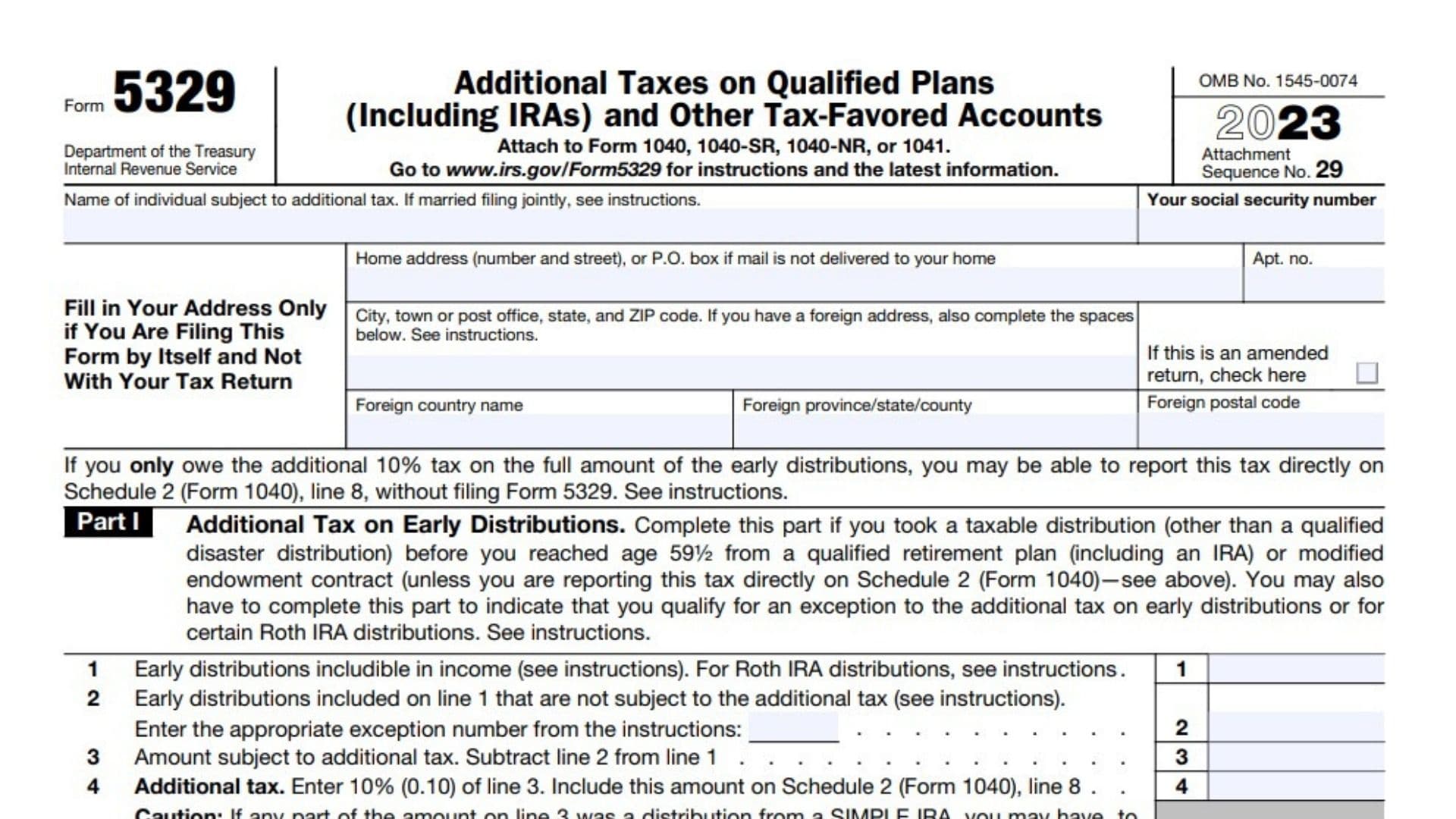

Form 5329, issued by the IRS, is used by taxpayers to report and calculate additional taxes on early distributions, excess contributions, and other transactions involving retirement plans, IRAs, and other tax-favored accounts. This form helps individuals determine whether they owe additional taxes on early withdrawals, excess contributions, or failure to meet minimum distribution requirements for retirement accounts. It also covers excess contributions to accounts like Health Savings Accounts (HSAs), Education Savings Accounts (Coverdell ESAs), and ABLE accounts.

How to File Form 5329?

- Obtain Form 5329 from the IRS website or through tax software that supports the form. You can also use tax preparation software like TurboTax or H&R Block, which will guide you through completing the form.

- You must file Form 5329 if:

- You took early distribution s from a qualified retirement plan (like an IRA) before age 59½.

- You contributed more to your retirement accounts, HSAs, or MSAs than allowed.

- You failed to take the required minimum distribution (RMD) from your retirement accounts.

- You have excess contributions to Education Savings Accounts (Coverdell ESAs) or ABLE accounts.

How to Complete Form 5329?

Part I: Additional Tax on Early Distributions

- Line 1: Enter early distributions includible in income (from retirement accounts before age 59½).

- Line 2: Enter any distributions exempt from additional tax and specify the exception number.

- Line 3: Subtract Line 2 from Line 1 to calculate the amount subject to additional tax.

- Line 4: Multiply Line 3 by 10% (0.10) to determine the additional tax. If it’s from a SIMPLE IRA, it may be 25%.

Part II: Additional Tax on Distributions from Education and ABLE Accounts

- Line 5: Enter taxable distributions from Coverdell ESAs, QTPs, or ABLE accounts.

- Line 6: Enter amounts exempt from additional tax.

- Line 7: Subtract Line 6 from Line 5 to determine the taxable amount.

- Line 8: Multiply Line 7 by 10% to calculate the additional tax.

Part III: Excess Contributions to Traditional IRAs

- Line 9: Enter the excess contributions from the previous year.

- Line 10-12: Enter current year’s contributions and distributions.

- Line 14-17: Calculate the additional tax (6%) on excess contributions.

Part IV: Additional Tax on Excess Contributions to Roth IRAs

- Line 18: Enter your excess contributions from the previous year (from Line 24 of the previous year’s Form 5329).

- Line 19: If your contributions for the current year are less than your maximum allowable, enter the amount here; otherwise, enter “-0-“.

- Line 20: Enter the distributions you made from your Roth IRA in 2025.

- Line 21: Add Lines 19 and 20.

- Line 22: Subtract Line 21 from Line 18. If zero or less, enter “-0-“.

- Line 23: Enter any additional excess contributions for 2025, if applicable.

- Line 24: Add Lines 22 and 23 to get the total excess contributions.

- Line 25: Multiply the smaller of Line 24 or the value of your Roth IRAs by 6% to calculate the additional tax.

Part V: Additional Tax on Excess Contributions to Coverdell ESAs

- Line 26: Enter your excess contributions from the previous year (from Line 32 of the previous year’s Form 5329).

- Line 27: If contributions for 2025 are less than the maximum allowable, enter the amount; otherwise, enter “-0-“.

- Line 28: Enter the distributions made from your Coverdell ESA in 2025.

- Line 29: Add Lines 27 and 28.

- Line 30: Subtract Line 29 from Line 26. If zero or less, enter “-0-“.

- Line 31: Enter any additional excess contributions for 2025.

- Line 32: Add Lines 30 and 31 to get the total excess contributions.

- Line 33: Multiply the smaller of Line 32 or the value of your Coverdell ESAs by 6% to calculate the additional tax.

Part VI: Additional Tax on Excess Contributions to Archer MSAs

- Line 34: Enter your excess contributions from the previous year (from Line 40 of the previous year’s Form 5329).

- Line 35: If contributions for 2025 are less than the maximum allowable, enter the amount; otherwise, enter “-0-“.

- Line 36: Enter the distributions made from your Archer MSA in 2025.

- Line 37: Add Lines 35 and 36.

- Line 38: Subtract Line 37 from Line 34. If zero or less, enter “-0-“.

- Line 39: Enter any additional excess contributions for 2025.

- Line 40: Add Lines 38 and 39 to get the total excess contributions.

- Line 41: Multiply the smaller of Line 40 or the value of your Archer MSAs by 6% to calculate the additional tax.

Part VII: Additional Tax on Excess Contributions to Health Savings Accounts (HSAs)

- Line 42: Enter your excess contributions from the previous year (from Line 48 of the previous year’s Form 5329).

- Line 43: If contributions for 2025 are less than the maximum allowable, enter the amount; otherwise, enter “-0-“.

- Line 44: Enter the distributions made from your HSAs in 2025.

- Line 45: Add Lines 43 and 44.

- Line 46: Subtract Line 45 from Line 42. If zero or less, enter “-0-“.

- Line 47: Enter any additional excess contributions for 2025.

- Line 48: Add Lines 46 and 47 to get the total excess contributions.

- Line 49: Multiply the smaller of Line 48 or the value of your HSAs by 6% to calculate the additional tax.

Part VIII: Additional Tax on Excess Contributions to an ABLE Account

- Line 50: Enter your excess contributions for 2025.

- Line 51: Multiply the smaller of Line 50 or the value of your ABLE account by 6% to calculate the additional tax.

Part IX: Additional Tax on Excess Accumulation in Qualified Retirement Plans (Including IRAs)

- Line 52: Enter your minimum required distribution (RMD) for 2025.

- Line 53: Enter the amount that was actually distributed to you in 2025.

- Line 54: Subtract Line 53 from Line 52. If zero or less, enter “-0-“.

- Line 55: Calculate the additional tax on the shortfall from the RMD (as per the instructions) and enter it here. If you qualify for the 10% tax rate, check the box.

Signature: Sign the form.