Form 637, Application for Registration (For Certain Excise Tax Activities), is used by businesses and individuals to apply for registration for activities subject to excise taxes under the Internal Revenue Code. Properly managing this form ensures compliance with IRS regulations and helps entities engage in activities that require excise tax registration. The primary purpose of Form 637 is to allow businesses and individuals to apply for registration for specific activities that are subject to excise taxes. This registration is necessary for entities that engage in activities such as manufacturing, selling, or importing products that are subject to federal excise taxes. By using Form 637, entities can obtain the necessary registration to comply with excise tax laws and regulations.

Who Must File Form 637?

Form 637 must be filed by:

- Manufacturers, Producers, and Importers: Entities involved in the manufacturing, production, or importation of products subject to federal excise taxes.

- Sellers of Taxable Fuel: Entities that sell, purchase, or use taxable fuel.

- Exporters: Entities that export products subject to excise taxes.

- Users of Certain Products: Entities that use products in a manner that requires excise tax registration.

- Other Activities: Entities involved in other activities specified by the IRS that require excise tax registration.

How To File Form 637?

Filing Form 637 involves several steps and requires detailed information to ensure all necessary details are provided. The form must be filed with the IRS, and approval must be obtained before engaging in activities that require excise tax registration.

- Obtain Form 637: The form can be downloaded from the IRS website. Ensure you have the correct version.

- Complete the form: Fill out the form with details of the business or individual’s activities that require excise tax registration.

- Attach supporting documentation: Gather all required documents, such as business licenses, permits, financial statements, and any necessary schedules to substantiate the information provided.

- Submit the form: Mail the completed form to the IRS at the address provided in the instructions. Ensure that all required information and supporting documentation are included.

How to Complete Form 637?

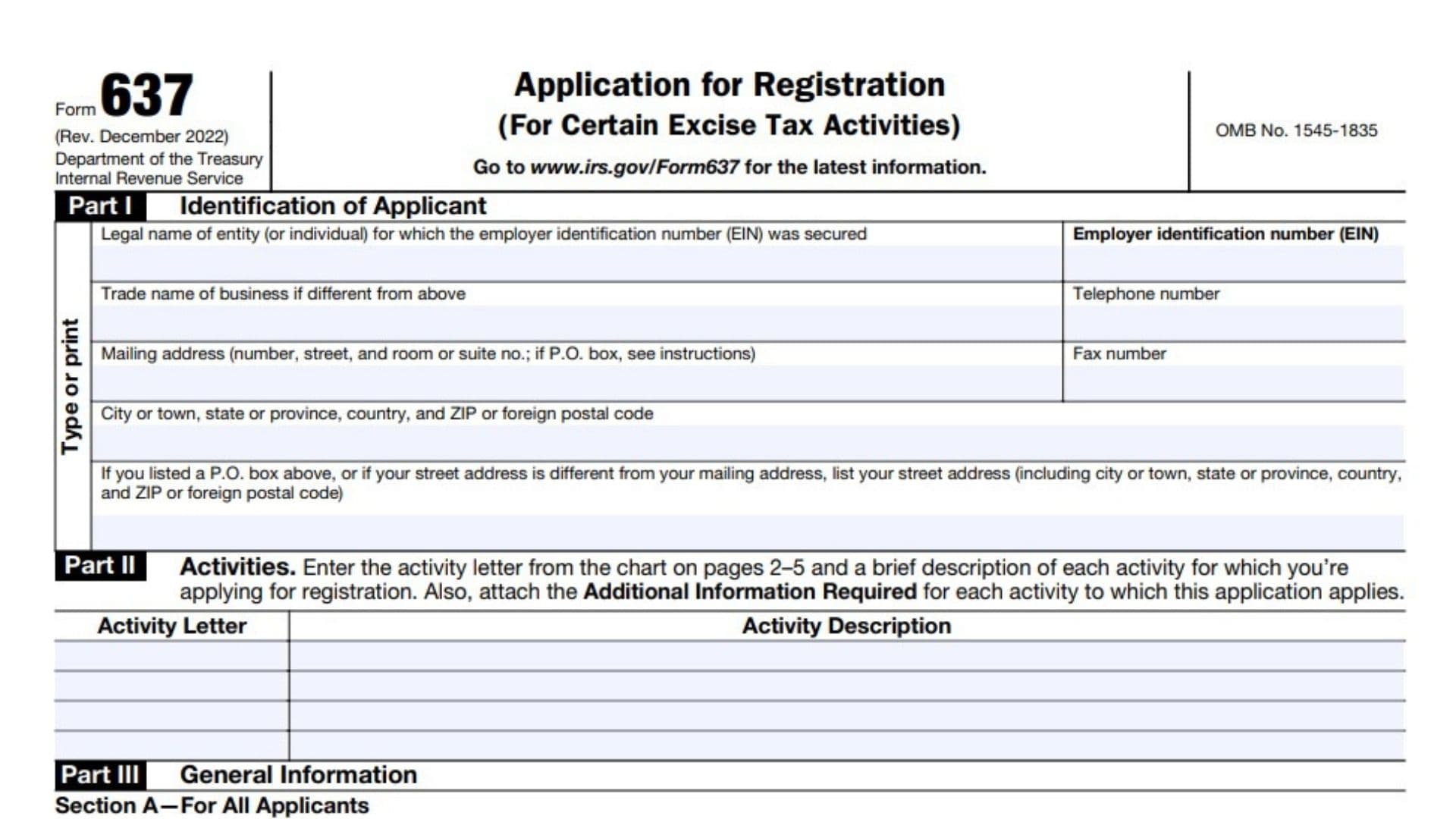

Below is a line-by-line guide to complete Form 637 accurately based on the current version.

Part I: Identification of Applicant

- Legal Name of Entity/Individual:

Enter the full legal name of the business or individual applying for excise tax registration. Ensure the name matches the one used when applying for an Employer Identification Number (EIN). - Employer Identification Number (EIN):

Enter the EIN for the entity. If you do not have an EIN, apply for one using Form SS-4 or online at the IRS website. - Trade Name:

If the business operates under a different name than the legal name entered on Line 1, provide the trade name. - Telephone Number:

Enter the primary telephone number where the IRS can contact you regarding this application. - Mailing Address:

Provide your full mailing address, including street number, city, state, and ZIP code. If using a P.O. Box, ensure this is indicated here. - Fax Number:

Provide your business fax number if applicable. - Street Address (if different from mailing):

If your street address differs from your mailing address, provide the street address here.

Part II: Activities

- Activity Letter:

Identify the activity for which you are applying for excise tax registration by entering the appropriate letter from the chart on pages 2–5 of the form. Examples include:- “M” for blenders of taxable fuel mixtures,

- “S” for enterers or refiners of fuel.

- Activity Description:

Provide a brief description of the activity that corresponds to the activity letter. For example, describe the type of fuel blending or manufacturing activities you are conducting. - Additional Information Required:

Some activities require supporting documentation. Attach any additional forms or descriptions as specified in the instructions for the chosen activity letter.

Part III: General Information

Section A: For All Applicants

- Line 1a:

Indicate whether you currently file, or will be required to file, Form 720 (Quarterly Federal Excise Tax Return). Check “Yes” or “No.” - Line 1b:

Indicate if you have previously applied for registration with any IRS office. If “Yes,” check the box and attach details, including the name of the office. - Line 1c:

If you or a related entity had a Certificate of Registry or Letter of Registration revoked or suspended by the IRS, check “Yes” and provide details. - Line 2a (Date of Business Start):

Provide the month and year when your business commenced operations. - Line 2b (Business Activity):

Explain your business activity in detail, such as the types of products sold or services rendered. - Line 3 (Related Business Entities):

List the name and EIN of any related entities. Include the percentage of ownership and how the businesses are related (e.g., stock, partnership, etc.). - Line 4 (Business Locations):

List all physical addresses of current business operations, including any out-of-state or international locations. - Line 5 (Books and Records Location):

Provide the address where the business’s financial records are kept, if different from the address listed in Part I. - Line 6 (Owners and Officers):

List the names and taxpayer identification numbers (TINs) for all owners, corporate officers, members, or partners. - Line 7 (Contact Person):

Enter the name and phone number of the person who will be the primary contact for any questions related to this application.

Section B: For Fuel Applicants Only

- Line 8 (Changes in Ownership):

If you are applying for fuel-related activities, describe any changes in your business’s ownership or controlling stock within the past two years. If no changes, enter “None.”

Section C: For Certain Fuel Applicants

Fuel applicants applying for activities K, M, S, or Y must answer the following questions and provide full explanations if the answer is “Yes.”

- Line 9:

Have you or any related person been assessed penalties for fraudulently failing to file or pay taxes under chapter 68 of the Internal Revenue Code? Check “Yes” or “No.” - Line 10:

Have you been assessed any penalties under chapter 68 of the Internal Revenue Code that haven’t been fully abated or credited? Check “Yes” or “No.” - Line 11:

Have you or a related entity been convicted of a crime under chapter 75 of the Internal Revenue Code? Check “Yes” or “No.” - Line 12:

Have you been convicted of a felony involving theft, fraud, or making false statements? Check “Yes” or “No.” - Line 13:

Were you assessed any taxes under section 4103 for willfully failing to pay excise taxes? Check “Yes” or “No.” - Line 14:

Have you been advised that your registration has been revoked by the IRS? Check “Yes” or “No.”

Signature Section

- Signature:

The form must be signed by an authorized representative of the business (e.g., owner, partner, corporate officer). - Title:

Enter the title of the individual signing the form (e.g., CEO, President). - Date:

Enter the date when the form was signed.

Once complete, submit Form 637 with any required additional documentation to the IRS by faxing it to 855-887-7735 or mailing it to:

Department of the Treasury

Internal Revenue Service

Excise Operations Unit—Form 637

Mail Stop 5701G

Cincinnati, OH 45999