Form 4466 allows corporations that overpaid their estimated income tax during a tax year to apply for a quick refund of that overpayment from the IRS. This form is specifically for corporations that meet two conditions: the overpayment is at least 10% of the corporation’s expected income tax liability for the year, and the overpayment is $500 or more. It is used after the end of the tax year but before filing the tax return. The IRS aims to process these refund applications within 45 days. Only the common parent corporation in an affiliated group may file Form 4466 unless a member paid estimated tax before joining the group. The form calculates the difference between the corporation’s estimated tax payments and expected tax liability, allowing eligible corporations to recover excess payments early.

How To File Form 4466

File Form 4466 after the corporation’s tax year has ended but before filing the actual tax return. Complete the form with accurate figures and sign it. Submit the original, signed Form 4466 to the appropriate IRS address. Also attach a signed or unsigned copy to the corporation’s income tax return when filed. If unsigned, keep the original signed copy for your records. The IRS processes requests within 45 days, but errors or omissions might delay or disallow refunds. Extensions for filing the return do not extend the deadline for filing Form 4466.

How To Complete Form 4466

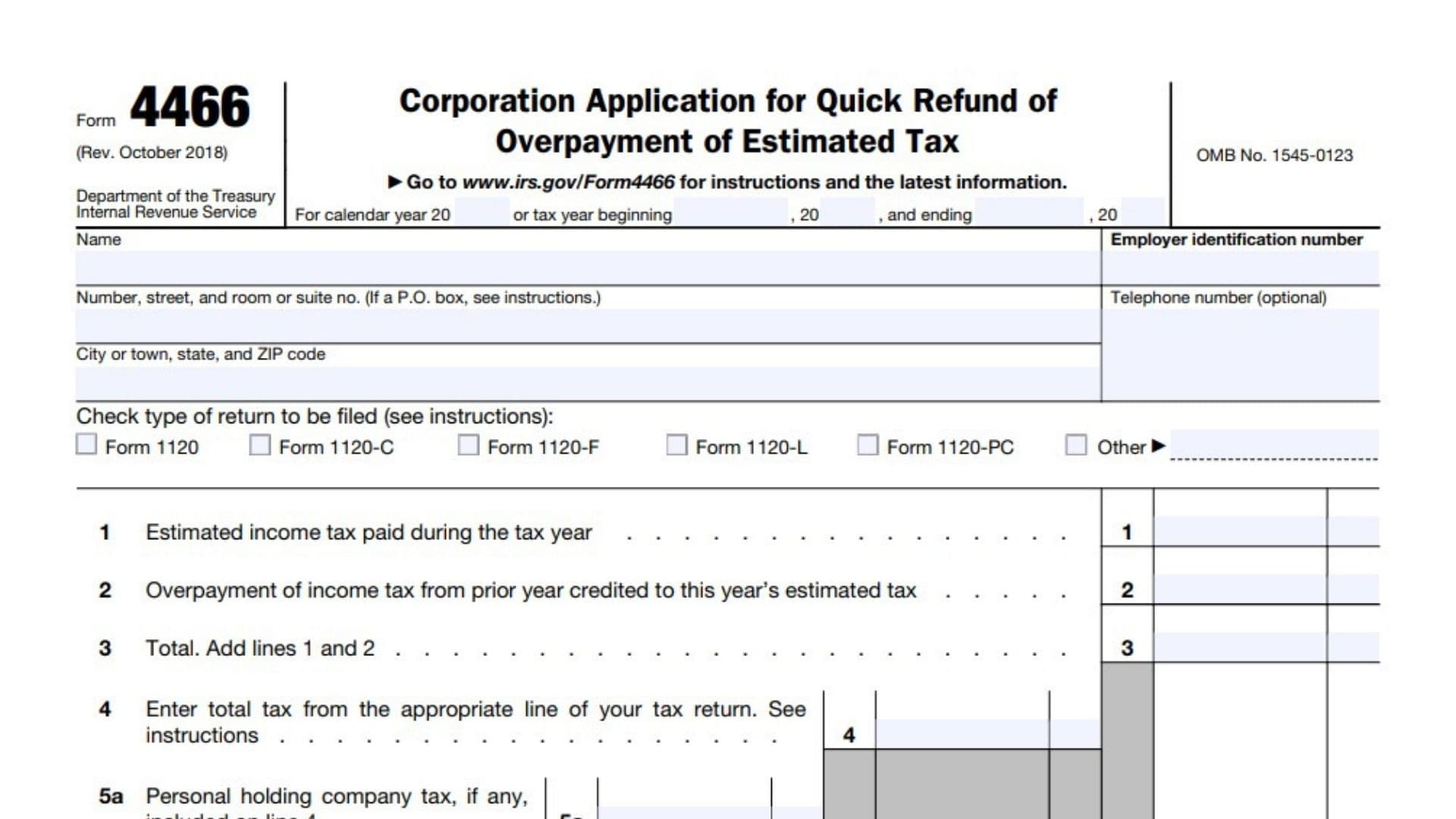

Name, Address, Employer Identification Number, Telephone: Enter corporation’s full legal name, complete mailing address, employer ID number (EIN), and optionally a contact phone number.

Type of Return: Check the box indicating the form type the corporation will file (e.g., 1120, 1120-C, 1120-F, etc.). If none apply, check “Other” and specify the form number.

Line 1: Estimated Income Tax Paid During the Tax Year — Enter total estimated income tax payments made by the corporation during the tax year.

Line 2: Overpayment of Income Tax From Prior Year Credited to This Year’s Estimated Tax — Enter any amount of overpayment from the previous tax year applied as a credit toward this year’s estimated tax.

Line 3: Total (Add lines 1 and 2) — Sum estimated tax payments and prior overpayment credits.

Line 4: Total Tax (Enter from tax return) — Enter total income tax expected as shown on the applicable corporate tax return line (e.g., from Schedule J of Form 1120).

Line 5a: Personal Holding Company Tax Included on Line 4, If Any — Enter personal holding company tax amount included in the total tax on line 4.

Line 5b: Estimated Refundable Tax Credit for Federal Tax on Fuels — Enter any refundable federal fuel tax credits.

Line 6: Total (Add lines 5a and 5b) — Sum lines 5a and 5b.

Line 7: Expected Income Tax Liability for the Tax Year (Subtract line 6 from line 4) — Subtract refundable credits and personal holding company tax from total tax to get expected tax liability.

Line 8: Overpayment of Estimated Tax (Subtract line 7 from line 3) — Calculate overpayment by subtracting expected liability from total payments and credits. If this overpayment is at least 10% of line 7 and at least $500, the corporation is eligible for a quick refund. Otherwise, do not file this form.

Record of Estimated Tax Deposits Section

List the dates and amounts of all estimated tax payments made during the tax year for IRS verification.

Signature Section

Sign, date, and include the title of the person authorized to sign on behalf of the corporation. This declaration confirms that the application is truthful, complete, and accurate under penalty of perjury.

This line-by-line guide simplifies Form 4466 to help corporations apply for quick estimated tax refunds efficiently and correctly.