Form 4562 allows businesses to deduct the cost of tangible property over its useful life and to amortize certain intangible assets. This process helps businesses recover the cost of significant investments in property and equipment over time, reducing their taxable income and overall tax liability. The form includes sections for various types of property, special depreciation allowances, and amortization of intangible assets.

Businesses must file Form 4562 if they:

- Are claiming a deduction for depreciation of property placed in service during the tax year.

- Are electing the Section 179 expense deduction for certain property.

- Are claiming a special depreciation allowance.

- Are amortizing costs for intangible assets such as goodwill, patents, or start-up costs.

This form is typically filed with the business’s annual tax return.

How to File Form 4562?

Filing the IRS Form 4562 involves several steps:

- Obtain the Form: Businesses can obtain Form 4562 from the IRS website or through tax preparation software.

- Complete the Form: Fill out the form with the required information about the property being depreciated or amortized.

- Attach to Tax Return: Attach the completed form to your annual business tax return (e.g., Form 1120 for corporations, Form 1065 for partnerships, or Schedule C for sole proprietors).

- Submit to the IRS: File your tax return along with Form 4562 by the regular tax filing deadline, typically April 15th for most businesses.

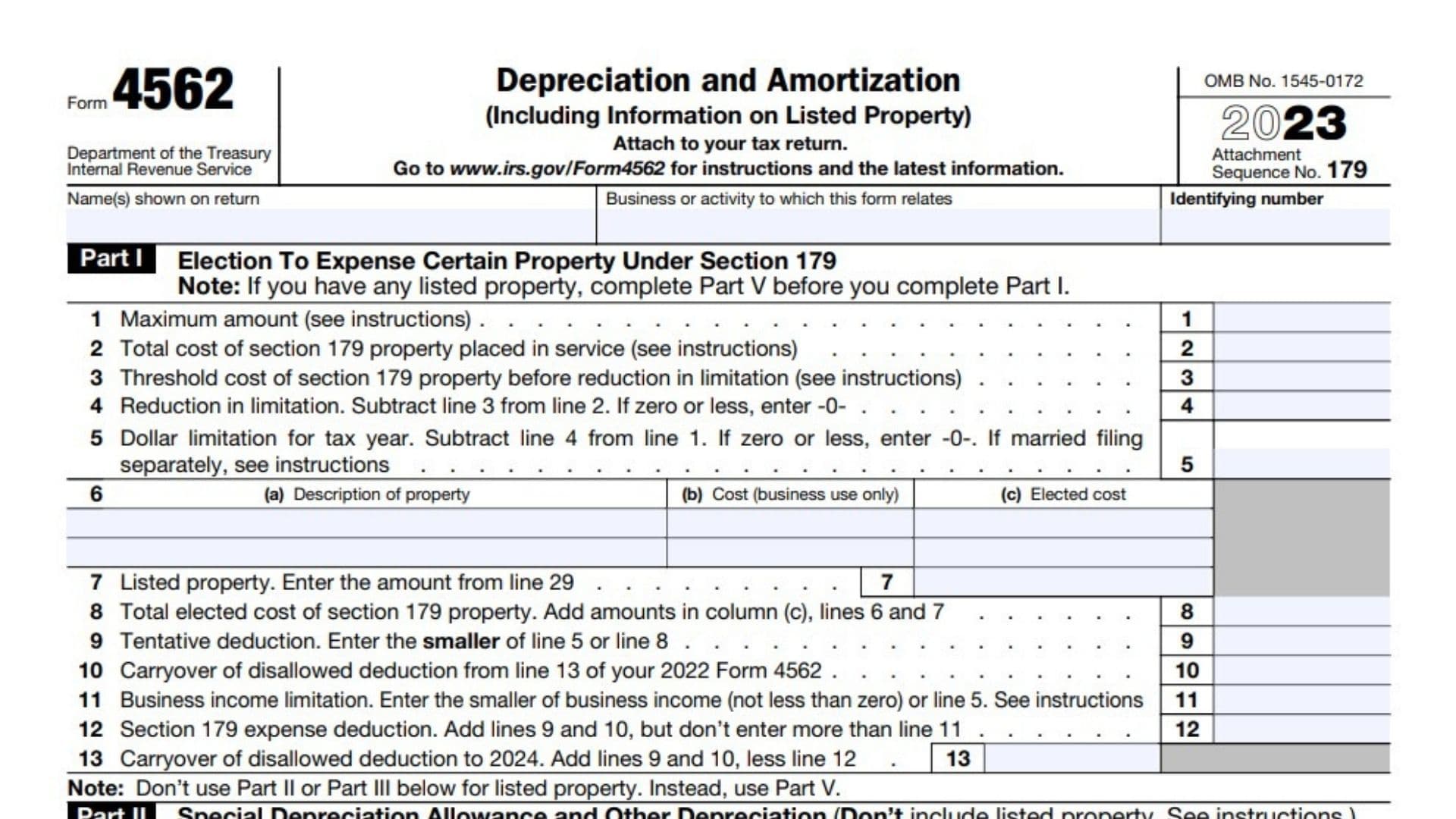

How to Complete Form 4562?

Completing the Form 4562 requires detailed information about your property and the depreciation or amortization methods used. Here’s how to do it:

Part I: Election To Expense Certain Property Under Section 179

- Section 179 Deduction:

- Line 1: Enter the total amount you are electing to expense under Section 179.

- Line 2: Enter the cost of Section 179 property placed in service.

- Line 6: Enter the maximum Section 179 deduction allowed for the year.

- Line 7: Enter the business income limitation for your Section 179 deduction.

- Reduction for Business Use:

- Adjust the deduction based on the percentage of business use and other limits.

Part II: Special Depreciation Allowance and Other Depreciation

- Special Depreciation:

- Line 14: Enter the special depreciation allowance for qualified property (e.g., bonus depreciation).

- Other Depreciation:

- Line 15: Enter any additional depreciation not included in the special allowance.

Part III: MACRS Depreciation

- Depreciation Deduction:

- Line 19: List the asset classes and depreciation methods used.

- Line 20: Enter the depreciation amount for each asset class.

- Summary:

- Line 21: Summarize the total depreciation claimed.

Part IV: Summary

- Total Depreciation:

- Line 22: Add up all depreciation and expensing deductions claimed.

- Additional Information:

- Line 23: Provide any additional details or explanations required.

Part V: Listed Property

- Listed Property:

- Line 24: Provide details about listed property (e.g., cars, computers), including business use percentage and costs.

- Line 25: Confirm business use percentage and hours for listed property.

- Unlisted Property:

- Line 26: Enter details for unlisted property used 100% for business.

Remaining Sections

Continue with similar steps for other sections, ensuring that you:

- Use the proper rates for the fuel types.

- Calculate gallons accurately and fill in the correct Credit Reference Numbers (CRNs).

Review all entries for accuracy and completeness before attaching the form to your tax return.

Additional Considerations for Form 4562

- Section 179 Deduction: This allows businesses to deduct the full cost of certain property up to a specific limit in the year it is placed in service. The maximum deduction limit varies each year and is subject to a phase-out threshold.

- Special Depreciation Allowance: Businesses can claim a bonus depreciation for certain qualified property. This allowance is typically a percentage of the property’s cost and can be claimed in addition to the regular depreciation deduction.

- Listed Property: Specific rules apply to listed property, which includes assets used for both business and personal purposes. Detailed records must be kept to substantiate the business use percentage.

Where to Mail Form 4562?

Form 4562 should be attached to your annual business tax return and mailed to the appropriate IRS address based on your business entity type and location. The IRS provides specific addresses for different types of tax returns, which are listed in the form’s instructions. Businesses can also file electronically using the IRS e-file system.

Due Dates

The Form 4562 must be filed by the regular tax filing deadline for your business’s annual tax return. For most businesses, this deadline is April 15th. If you cannot file by this date, you can request an extension by filing Form 7004, which grants an additional six months to file the return. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Frequently Asked Questions

- Can I claim depreciation on personal property?No, depreciation deductions can only be claimed on property used for business or income-producing purposes.

- What is the maximum Section 179 deduction for 2023?For the 2023 tax year, the maximum Section 179 deduction is $1,050,000, with a phase-out threshold of $2,620,000.

- Can I claim both Section 179 and bonus depreciation?Yes, you can claim both deductions in the same tax year. Section 179 is applied first, followed by any eligible bonus depreciation.