The purpose of Form 5884 is to calculate and claim the Work Opportunity Credit. This credit allows employers to reduce their federal tax liability based on the wages paid to qualified employees during their first year of employment. Employers can receive a tax incentive by hiring individuals from specific target groups. To determine if you are eligible for the Work Opportunity Credit and need to file Form 5884, you should consider the following target groups:

- Qualified IV-A recipients: Individuals receiving benefits from Temporary Assistance for Needy Families (TANF).

- Unemployed veterans: Veterans who have been unemployed for a specified period.

- Ex-felons: Individuals convicted of a felony and who have completed or are participating in a rehabilitation program.

- Designated community residents: Individuals aged 18 to 39 living in empowerment zones or rural renewal counties.

- Vocational rehabilitation referrals: Individuals who have completed or are undergoing rehabilitation services.

- Summer youth employees: Individuals aged 16 to 17 or 18 to 24 employed between May 1 and September 15.

- Supplemental Nutrition Assistance Program (SNAP) recipients: Individuals receiving SNAP benefits.

- Supplemental Security Income (SSI) recipients: Individuals receiving SSI benefits.

- Long-term family assistance recipients: Individuals receiving long-term family assistance.

How to File Form 5884?

To file Form 5884, follow these steps:

- Obtain the most recent version of Form 5884 from the Internal Revenue Service (IRS) website or consult with a tax professional.

- Provide the necessary information about your business, including the Employer Identification Number (EIN) and business name and address.

- Calculate the amount of the credit based on the wages paid to qualified employees from the target groups.

- Complete the form with accurate and detailed information about the employees, including their names, Social Security numbers, and the target group they belong to.

- Attach Form 5884 to your business tax return (such as Form 1120, 1120-S, or 1065) when filing your taxes.

How to Complete Form 5884?

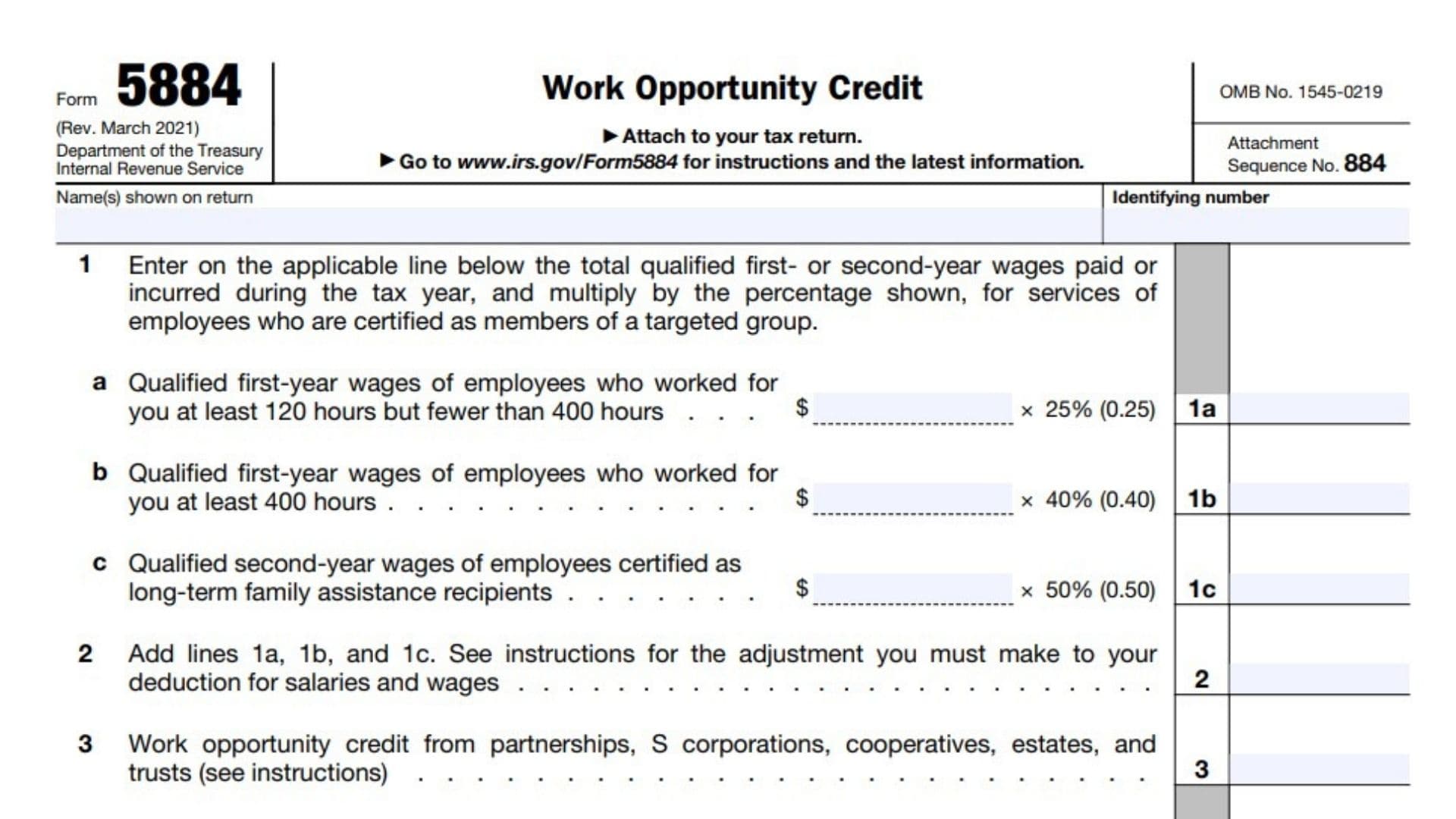

Line 1: The form instructs you to enter on the applicable line below the total qualified first- or second-year wages paid or incurred during the tax year and multiply by the percentage shown for services of employees who are certified as members of a targeted group.

Line 1a: Qualified first-year wages of employees who worked between 120 – 400 hours for you.

- Multiply the amount by 25% (0.25).

Line 1b: Qualified first-year wages of employees who worked at least 400 hours for you.

- Multiply the amount by 40% (0.40).

Line 1c: Qualified second-year wages of employees certified as long-term family assistance recipients.

- Multiply the amount by 50% (0.50).

Line 2: Add lines 1a, 1b, and 1c.

Line 3: Work opportunity credit from partnerships, S corporations, cooperatives, estates, and trusts.

Line 4: Add lines 2 and 3. Cooperatives, estates, and trusts, go to line 5. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and report this amount on Form 3800, Part III, line 4b.

Line 5: Enter amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

Line 6: Cooperatives, estates, and trusts, subtract line 5 from line 4. Enter the amount on Form 3800, Part III, line 4b.