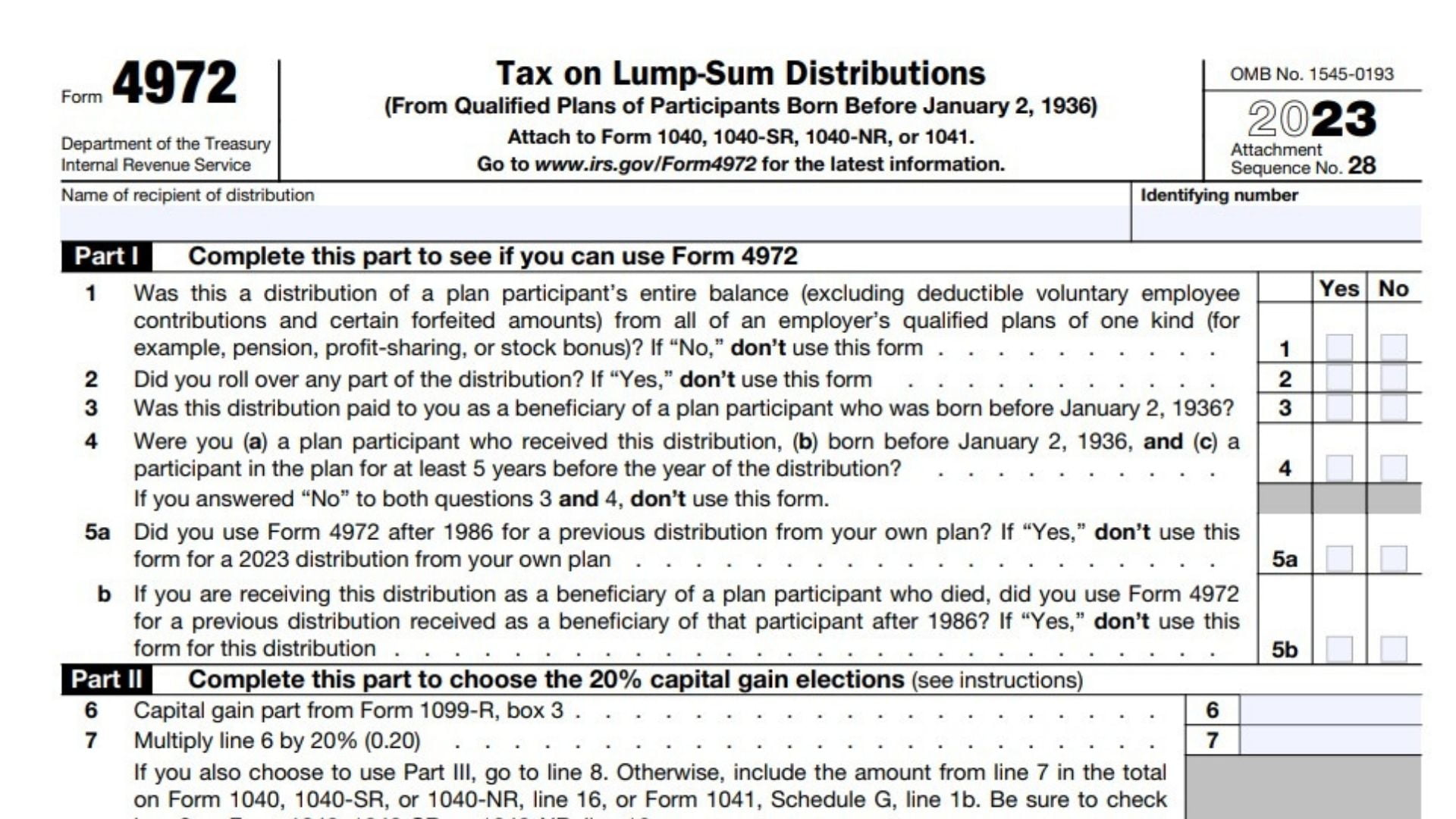

Form 4972 is used by taxpayers and their spouses to determine the tax owed on a qualified lump-sum distribution. Taxpayers choose either the 20% capital gains election or the 10-year tax option. If you choose either option, you must use the correct form. Form 4972 is a required document that must be filled out by an individual older than 70 1/2. These forms are not available for prior-year distributions. The Instructions for Form 4972 also explain how to calculate the tax on a lump-sum distribution if it is a capital gain. This tax must be paid in the year of distribution, even if it is paid over 10 years.

How to Complete Form 4972?

You need to know several things when filling out Form 4972, a federal tax form. The first thing is to ensure that you’re eligible to use it. Certain categories of people are not eligible to use the form, including pensioners, deceased beneficiaries, and those born after 1936. If you think you may be eligible, you can find out more by contacting the IRS. Also, the form is not used for distributions from prior years.

The Instructions for Form 4972 detail the tax computation rules applicable to a lump sum distribution. These rules apply only to distributions made from a qualified plan, such as a 401(k) or IRA. They do not apply to distributions made to death beneficiaries. If you receive more than one lump sum distribution, you must fill out separate Forms 4972 for each distribution.

If you plan to distribute lump sum income:

- You should complete part II of the form.

- Then, you must select one of the codes in box 50 – Method of averaging.

- Code 2 forces you to compute capital gain and ordinary income at 20%,

- While Code 4 and Code 5 force ordinary income to be 10%. Otherwise, you should fill out the form with a blank, which will minimize the federal tax liability.