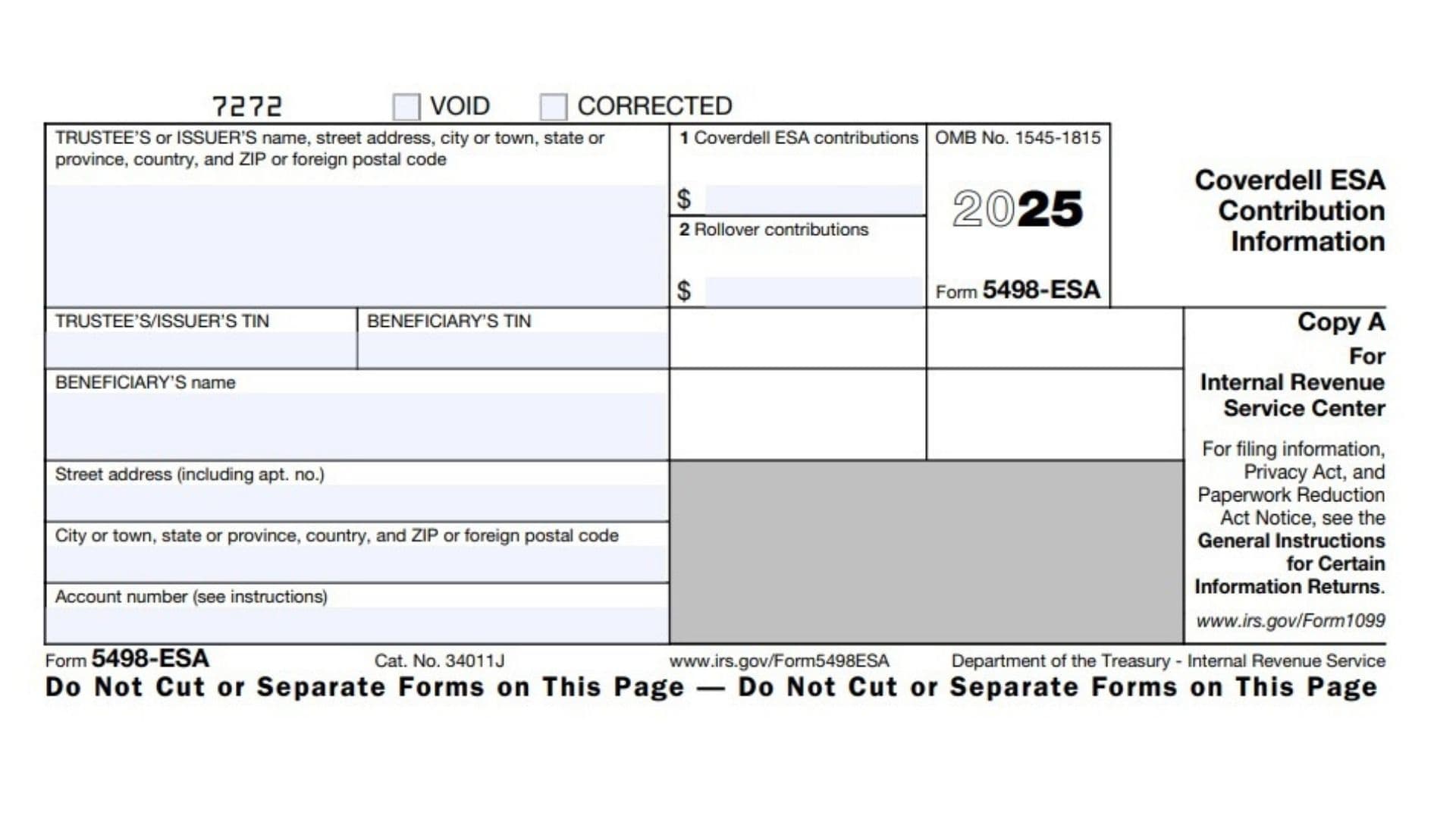

Form 5498-ESA, titled “Coverdell ESA Contribution Information,” is an IRS form used by trustees or issuers of Coverdell Education Savings Accounts (ESAs) to report contributions and rollover contributions made to these accounts during the tax year. Coverdell ESAs allow individuals to save for qualified educational expenses with tax advantages. The form helps the IRS track contributions to ensure compliance with annual limits and other rules. It reports both regular contributions and rollovers made to a beneficiary’s ESA, along with identifying information for the trustee/issuer, beneficiary, and the account. This form is important for beneficiaries or account holders to confirm the amounts contributed to their ESA, though the reported contributions are not deductible on income tax returns. Understanding Form 5498-ESA helps taxpayers manage ESA contributions properly, avoid penalties from excess contributions, and utilize the account benefits effectively.

How To File Form 5498-ESA

Form 5498-ESA must be filed by the trustee or issuer responsible for holding the Coverdell ESA.

- Copy A is sent to the IRS and must be scannable if filed on paper; electronic filing is required for 250 or more forms.

- Copy B is provided to the beneficiary or account holder by May 31 of the year following the tax year to report contributions made for that year.

- Trustees or issuers must use official IRS forms or authorized electronic filing methods to comply with IRS requirements.

- Beneficiaries or account holders keep Copy B for their records and reference when managing their ESAs.

How To Complete Form 5498-ESA

Trustee’s or Issuer’s Name, Address, and Telephone Number

Enter the full legal name of the trustee or financial institution managing the Coverdell ESA account, along with their street address, city or town, state or province, country, foreign postal code, and a contact phone number.

Trustee’s/Issuer’s TIN

Provide the trustee or issuer’s Taxpayer Identification Number (EIN) used by the IRS to identify the reporting entity.

Beneficiary’s TIN

The beneficiary’s Taxpayer Identification Number (typically Social Security Number or ITIN). For privacy reasons, only the last four digits may appear on the form sent to the beneficiary, but the full TIN is reported to the IRS.

Beneficiary’s Name

Enter the full legal name of the Coverdell ESA beneficiary—the person for whose education expenses the account is maintained.

Beneficiary’s Address

Fill in the beneficiary’s street address (including apartment or unit number), city or town, state or province, country, and ZIP/postal code.

Account Number

Enter the account or unique number assigned by the trustee or issuer to distinguish this particular ESA account.

Box 1 — Coverdell ESA Contributions

Report total contributions made in 2025, including those made through April 15, 2026, for the 2025 tax year, on behalf of the beneficiary. These amounts are not deductible on the beneficiary’s or contributor’s tax returns.

Box 2 — Rollover Contributions

Show any rollover contributions made in 2025 from another Coverdell ESA, including direct rollovers or military death gratuity contributions. Rollovers to a Coverdell ESA for the same beneficiary or a qualified family member under age 30 are generally not taxable.

Additional Key Information

- Excess Contributions: If total contributions to all Coverdell ESAs for the beneficiary exceed $2,000 for the year, the excess plus earnings must be withdrawn by June 1 of the following year to avoid penalties.

- Record Keeping: Beneficiaries or account holders should maintain records of contributions and distributions to track their ESA basis and avoid tax issues later.

- Deadlines: Trustees/issuers must furnish the form to beneficiaries by May 31 each year for the previous tax year.

- Additional Guidance: See IRS Publication 970 for detailed ESA rules and contribution limits.