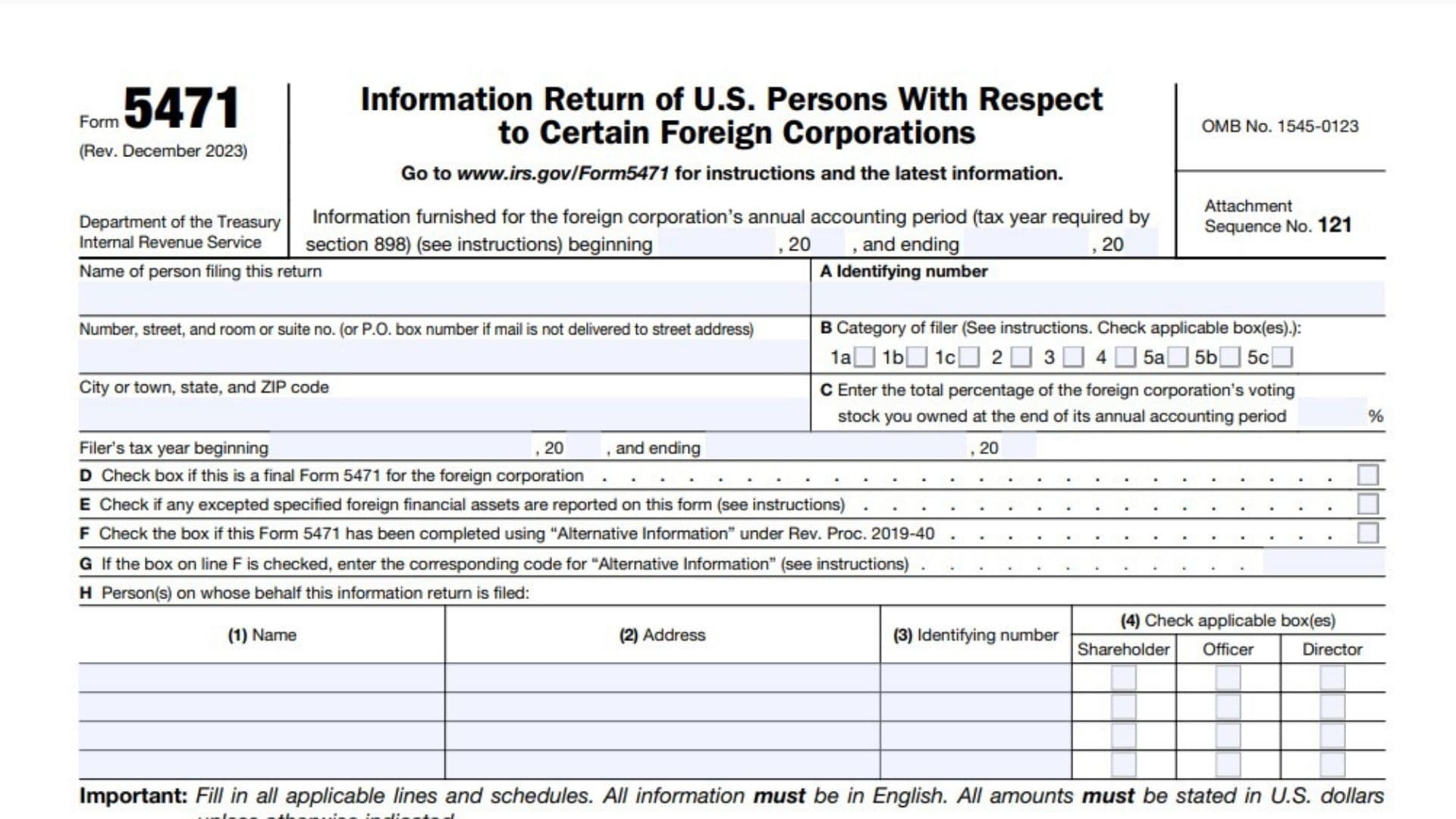

Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is a critical tax form required by the IRS for U.S. persons who are officers, directors, or shareholders in certain foreign corporations. This form helps the IRS monitor U.S. persons’ involvement with foreign corporations and ensure compliance with U.S. tax laws regarding international business operations.

How To Complete Form 5471?

General Information Section

Identifying Information

- Enter the tax year beginning and ending dates for the foreign corporation

- Provide your full name, address, and identifying number

- Check applicable category of filer boxes (1a through 5c)

- Enter percentage of foreign corporation’s voting stock owned

Basic Corporate Information

- Enter foreign corporation’s name and address

- Provide employer identification number (if any)

- Include country of incorporation and date

- List principal business activity and code

- Specify functional currency code

Schedule A – Stock of the Foreign Corporation

- Column (a): Describe each class of stock

- Column (b)(i): Enter number of shares at beginning of year

- Column (b)(ii): Enter number of shares at end of year

- Include both common and preferred stock details

- List all U.S. shareholders’ information

- Include ownership percentages

- Provide subpart F income details

- List all direct shareholders regardless of nationality

- Include complete ownership information

- Provide share counts for beginning and end of year

Schedule C – Income Statement

Income Section

- Line 1a: Enter gross receipts or sales from all business activities

- Line 1b: Enter returns and allowances related to gross receipts

- Line 1c: Calculate net sales by subtracting line 1b from 1a

- Line 2: Enter cost of goods sold

- Line 3: Calculate gross profit by subtracting line 2 from 1c

- Line 4: Enter all dividend income received

- Line 5: Enter all interest income

- Line 6a: Enter gross rental income

- Line 6b: Enter gross royalties and license fees

- Line 7: Report net gain or loss from sale of capital assets

- Line 8a: Enter unrealized foreign currency transaction gains/losses

- Line 8b: Enter realized foreign currency transaction gains/losses

- Line 9: Enter any other income (attach detailed statement)

- Line 10: Calculate total income by adding lines 3 through 9

Deductions Section

- Line 11: Enter compensation not included elsewhere

- Line 12a: Enter rental expenses

- Line 12b: Enter royalty and license fee expenses

- Line 13: Enter interest expenses

- Line 14: Enter depreciation not included elsewhere

- Line 15: Enter depletion expenses

- Line 16: Enter taxes (excluding income tax)

- Line 17: Enter other deductions (attach statement)

- Line 18: Calculate total deductions

Net Income Section

- Line 19: Calculate net income before unusual items

- Line 20: Enter unusual or infrequently occurring items

- Line 21a: Enter current income tax expense/benefit

- Line 21b: Enter deferred income tax expense/benefit

- Line 22: Calculate current year net income/loss

- Line 23a: Enter foreign currency translation adjustments

- Line 23b: Enter unrealized gains/losses on available-for-sale securities

- Line 23c: Enter any other comprehensive income items (attach statement explaining each item)

- Line 24: Calculate net comprehensive income by combining Line 22 (net income/loss) with Lines 23a through 23c

Schedule F – Balance Sheet

Assets Section

- Line 1: Enter cash balance

- Line 2a: Enter trade notes and accounts receivable

- Line 2b: Enter allowance for bad debts

- Line 3: Enter derivatives

- Line 4: Enter inventory value

- Line 5: Enter other current assets

- Lines 6-8: Enter various investments and loans

- Lines 9a-b: Enter fixed assets and accumulated depreciation

- Lines 10a-b: Enter depletable assets and accumulated depletion

- Line 11: Enter land value

- Lines 12a-d: Enter intangible assets and amortization

- Line 13: Enter the total amount of other assets not included in Lines 1-12 (attach detailed statement if significant)

- Line 14: Calculate total assets by adding Lines 1 through 13 (must equal Line 24 – total liabilities and shareholders’ equity)

- Liabilities Section

- Line 15: Enter accounts payable

- Line 16: Enter other current liabilities

- Line 17: Enter derivatives liabilities

- Line 18: Enter shareholder loans

- Line 19: Enter other liabilities

Equity Section

- Lines 20a-b: Enter preferred and common stock

- Line 21: Enter paid-in capital

- Line 22: Enter retained earnings

- Line 23: Enter treasury stock cost

- Line 24: Calculate total liabilities and equity

Schedule G – Other Information

Complete all yes/no questions and provide required information for:

- Foreign partnerships

- Trust ownership

- Disregarded entities

- Base erosion payments

- Interest/royalty deductions

- FDII transactions

- Cost sharing arrangements

- Stock transactions

- Intangible property transfers

- Foreign tax credits

- Interest expense limitations

- Lines 1a-h: Enter various types of Subpart F income

- Line 2: Enter earnings invested in U.S. property

- Line 3: Reserved for future use

- Line 4: Enter factoring income

- Lines 5a-e: Enter various types of dividends

- Line 6: Enter exchange gain/loss

- Lines 7-9: Complete additional information about:

- Blocked income

- Extraordinary disposition accounts

- Hybrid deduction accounts

Remember to:

- Report all amounts in functional currency and U.S. dollars

- Attach required statements and schedules

- Maintain supporting documentation

- Follow GAAP translation rules

- Consider special rules for DASTM corporations