Filing Form 4790, also known as the Report of International Transportation of Currency or Monetary Instruments (CMIR), is mandatory for anyone who physically transports, mails, or ships currency or monetary instruments exceeding $10,000 into or out of the United States. The form must also be filed by those who receive such amounts from abroad. Proper filing ensures compliance with federal laws and helps maintain the integrity of the U.S. financial system.

Who Must File Form 4790?

You must file Form 4790 if you:

- Physically transport, mail, or ship currency or monetary instruments exceeding $10,000 into or out of the United States.

- Receive currency or monetary instruments exceeding $10,000 from abroad.

This requirement applies to individuals, businesses, banks, and other financial institutions. Each party involved in the transportation or receipt of the currency must file a separate form. This includes travelers carrying cash or other monetary instruments as well as companies involved in the shipment of large sums of money.

How to File Form 4790?

To file Form 4790, follow these general steps:

- Obtain the Form: Download Form 4790 from the IRS website or request a copy from the Bureau of Customs and Border Protection.

- File Electronically or by Mail: The form can be filed electronically via the FinCEN BSA E-Filing System or mailed to the appropriate IRS address. If filing by mail, ensure you retain a copy of the form and any supporting documentation for your records.

- Submit at Time of Entry or Departure: If physically transporting currency, the form must be submitted to a Customs and Border Protection officer at the time of entry into or departure from the United States. If mailing or shipping, the form should be included with the shipment.

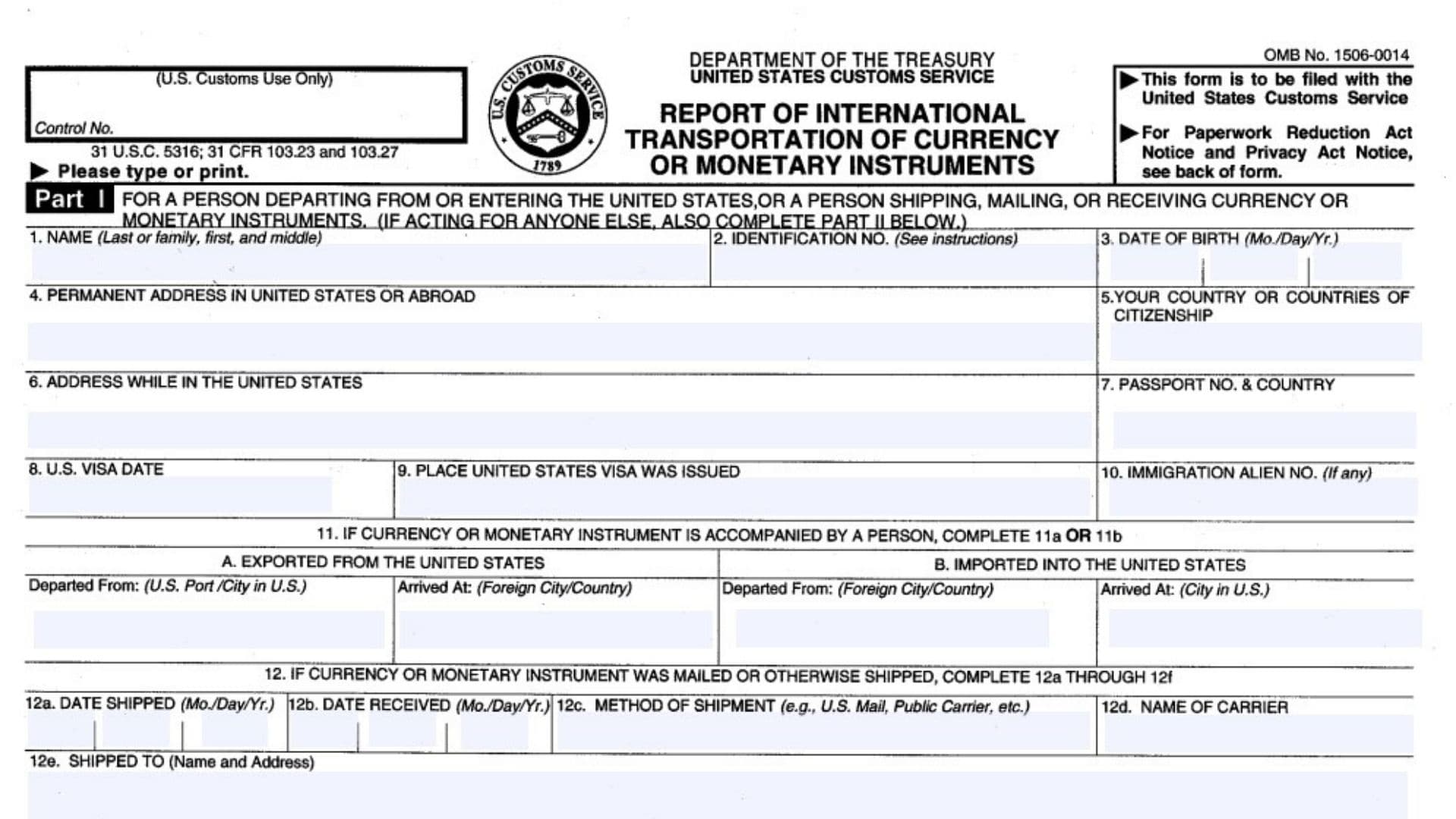

How to Complete Form 4790?

Filling out Form 4790 requires detailed information about the transportation or receipt of the currency. Follow these steps to ensure accuracy:

Part I – Contact Information (Lines 1-3)

Line 1: Provide your name and address.

Line 2: Enter your identification number (SSN, EIN, or foreign ID number).

Line 3: Include your date of birth and occupation or business.

Part II – Details of the Transaction (Lines 4-7)

Line 4: Specify the type of transportation (e.g., physical transport, mailing, or shipping).

Line 5: Indicate the amount and type of currency or monetary instruments being transported.

Line 6: Provide the country to or from which the currency is being transported.

Line 7: Include the date of transportation or receipt.

Part III – Additional Information (Lines 8-9)

Line 8: Provide information about any other parties involved in the transaction (e.g., senders, recipients).

Line 9: Include any additional details that may be relevant to the transaction.

Part IV – Declaration (Lines 10-11)

Line 10: Read the declaration statement carefully.

Line 11: Sign and date the form to certify that the information provided is accurate and complete.

Things to Know About Form 4790

- Eligibility: Anyone transporting, mailing, shipping, or receiving currency or monetary instruments exceeding $10,000 into or out of the U.S. must file this form.

- Due Date: The form must be filed at the time of entry into or departure from the U.S. If mailing or shipping, it must accompany the shipment.

- Penalties: Failure to file Form 4790 or providing false information can result in significant penalties, including fines and imprisonment. Civil penalties may include the forfeiture of the currency or monetary instruments involved.