IRS Form 8027 is an annual information return filed by employers in the food and beverage industry to report tip income and allocated tips. This form ensures compliance with the IRS regulations regarding tip reporting, especially for businesses that rely on tips as part of their employees’ income. Establishments such as restaurants, bars, and other service-oriented businesses where employees receive tips must submit this form. The purpose is to provide a comprehensive report of both directly and indirectly reported tips, as well as to allocate unreported tips to the appropriate employees. This helps the IRS ensure that all tip income is properly reported and taxed.

Form 8027 helps determine how much of the total tip income is reported by employees, ensuring that the correct amount of taxes is paid on these tips. The form covers a variety of income types, including directly tipped employees and those who receive indirect tips, as well as service charges that may be treated as wages. Essentially, it helps establish an accurate and fair record of tip income across the business, ensuring the correct amount is allocated and reported.

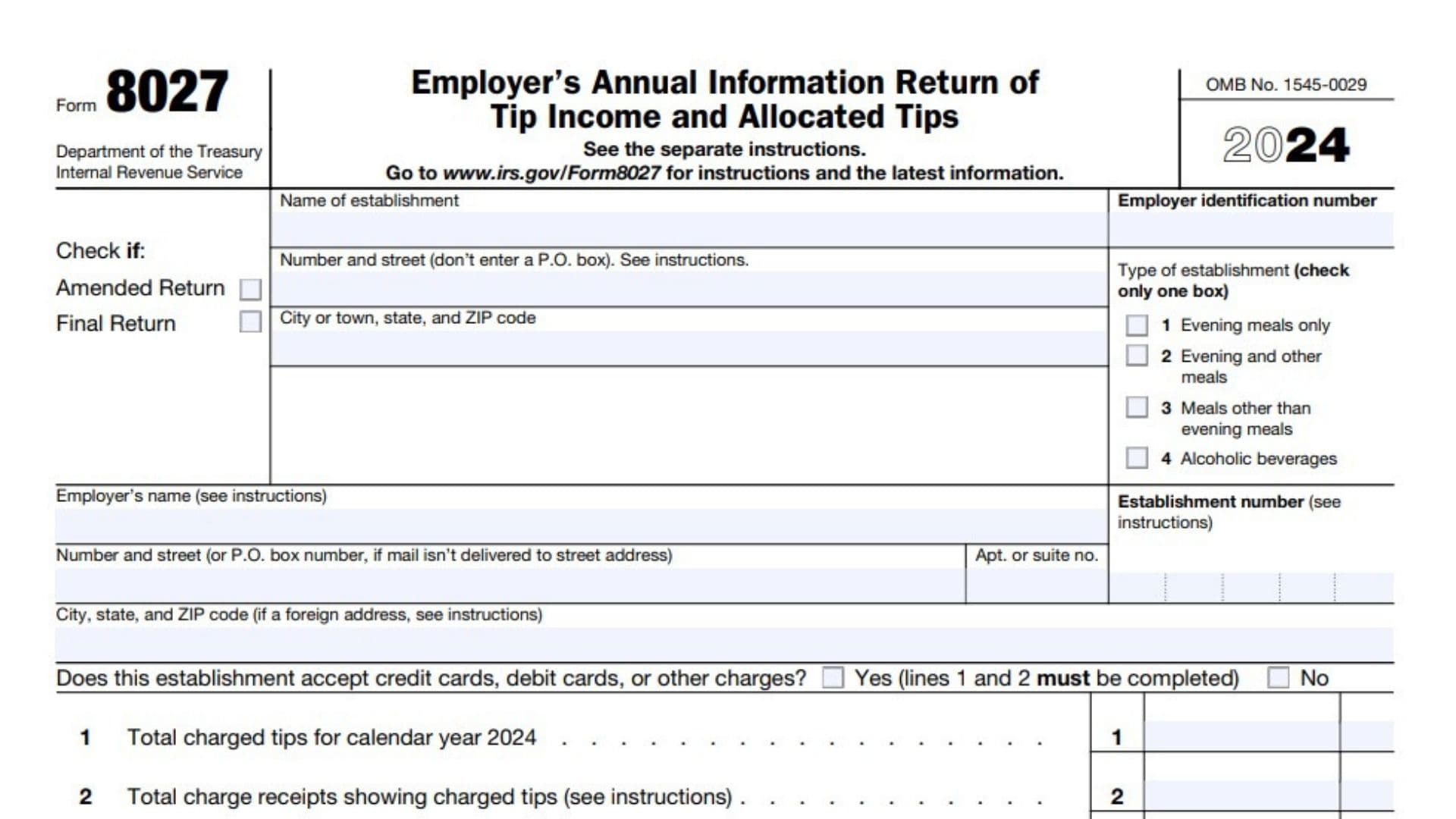

Who Should File Form 8027?

Form 8027 should be filed by employers operating establishments that provide meals or alcoholic beverages, where employees receive tips. This includes establishments such as restaurants, bars, and other similar businesses where tips are commonly given for services provided. Employers must file this form if they have any tipped employees and if their annual gross receipts from food and beverages meet the minimum threshold specified by the IRS.

How to Complete Form 8027?

- Establishment Information (Part 1):

- Name of Establishment: Enter the name of the business or establishment.

- Employer Identification Number (EIN): Provide the EIN associated with the business for tax identification purposes.

- Type of Establishment: Select the type of establishment, whether it’s an evening meals only establishment, a full-service restaurant, a bar serving alcoholic beverages, or something else.

- Does the Establishment Accept Credit or Debit Cards? Indicate whether the establishment processes payments via credit cards or debit cards. This impacts the report of charged tips and receipts.

- Tip Income Reporting (Part 2):

- Line 1 – Total Charged Tips: Report the total amount of charged tips received during the year.

- Line 2 – Total Charge Receipts Showing Charged Tips: Report the total receipts showing tips on charge transactions. This includes credit card and debit card tips.

- Line 3 – Service Charges: Report the total amount of service charges (less than 10%) that are paid as wages to employees, not as tips.

- Line 4 – Reported Tips by Employees:

- 4a: Enter the total tips reported by indirectly tipped employees (those who don’t directly receive tips from customers but may receive shared tips from others).

- 4b: Enter the total tips reported by directly tipped employees (those who receive tips directly from customers).

- 4c: Add lines 4a and 4b to get the total amount of tips reported by all employees.

- Gross Receipts and Allocation of Tips (Part 3):

- Line 5 – Gross Receipts from Food and Beverages: Report the total gross receipts from food and beverage sales, which should be at least as large as the amount in line 2.

- Line 6 – Allocation of Tips: This is the calculated allocation of tips based on a percentage of gross receipts (usually 8%). If a different rate is used, attach an IRS determination letter to support this. If tips were allocated using a period other than the calendar year, indicate that here.

- Line 7 – Excess Tips Allocation: If the amount in line 6 exceeds the total tips reported in line 4c, the excess must be allocated to directly tipped employees.

- Methods of Allocation (Part 4):

- The IRS provides several methods for allocating tips among employees. Employers must select the method used for allocation on line 7:

- Allocation Based on Hours Worked: This method distributes tips based on the number of hours worked by each employee.

- Allocation Based on Gross Receipts: In this method, tips are allocated based on the establishment’s gross receipts.

- Good-Faith Agreement Method: This method allocates tips based on an agreement made in good faith between the employer and employees.

- The IRS provides several methods for allocating tips among employees. Employers must select the method used for allocation on line 7:

- Employee Information (Part 5):

- Line 8 – Number of Directly Tipped Employees: Report the total number of employees who receive tips directly.

- Signature Section:

- Employer Declaration: Under penalties of perjury, the employer must sign and date the form, confirming that the information provided is accurate and complete to the best of their knowledge.