typically EIN) of the pass-through entity. |

| 3 | Tax year of the pass-through entity (start and end dates). |

| 4 | IRS Center where the pass-through entity filed its return (e.g., Ogden, UT; Fresno, CA). |

This allows the IRS to trace the origin of the item back to the entity.

Part IV – Explanations (continued from Parts I and/or II)

Use this page to continue any explanations from Part I or II that didn’t fit due to space constraints.

- Clearly indicate which item you’re expanding upon.

- Use the same line number or identifier as on previous parts.

- Maintain the same clear structure and cite supporting authorities.