If you’re involved in a business subject to federal excise tax, you will likely be required to file Form 720. This is an information return that is required to be filed on a quarterly basis by anyone who collects an excise tax from the sale of certain goods or services. While there are some exceptions, most businesses that produce or sell goods that are subject to excise tax will be required to file this form. This includes manufacturers, importers, exporters, brokers, and other companies that collect the Tax from the sale of goods or services.

How to File Form 720?

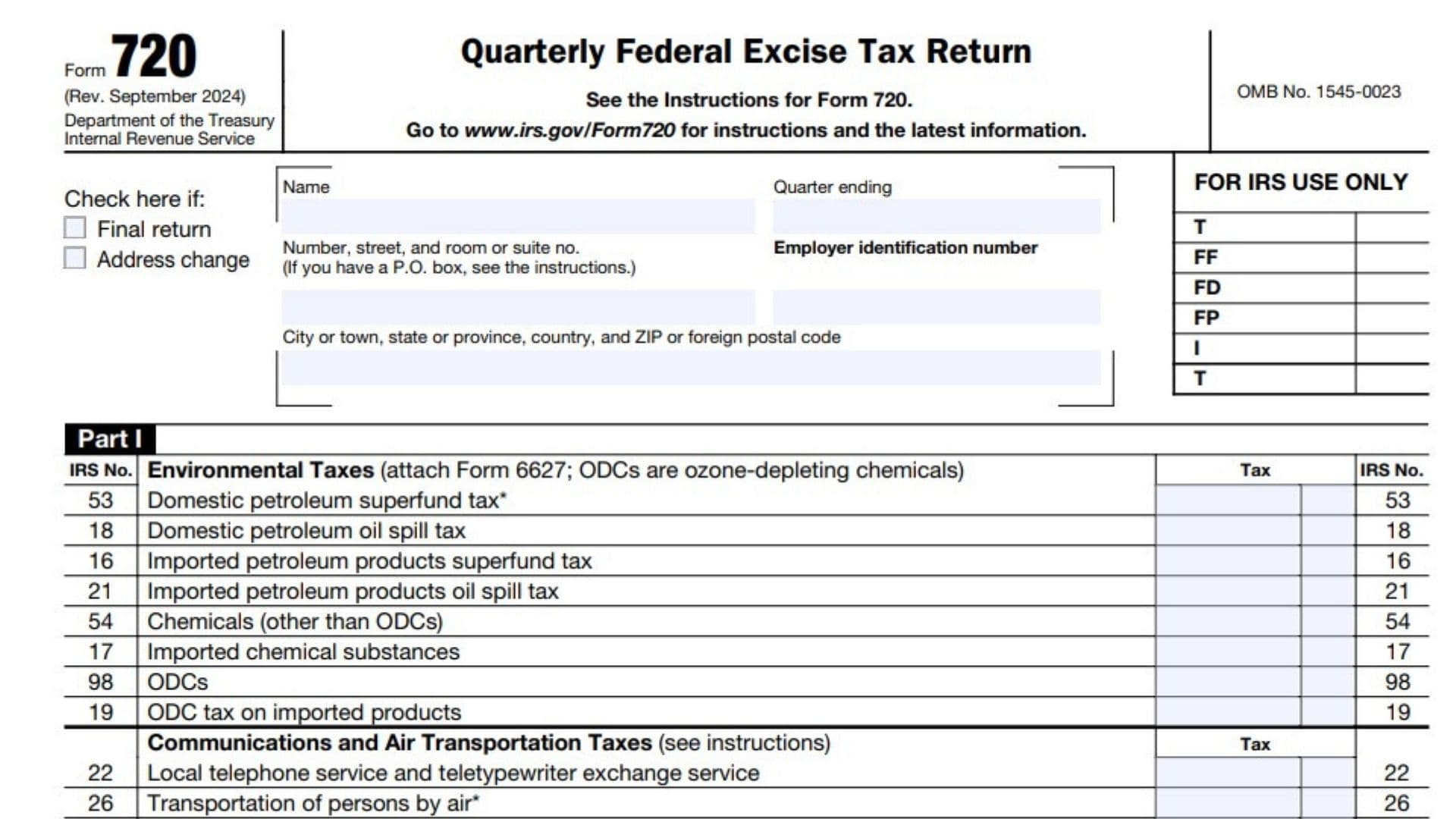

The first step in filing Form 720 is to enter your name, address, and quarter-ending date on the top of the form. If you have an employer identification number, include it in the box provided. If you’re a onetime filer or plan to close your business permanently, check the final return box.

Next, move down to Part One of the form and report your excise tax liabilities. If you’re reporting a onetime gas guzzler filing, skip to Part Two and follow the instructions in that section for filling out the form. Part, One of the form also asks you to allocate your total reported excise tax liability over each half-month of the quarter.

Then, in Part II of the form, report your excise tax payments made during the quarter. If the due date for this payment falls on a weekend or legal holiday, you must make your payment by the next business day. Once you’ve completed Parts I and II of the form, complete Schedule A if necessary. This is a detailed report of your method to calculate your excise tax liability.

How to Complete Form 720?

Part I

Environmental Taxes – You must you Form 6627 to figure the environmental taxes on the followings:

- Domestic petroleum superfund tax

- Imported petroleum products superfund tax

- • Oil spill liability

- Ozone-depleting chemicals

- Imported products that used ODCs as materials in the manufacture or production of the product

- The floor stocks Tax on ODCs

- Attach Form 6627 to Form 720

Communications and Air Transportation Taxes –

- Local telephone and teletypewriter exchange service

- Transportation of persons by air

- Transportation of property by air

- Use of international air travel facilities

Fuel Taxes

Fill out number of gallons for your Diesel, Kerosene, Gasoline, LPG, Liquefied natural gas, and other fuel consumption.

Retail Tax – —Truck, trailer, and semitrailer chassis and bodies, and tractor

Ship Passenger Tax

Other Excise Tax

Foreign Insurance Taxes

Manufacturers Taxes

- Coal (Underground / Surface Mined )

- Taxable tires

- Gas guzzler tax (Form 6197)

- Vaccines

1 – Add all amounts in Part I to figure the total here. Complete Schedule A unless onetime filing

Part II

Patient-Centered Outcomes Research Fee.

- Specified health insurance policies

- 133 Applicable self-insured health plans

- Sport fishing equipment

- Fishing rods and fishing poles

- Electric outboard motors

- Fishing tackle boxes

- Bows, quivers, broadheads, and points

- Arrow shafts

- Indoor tanning services

- Inland waterways fuel use tax

- LUST tax on inland waterways fuel use

- Section 40 fuels

- Biodiesel sold as but not used as fuel

- Floor Stocks Tax (attach Form 6627)

2 – Add all amounts in Part II to figure your total.

Part III

3 – Total tax. Add Part I, line 1, and Part II, line 2

4 – Claims

5 – Deposits made for the quarter

6 – Overpayment from previous quarters

7 – Enter the amount from Form 720-X included on line 6

8 – Add lines 5 and 6

9 – Add lines 4 and 8

10 – Balance Due: If line 3 > line 9, enter the difference here. Pay the full amount with the return

11 – Overpayment: Enter the difference if line 9 > line 3.