Form 5452 is used by corporations to report nondividend distributions made to shareholders during the tax year. Nondividend distributions occur when a corporation distributes money or property to shareholders in excess of its current and accumulated earnings and profits (E&P), which are generally nontaxable as dividends. Corporations must file this form to disclose these distributions to the IRS, providing details such as whether distributions are part of partial or complete liquidations, or come from an S corporation’s accumulated adjustments account (AAA). The form requires detailed earnings and profits computations and precise identification of taxable versus nontaxable portions of distributions, ensuring transparency in corporate shareholder transactions and compliance with tax reporting regulations. It must be attached to the corporation’s income tax return for the year the nondividend distributions were made.

How To File Form 5452

File Form 5452 by completing the form fully and attaching it to the corporation’s income tax return for the applicable tax year. If the corporation has a fiscal year, file with the return for the fiscal year ending after the calendar year in which distributions were made. Include all required supporting schedules and worksheets such as earnings and profits computations and allocation schedules. For consolidated groups, the parent corporation files the form with supporting information for group members that made distributions. Accurate reporting prevents IRS issues related to shareholder income classification.

How To Complete Form 5452

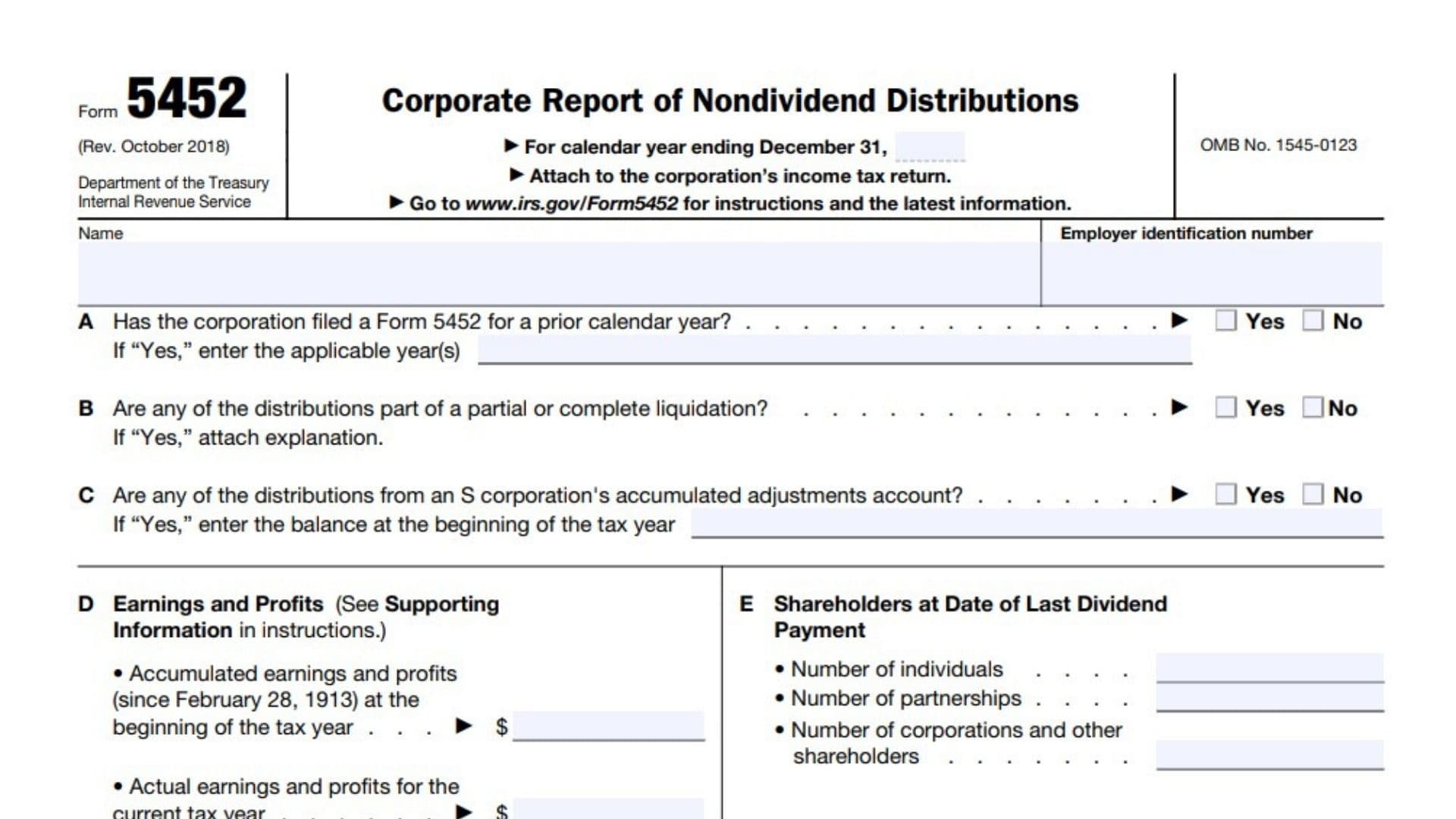

Name: Enter the legal name of the corporation filing the form.

Employer Identification Number (EIN): Provide the corporation’s EIN.

A. Has the corporation filed a Form 5452 for a prior calendar year? Check “Yes” or “No.” If “Yes,” enter the year(s) when prior forms were filed.

B. Are any of the distributions part of a partial or complete liquidation? Check “Yes” or “No.” If “Yes,” you must attach an explanation detailing the liquidation.

C. Are any distributions from an S corporation’s accumulated adjustments account (AAA)? Check “Yes” or “No.” If “Yes,” enter the AAA balance at the beginning of the tax year.

D. Earnings and Profits:

- Accumulated earnings and profits (since February 28, 1913) at the beginning of the tax year: Enter the accumulated balance from prior years.

- Actual earnings and profits for the current tax year: Enter the current year’s earnings and profits amount.

E. Shareholders at Date of Last Dividend Payment:

- Number of individuals – Enter the count of individual shareholders.

- Number of partnerships – Enter number of partnership shareholders.

- Number of corporations and other shareholders – Enter total count of corporate and other shareholders.

F. Corporate Distributions:

| Subheading | Description |

|---|---|

| Date Paid | Enter the date of each distribution payment made during the calendar year. |

| Total Amount Paid | Record total dollar amount paid, specifying if amounts relate to Common (C), Preferred (P), or Other (O) stock. |

| Amount Per Share | Enter the distribution amount assigned per share for each distribution entry. |

| Amount Paid During Calendar Year From Earnings & Profits Since February 28, 1913 | Enter the portion of the payment considered taxable as dividend from both current and accumulated E&P. |

| Percentage Taxable | Enter the percentage of the distribution amount that is taxable. |

| Amount Paid During Calendar Year From Other Than Earnings & Profits Since February 28, 1913 | Enter the portion nontaxable because the corporation’s E&P do not cover full distribution. This is returned capital. |

| Percentage Nontaxable | Enter percentage of the distribution that is nontaxable. |

| Amount Paid From the Current Year Accumulated Total | Total distribution amount separated by year basis or type of income. |

- Complete all rows for each distribution made during the calendar year.

Supporting Information to Attach

Attach the following with Form 5452:

- A detailed computation of earnings and profits for the tax year, including adjustments.

- A year-by-year computation of accumulated earnings and profits, with reconciliation from February 28, 1913, or last reporting year.

- Tax basis balance sheet and adjustments, especially if accelerated depreciation methods were used.

- For consolidated groups, schedules allocating consolidated tax liability and taxable income or loss by member, plus detailed data for members with distributions.

- Explanation and documentation for any noncash distributions showing tax bases and fair market values.