Form 730, Monthly Tax Return for Wagers, is used by individuals and entities involved in accepting wagers to report and pay the federal excise tax on those wagers. Properly managing this form ensures compliance with IRS regulations and helps taxpayers accurately calculate and remit their wagering tax liabilities. The primary purpose of Form 730 is to allow individuals and entities that accept wagers to report and pay the federal excise tax on those wagers. This tax is imposed on various types of betting activities, including those conducted by bookmakers, lottery operators, and other entities involved in the wagering industry. By using Form 730, these taxpayers can fulfill their obligation to report and pay taxes on their wagering activities monthly.

Who Must File Form 730?

Form 730 must be filed by:

- Bookmakers: Individuals or businesses that accept bets on sporting events or other outcomes.

- Lottery Operators: Entities that operate lotteries, including those run by states, municipalities, or private organizations.

- Other Wagering Entities: Any individual or business involved in accepting wagers, including those who operate betting pools or similar activities.

How To File Form 730?

Filing Form 730 involves several steps and requires detailed information to ensure all necessary details are provided. The form must be filed monthly with the IRS.

- Obtain Form 730: The form can be downloaded from the IRS website. Ensure you have the correct version for the month in which you are filing.

- Complete the form: Fill out the form with details of the wagering activities, including the amount of wagers accepted and the excise tax due.

- Submit the form: Mail the completed form to the IRS by the last day of the month following the month in which the wagers were accepted. Ensure that the form and any payment for the tax due are included.

How to Complete Form 730?

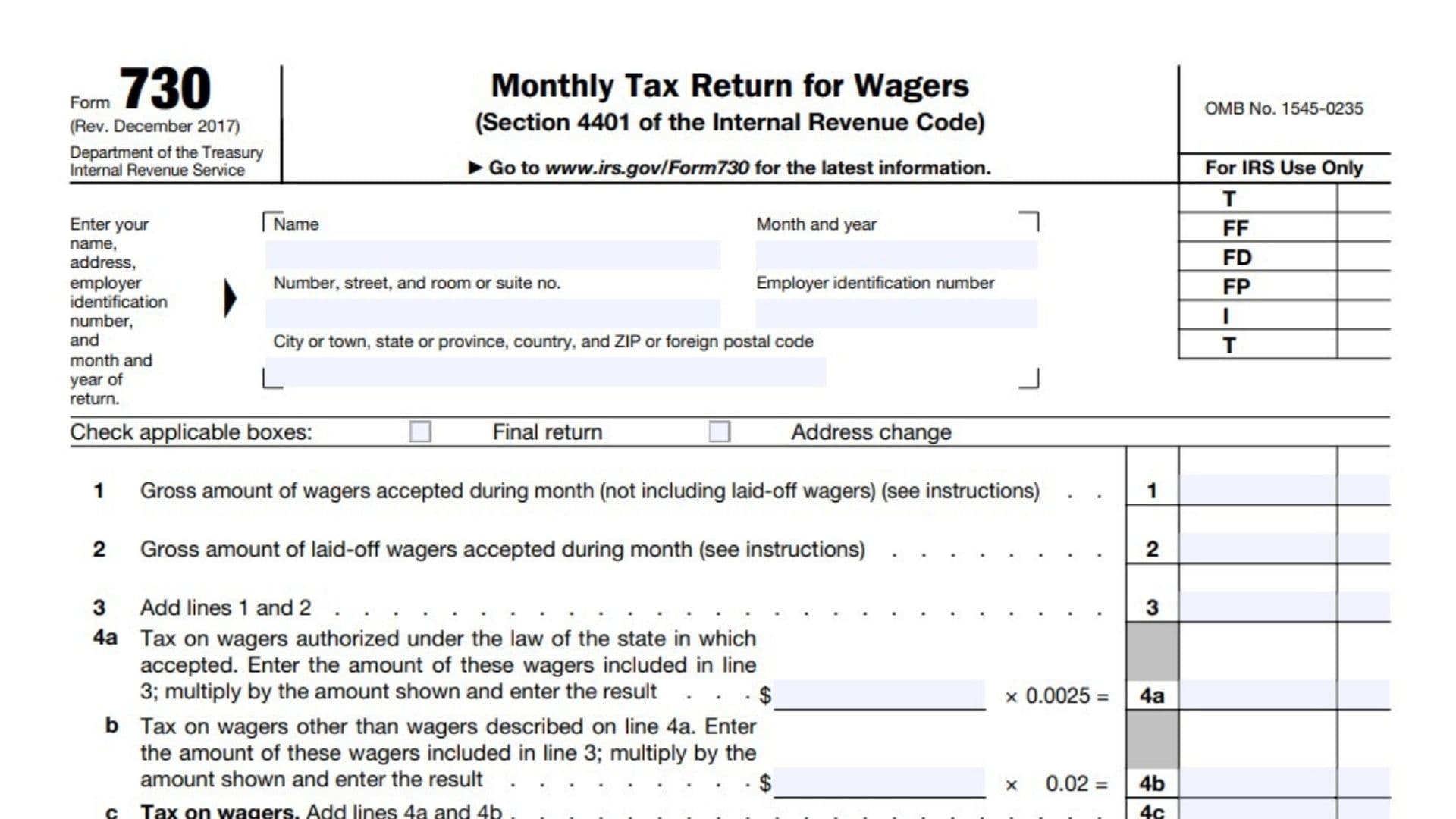

IRS Form 730 is a tax form used by entities involved in accepting wagers, operating wagering pools, or lotteries to report and pay taxes on those wagers as required under Section 4401 of the Internal Revenue Code. Below are detailed, line-by-line instructions for completing the form accurately.

Part I: Information Section

- Name:

Enter the legal name of the business or individual that accepts wagers. This should match the name used when applying for the Employer Identification Number (EIN). - Number, Street, and Room or Suite Number:

Provide the complete street address, including any room or suite number. - City, State, ZIP, or Foreign Postal Code:

Enter the city, state, and ZIP code (or foreign postal code) for the mailing address. - Month and Year:

Specify the month and year of the period for which the return is being filed. The format should be MM/YYYY (for example, “06/2023” for June 2023). - Employer Identification Number (EIN):

Provide the EIN assigned by the IRS. If you do not have an EIN, apply using Form SS-4.

Checkboxes

- Final Return:

Check this box if this is the last return because you will no longer be accepting wagers or engaging in activities that require filing Form 730. - Address Change:

Check this box if the address on this return is different from previous filings.

Part II: Tax Computation

- Line 1: Gross Amount of Wagers Accepted During the Month

Enter the gross amount of wagers you accepted during the month. Do not include “laid-off” wagers (wagers placed with another entity to offset your liability) in this total. This includes any fees or charges associated with placing the wagers. - Line 2: Gross Amount of Laid-off Wagers Accepted During the Month

Enter the gross amount of laid-off wagers (wagers you accepted from others to cover their bets). Laid-off wagers are reported separately. - Line 3: Add Lines 1 and 2

Combine the amounts from Lines 1 and 2 to calculate the total amount of wagers. - Line 4a: Tax on Wagers Authorized Under the Law of the State

Enter the amount of wagers from Line 3 that are authorized by state law. Multiply the amount by 0.0025 (0.25%) to calculate the tax due for these wagers. - Line 4b: Tax on Other Wagers (Not Authorized by State Law)

For wagers not authorized by state law, enter the amount included in Line 3. Multiply by 0.02 (2%) to calculate the tax for unauthorized wagers. - Line 4c: Tax on Wagers

Add the amounts from Lines 4a and 4b. This is your total tax liability for the month. - Line 5: Credits

Enter any credits you are claiming, if applicable. No credit is allowed unless you provide supporting documentation (such as evidence of overpayment or a laid-off wager adjustment). Include an explanation with your return. - Line 6: Balance Due

Subtract Line 5 from Line 4c. If the result is less than $1, you do not need to pay. This is your total amount due.

Signature Section

- Signature:

The individual responsible for filing the return must sign here, under penalties of perjury, confirming that the information provided is correct. - Date:

Enter the date the form is signed. - Paid Preparer Use Only (If Applicable):

If someone other than the taxpayer is preparing the return, they must provide their name, signature, and PTIN (Preparer Tax Identification Number). Also, include the firm’s name, address, and EIN, if applicable.

Form 730-V Payment Voucher

If you are making a payment by check or money order, complete Form 730-V and include it with your return. Do not attach it to Form 730. Key sections include:

- Employer Identification Number (EIN):

Enter your EIN, as on the main form. - Amount Paid:

Enter the amount you are paying, as calculated on Line 6. - Year and Month:

Enter the same year and month as on Form 730. - Business Name and Address:

Provide the name and address exactly as shown on Form 730.

Where to File

Mail Form 730, the payment voucher, and your payment to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0100

If using the Electronic Federal Tax Payment System (EFTPS) to pay, do not send Form 730-V.