IRS Form 6251, Alternative Minimum Tax – Individuals, is designed to calculate whether a taxpayer’s income and deductions trigger the Alternative Minimum Tax (AMT), a parallel tax system aimed at ensuring high-income individuals pay a fair share of taxes. The AMT applies when certain deductions, exemptions, or credits reduce regular tax liability below a mandated threshold. Taxpayers complete Form 6251 by recalculating their income without specific deductions and comparing the AMT to their regular tax. If the AMT is higher, the taxpayer must pay the additional tax. This form is most relevant to those with complex tax situations, such as large deductions or investments.

Who Must File Form 6251?

Form 6251 is required for taxpayers who meet certain criteria:

- If your taxable income exceeds a certain threshold, you may be subject to the AMT and must file Form 6251.

- Additionally, claim certain tax deductions, such as many itemized deductions or certain tax credits. You may also be subject to the AMT and must file Form 6251.

- Generally, individuals with high income, significant investment income, or large amounts of itemized deductions are more likely to be subject to the AMT.

- The specific income thresholds for AMT depend on various factors such as filing status, dependents, and deductions.

- Taxpayers who have exercised incentive stock options or have significant capital gains may also be required to file Form 6251. It is important to note that the criteria for the AMT can change from year to year and may be affected by changes in tax laws or regulations.

Therefore, it is always a good idea to consult with a tax professional to determine if you must file Form 6251 or may be subject to the AMT. Failing to file Form 6251, if required, could result in penalties and interest charges.

How to Complete Form 6251?

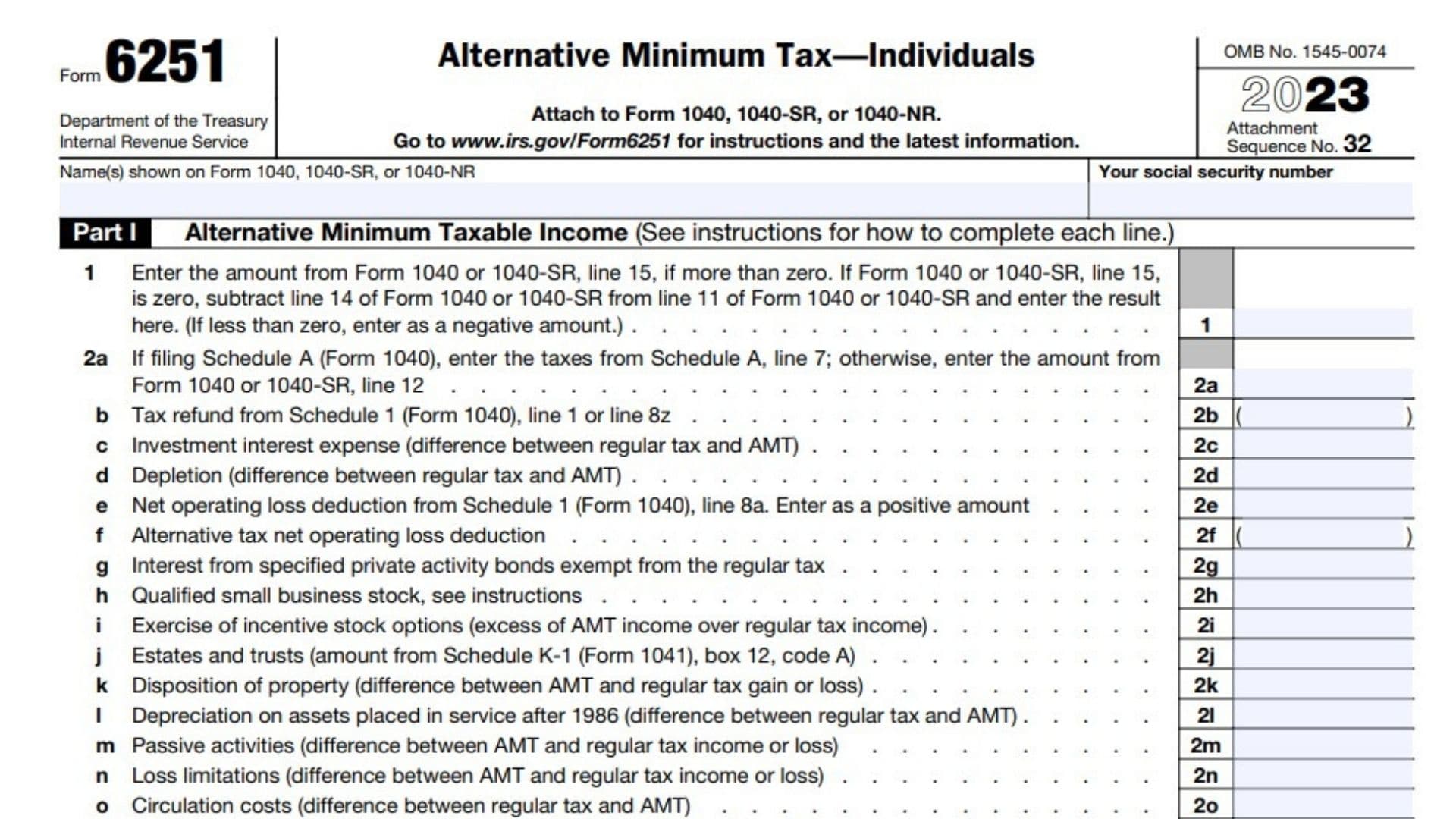

Part I Alternative Minimum Taxable Income

Line 1:

- Form 1040 or 1040-SR – Line 15 amount. , If more than zero.

- If Form 1040 or 1040-SR, line 15, is zero, subtract line 14 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR. Enter the amount.

- If less than zero, enter it as a negative amount.

Line 2a: Enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040 or 1040-SR, line 12If filing Schedule A (Form 1040)

Line 2b: Schedule 1 Tax Refund – line 1 or 8z.

Line 2c: Investment interest expense

Line 2d: Depletion

Line 2e: Schedule 1 (Form 1040, line 8a – Net operating loss deduction. Enter as a positive amount.

Line 2f: Alternative tax net operating loss deduction

Line 2g: Interest from specified private activity bonds exempt from the regular tax

Line 2h: Qualified small business stock

Line 2i: Exercise of incentive stock options

Line 2j: Estates and trusts. (Schedule K-1 (Form 1041), box 12, code A)

Line 2k: Disposition of property

Line 2l: Depreciation on assets placed in service after 1986

Line 2m: Passive activities

Line 2n: Loss limitations

Line 2o:Circulation costs

Line 2p: Long-term contracts

Line 2q: Mining costs

Line 2r: Research and experimental costs

Line 2s: Income from certain installment sales (before January 1, 1987)

Line 2t: Intangible drilling costs preference

Line 3: Other adjustments

- LINE 4: Alternative minimum taxable income: Combine lines 1-3

- Married Filing Separately and Line 4 is more than $776,100.

Part II Alternative Minimum Tax (AMT)

Line 5: Exemption

- If your filing status is Single or head of household and line 4 is not over $539,900, enter $ 75,900 on line 5.

- If your filing status is Married filing jointly or qualifying widow(er) and line 4 is not over $1,079,800, enter $118,100 on line 5.

- If your filing status is Married, filing separately, and line 4 is less than 539,900, enter 59,050 on line 5.

Line 6:

- Subtract line 5 from line 4.

- If more than zero, go to line 7

- If zero or less, enter -0- here and on lines 7, 9, and 11, and go to line 10.

Line 7:

If you are filing Form 2555, see IRS instructions.

Complete Part III on the back and enter the amount from line 40 here IF:

– You reported capital gain distributions directly on Form 1040 or 1040-SR, line 7

– You reported qualified dividends on Form 1040 or 1040-SR, line 3a

– You had a gain on both lines 15 and 16 of Schedule D (Form 1040)

Line 8: Alternative minimum tax foreign tax credit

Line 9: Subtract line 8 from line 7 to figure the Tentative Minimum Tax amount.

Line 10:

- Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2.

- Subtract from the result Schedule 3 (Form 1040), line 1, and any negative amount reported on Form 8978, line 14 (treated as a positive number. If zero or less, enter -0-

- If you used Schedule J to figure your tax on Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line.

Line 11: Alternative Minimum Tax: Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 1.

Line 12: Enter Form 6251, line 6 amount. Form 2555 filers must enter the amount from line 3 of the worksheet in the IRS Instructions for line 7.

Line 13: (IRS Instructions required)

- Enter the amount from line 4 of the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040

- Or the amount from line 13 of the Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if necessary).

- If you are filing Form 2555, see the instructions for the amount to enter.

Line 14: Enter Schedule D (Form 1040), line 19 amount.

Line 15: Enter the amount from line 13 if you did not complete a Schedule D Tax Worksheet for the regular tax or the AMT.

Line 16: Enter the smaller of line 12 or line 15.

Line 17: Subtract line 16 from line 12.

Line 18:

- If line 17 is $206,100 or less ($103,050 or less if married filing separately), multiply line 17 by 26% (0.26)

- Otherwise, multiply line 17 by 28% (0.28) and subtract $4,122 ($2,061 if married filing separately) from the result.

Line 19:

- If married filing jointly, or qualifying widow(er)

- If Single or married filing separately:

- If head of household:

Line 20: Do whichever applies

- Qualified Dividends and Capital Gain Tax Worksheet – Enter line 5 amount. Or,

- Schedule D Tax Worksheet: Enter Line 14 amount

- If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15

- If zero or less, enter -0-. If you are filing Form 2555, see the IRS Instructions for the amount to enter.

Line 21: Subtract line 20 from line 19. If zero or less, enter -0.

Line 22: Enter the smaller of line 12 or line 13.

Line 23: Enter the smaller of line 21 or line 22. This amount is taxed at 0%

Line 24: Subtract line 23 from line 22

Line 25:

- Single filer: Enter $459,750

- Married filing separately: Enter $258,600

- Married filing jointly or qualifying widow(er): Enter $517,200.

Line 26: Enter the amount from line 21

Line 27: Choose whichever applies

- Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or

- The amount from line 21 of the Schedule D Tax Worksheet

- If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15

- If zero or less, enter -0-. If you are filing Form 2555, see the IRS Instructions.

Line 28: Add line 26 and line 27

Line 29: Subtract line 28 from line 25. If zero or less, enter -0

Line 30: Enter the smaller of line 24 or line 29

Line 31: Multiply line 30 by 15% (0.15)

Line 32: Add lines 23 and 30

- If lines 32 and 12 are the same, skip lines 33 through 37 and go to line 38

- Otherwise, go to line 33.

Line 33: Subtract line 32 from line 22

Line 34: Multiply line 33 by 20%

Line 35: Add lines 17, 32, and 33

Line 36: Subtract line 35 from line 12

Line 37: Multiply line 36 by 25%

Line 38: Add lines 18, 31, 34, and 37

Line 39:

- If line 12 is $206,100 or less ($103,050 or less if married filing separately), multiply line 12 by 26% (0.26).

- Otherwise, multiply line 12 by 28% (0.28) and subtract $4,122 ($2,061 if married filing separately) from the result.

Line 40: Enter the smaller of line 38 or line 39 here and on line 7. If you are filing Form 2555, do not enter this amount on line 7. Instead, enter it on line 4 of the worksheet in the instructions for line 7.