IRS Form 4797, Sales of Business Property, is a critical document for reporting gains and losses from the sale or exchange of business property. It also includes provisions for recapturing deductions and detailing involuntary conversions. This form is applicable to:

- Sales of business property held for over a year.

- Ordinary gains or losses on property held for less than a year.

- Depreciation recapture on business property.

- Recapture amounts when business use of property drops below 50%.

Filing this form correctly ensures compliance with tax regulations and helps you calculate taxable income accurately.

How to Complete Form 4797?

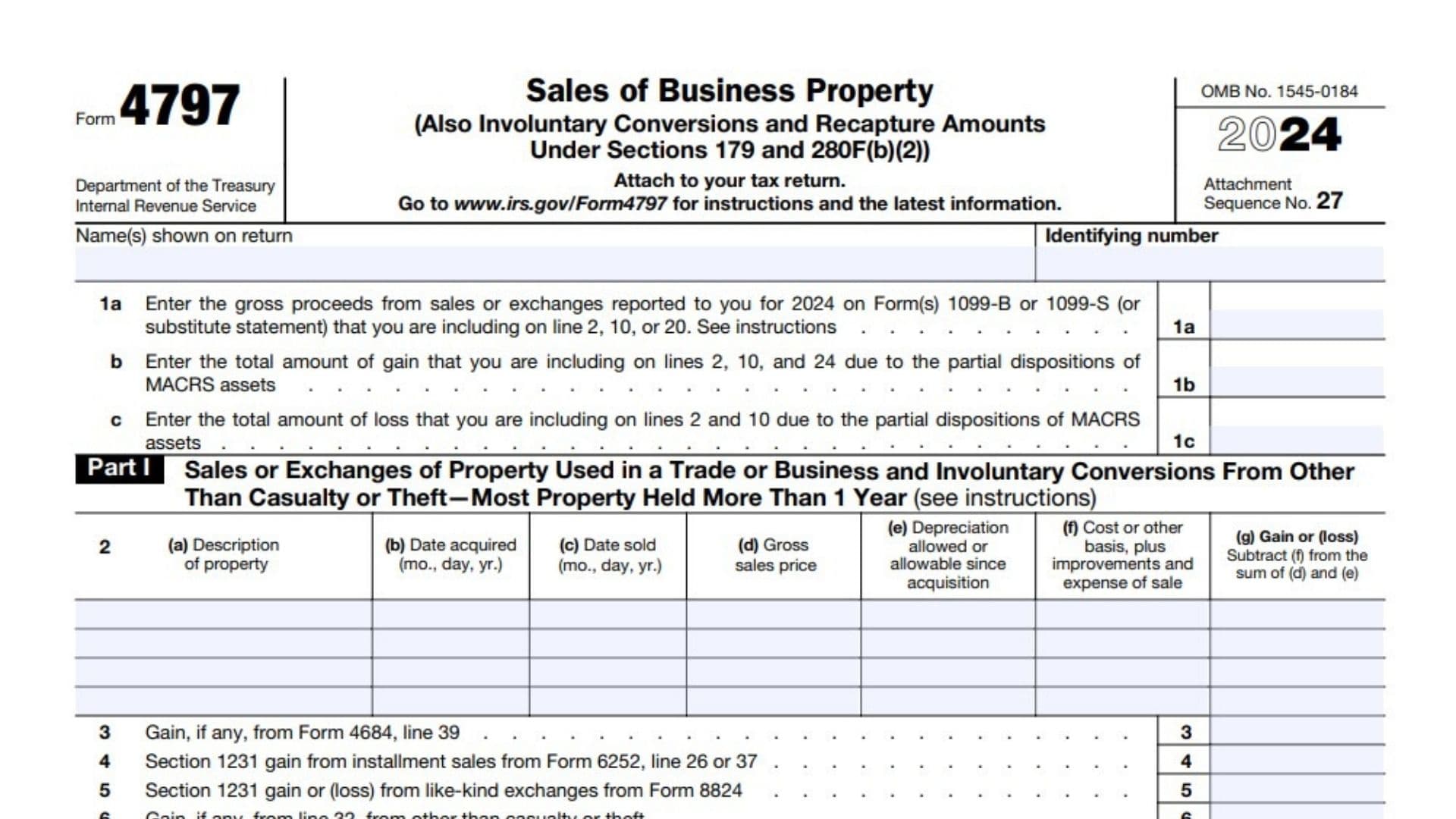

Header Section

- Name(s) shown on return: Enter the name(s) from your tax return.

- Identifying number: Provide your Social Security Number (SSN) or Employer Identification Number (EIN).

Part I: Sales or Exchanges of Property Used in a Trade or Business (Held Over 1 Year)

This section is for property used in a business and held for over one year. It calculates long-term capital gains or losses.

- Line 1a: Report gross proceeds from Forms 1099-B or 1099-S. Include amounts reported on lines 2, 10, or 20.

- Line 1b: Enter total gains from partial dispositions of Modified Accelerated Cost Recovery System (MACRS) assets.

- Line 1c: Enter total losses from partial dispositions of MACRS assets.

For Lines 2–7:

- Line 2 (Columns a–g):

- (a) Provide a description of the property (e.g., “Office Building”).

- (b) Enter the date the property was acquired.

- (c) Enter the date it was sold.

- (d) Record the gross sales price.

- (e) Input depreciation allowed or allowable since acquisition.

- (f) Enter the cost or other basis, plus any improvements and sale expenses.

- (g) Subtract (f) from the sum of (d) and (e) to calculate gain or loss.

- Line 3: Report gains from Form 4684 (line 39), which relates to casualty and theft losses.

- Line 4: Include Section 1231 gains from installment sales reported on Form 6252 (line 26 or 37).

- Line 5: Report Section 1231 gains or losses from like-kind exchanges on Form 8824.

- Line 6: Include gains reported on Form 4797, line 32 (from other than casualty or theft).

- Line 7: Combine lines 2 through 6.

- If the total is a gain, it may qualify as a long-term capital gain.

- If the total is a loss, it is treated as an ordinary loss.

- Line 8: Nonrecaptured Net Section 1231 Losses From Prior Years

- This line accounts for any Section 1231 losses from previous years that have not yet been recaptured.

- Check your prior tax returns for unused Section 1231 losses.

- Enter the total amount of nonrecaptured losses from previous years here.

- These losses are subtracted from the current year’s Section 1231 gain (reported on Line 7) to determine the portion of the gain that is taxable as ordinary income.

- Line 9: Subtract Line 8 From Line 7

- Calculate the difference between the current year’s gain or loss (from Line 7) and the nonrecaptured Section 1231 losses (from Line 8).

- If the result is zero or less, enter 0.

- If the result is greater than zero, this amount represents the net gain for the year that can be reported as a long-term capital gain.

- Report this amount on Schedule D if it qualifies as a capital gain.

- Also, enter the value from Line 8 on Line 12, if applicable.

Important Note: If Line 9 is zero, ensure that the Section 1231 gain is treated as ordinary income as per IRS rules.

Part II: Ordinary Gains and Losses

This section is for gains or losses not covered in Part I, including property held for less than one year.

- Line 10: Include any ordinary gains or losses not reported in lines 11–16. This may include short-term property transactions.

- Line 11: If there is a loss from Part I (line 7), record it here as a negative number.

- Line 12: Enter gains from line 7 or amounts from line 8, if applicable.

- Line 13: Record any gains from Part III (line 31).

- Line 14: Include net gains or losses from Form 4684, lines 31 and 38a.

- Line 15: Report ordinary gains from installment sales (Form 6252, line 25 or 36).

- Line 16: Record ordinary gains or losses from like-kind exchanges (Form 8824).

- Line 17: Combine lines 10 through 16 and calculate the net ordinary gain or loss.

For individual returns:

- Line 18a: If the loss in line 11 includes income-producing property from Form 4684, record that amount here.

- Line 18b: Recalculate the gain or loss from line 17, excluding the amount in line 18a. Enter this amount on Schedule 1 (Form 1040), Part I, line 4.

Part III: Gain From Disposition of Certain Properties

This section deals with property subject to special tax rules under Sections 1245, 1250, 1252, 1254, and 1255.

- Line 19 (Columns a–c):

- (a) Describe the property (e.g., “Machinery” or “Farmland”).

- (b) Enter the date acquired.

- (c) Enter the date sold.

- Line 20: Record the gross sales price.

- Line 21: Enter the cost or other basis plus expenses of sale.

- Line 22: Report the depreciation or depletion allowed or allowable.

- Line 23: Calculate the adjusted basis by subtracting line 22 from line 21.

- Line 24: Subtract line 23 from line 20 to calculate total gain.

For specific property types:

- Line 25: For Section 1245 property, enter the smaller of line 24 or depreciation allowed (line 25a).

- Line 26: For Section 1250 property, follow instructions to calculate additional depreciation.

- Line 27: For Section 1252 property (e.g., farmland), calculate gains based on applicable percentages.

- Line 28: For Section 1254 property (e.g., oil or gas properties), report intangible drilling costs.

- Line 29: For Section 1255 property, calculate gains from payments excluded from income.

- Line 30: Add total gains for all properties (sum of column D, line 24).

- Line 31: Add all recapture amounts from lines 25b, 26g, 27c, 28b, and 29b. Report this on line 13.

- Line 32: Subtract line 31 from line 30. Separate gains from casualty/theft and other sources.

Part IV: Recapture Amounts When Business Use Drops Below 50%

This part handles the recapture of depreciation or deductions when business use decreases to 50% or less.

- Line 33: Report Section 179 expense deductions or depreciation allowable in prior years.

- Line 34: Recalculate depreciation using updated percentages.

- Line 35: Subtract line 34 from line 33 to determine the recapture amount. Report this amount on the appropriate form or schedule.