Form 4952 helps taxpayers figure the amount of investment interest that can be deducted and determine how much of this deduction can be carried forward to future tax years if it exceeds their net investment income. Investment interest is interest paid on money borrowed to purchase property held for investment, such as margin loans used to buy stock in a brokerage account. The deduction is limited to the taxpayer’s net investment income for the year, but any disallowed interest can be carried forward indefinitely.

Investment interest expense is interest paid on loans used to purchase taxable investments. These investments can include stocks, bonds, and other securities, but they must generate taxable income. The IRS allows taxpayers to deduct these expenses, but the deduction is limited by the amount of net investment income earned during the year. Net investment income generally includes gross income from property held for investment (such as interest, dividends, annuities, and royalties) and net gain attributable to the disposition of property held for investment purposes.

It’s important to distinguish between investment interest expense and other types of interest expenses. For instance, personal interest, such as interest on credit cards or car loans, is not deductible. Similarly, interest expense related to a passive activity, such as a limited partnership, is reported on different forms and subject to different limitations.

Who Must File Form 4952?

Taxpayers who paid interest on money borrowed to purchase investments may need to file Form 4952. Specifically, if you have investment interest expenses that you want to deduct and you itemize your deductions on Schedule A of Form 1040, you’ll need to complete and file Form 4952. This form is necessary to determine the amount of investment interest expense you can deduct and how much can be carried forward to future years if it exceeds your net investment income.

How to File Form 4952?

Filing Form 4952 involves several steps:

- Download Form 4952 from the IRS website or use tax preparation software.

- Provide detailed information about your investment interest expenses and net investment income.

- Attach the completed Form 4952 to your federal income tax return (Form 1040 or Form 1040-SR) if you are itemizing your deductions.

- File your tax return, including Form 4952, with the IRS by the standard tax filing deadline, which is usually April 15.

How to Fill Out Form 4952?

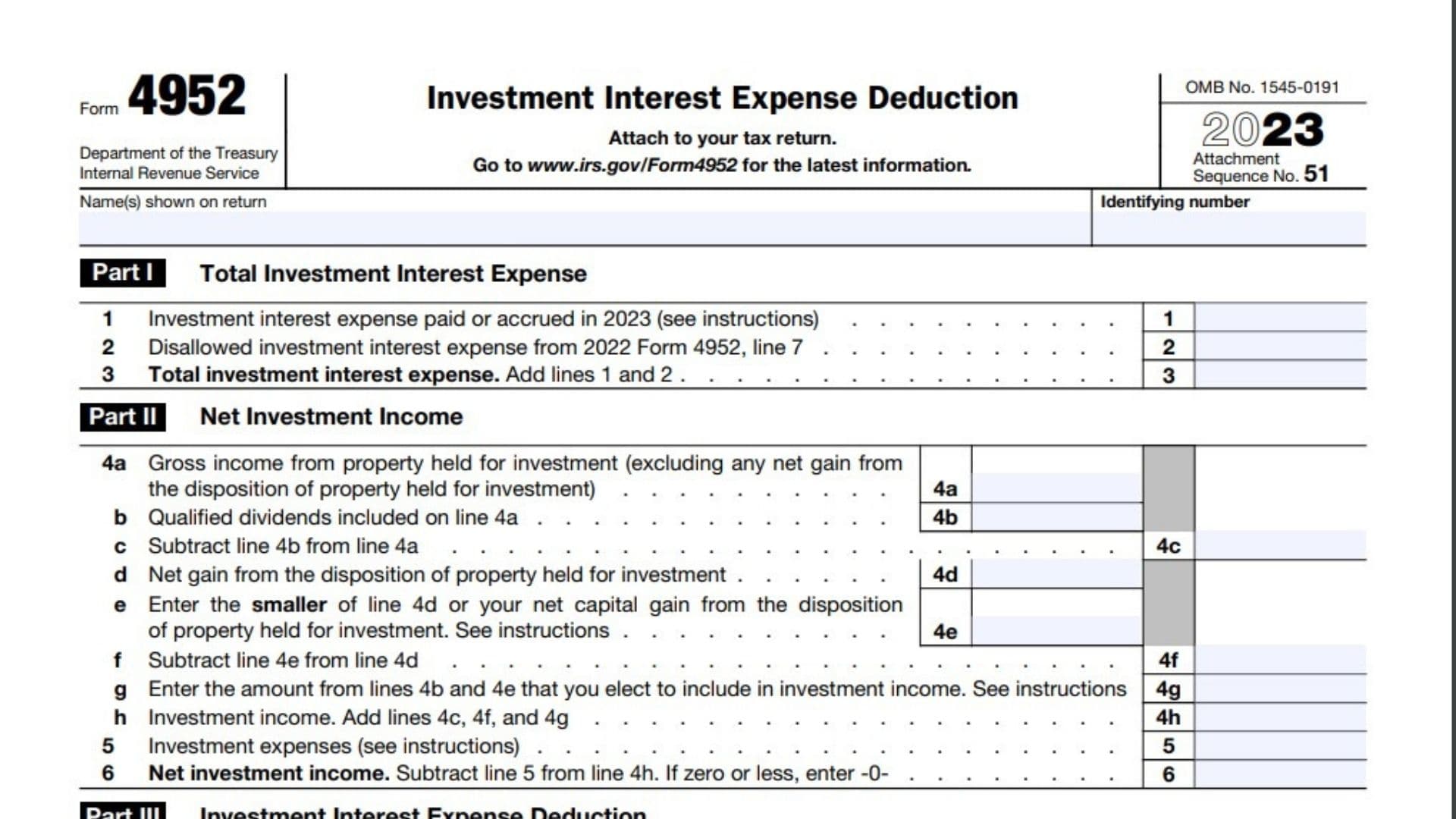

Filling out Form 4952 requires detailed information about your investment interest expenses and net investment income. The form is divided into three parts:

Part I – Total Investment Interest Expense

In this section, you will list all the investment interest expenses you paid during the year. This includes any interest paid on loans used to buy property held for investment. For example, if you took out a margin loan to purchase stocks, the interest paid on that loan would be included here. You must also include any investment interest expense passed through to you from partnerships or S corporations.

Part II – Net Investment Income

Here, you will calculate your net investment income. Start by listing all your gross income from property held for investment, such as interest, dividends, annuities, and royalties. You will also include net gain from the disposition of property held for investment purposes. From this total, you will subtract any investment expenses (other than interest) that are directly connected to the production of this income. The result is your net investment income for the year.

Part III – Investment Interest Expense Deduction

In this section, you will determine the amount of your investment interest expense that is deductible for the year. The deductible amount is the lesser of the total investment interest expense (from Part I) or the net investment income (from Part II). If your investment interest expense exceeds your net investment income, the excess can be carried forward to future years. You will enter the deductible amount on Schedule A of your Form 1040.