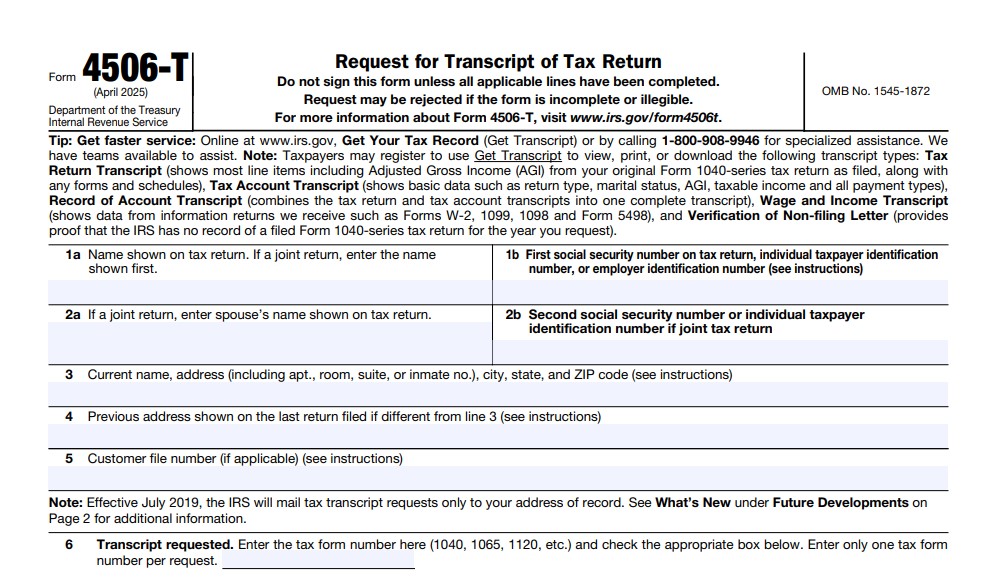

IRS Form 4506-T, also known as the Request for Transcript of Tax Return, allows individuals and businesses to request tax return information from the IRS. This form is often used when a taxpayer needs a transcript of their tax return, such as for applying for a loan, resolving discrepancies with the IRS, or for other legal and financial purposes. The form provides various options to request transcripts, including tax return transcripts, account transcripts, and more. By understanding the specific instructions and requirements for each section, you can ensure that your request is processed smoothly and without delay.

How to File IRS Form 4506-T

Filing IRS Form 4506-T involves several key steps:

- Complete the form: Make sure all the required fields are filled out accurately.

- Mail or fax the form: Once completed, the form must be sent to the appropriate IRS office based on your location or business state at the time the return was filed.

- Provide necessary signatures: Ensure the form is signed by the taxpayer or authorized representative.

- Wait for your transcript: The IRS typically processes these requests within 10 business days, although it can take longer in some cases.

How to Complete Form 4506-T

Line 1a: Name Shown on Tax Return

Enter the name(s) of the taxpayer as they appear on the tax return. If you filed a joint return, enter the first name listed.

Line 1b: Social Security Number (SSN) or Employer Identification Number (EIN)

Enter the first SSN, individual taxpayer identification number (ITIN), or EIN listed on the tax return. This identifies the taxpayer whose records you are requesting.

Line 2a: Spouse’s Name (If Joint Return)

If you filed a joint return, enter your spouse’s name exactly as it appears on the return. This is important to ensure all records are correctly matched.

Line 2b: Spouse’s SSN or ITIN

Enter the second SSN, ITIN, or EIN (if applicable) of the spouse listed on the tax return.

Line 3: Current Address

Provide your current address, including any apartment or suite numbers. If you’re incarcerated, include your inmate identification number along with your address.

Line 4: Previous Address

If you moved since filing your last tax return, provide the address you used when you filed your most recent return.

Line 5: Customer File Number (Optional)

If you have a customer file number, enter it here. This number is optional and can be used to track your request. If you leave this blank, the IRS will not include it on your transcript.

Line 6: Transcript Requested

Enter the type of transcript you are requesting. You can choose from the following:

- a. Return Transcript: Includes most line items of the tax return, showing the original filed return without any subsequent amendments or changes.

- b. Account Transcript: Contains basic account information, such as payments made and penalties assessed, but does not show the entire return.

- c. Record of Account: Combines both the Return and Account Transcript, providing the most detailed information available.

- d. Verification of Nonfiling: Proof that the IRS has no record of a filed tax return for the year you requested.

- e. W-2, 1099, 1098, or 5498 Transcripts: Includes data from forms W-2, 1099, and other information returns.

Line 7: Year or Period Requested

Indicate the tax year or period for which you are requesting the transcript. Use the MM/DD/YYYY format for calendar years or specific fiscal years.

Line 8: Signature of Taxpayer(s)

The form must be signed by the taxpayer(s) listed on Line 1a and 2a. If the request is for a joint return, only one signature is needed. Ensure that you sign exactly as your name appeared on the original tax return.

Line 9: Signature of Spouse

If the request is for a joint return, your spouse must sign here. This ensures that both parties authorize the release of the transcript.

Line 10: Date

Both the taxpayer and spouse (if applicable) must date the form when signing.

Line 11: Title (If Applicable)

If the taxpayer is a corporation, partnership, estate, or trust, the person signing must indicate their title (e.g., corporate officer, partner, trustee).

Line 12: Phone Number

Provide a phone number where you or your spouse can be reached in case the IRS needs further information.

Additional Notes:

- Customer File Number: You can provide a customer file number if needed, but it is optional. If you choose to include it, make sure it does not contain any sensitive personal information such as your SSN.

- Form Submission: After completing the form, you must send it to the correct IRS office. Use the IRS charts provided to determine the appropriate mailing address based on your location or business state at the time the return was filed.

- IRS Processing Time: The IRS typically processes Form 4506-T within 10 business days, but it may take longer depending on the specific transcript type and other circumstances.