Form 4219, Statement of Liability of Lender, Surety, or Other Person for Withholding Taxes, is used by lenders, sureties, or other persons to report their liability for withholding taxes in situations where they have taken control of a business or assets subject to such taxes. Properly managing this form ensures compliance with IRS regulations and helps liable parties accurately report and fulfill their tax obligations. The primary purpose of Form 4219 is to allow lenders, sureties, or other persons who take control of a business or assets to report their liability for unpaid withholding taxes. This form is necessary because these parties can become liable for the withholding taxes that the original business or asset owner was responsible for but failed to pay. The form ensures that the IRS can identify and collect taxes from parties who are liable under the law.

Who Must File Form 4219?

Form 4219 must be filed by:

- Lenders: Entities that take control of a business or assets through foreclosure, repossession, or other means.

- Sureties: Individuals or entities that guarantee the performance of another party and take control of business operations or assets.

- Other Liable Persons: Any person or entity that assumes control of a business or assets and becomes liable for the business’s withholding taxes.

How To File Form 4219?

Filing Form 4219 involves several steps and requires detailed information to ensure all necessary details are provided. The form must be filed with the IRS when a party takes control of a business or assets and becomes liable for withholding taxes.

- Obtain Form 4219: The form can be downloaded from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out the form with details of the liable party, the business or assets taken control of, and the withholding taxes due.

- Attach supporting documentation: Gather all required documents, such as records of the transaction, financial statements, and any necessary schedules to substantiate the information provided.

- Submit the form: File Form 4219 with the IRS as soon as the liable party takes control of the business or assets. Ensure that the form and all supporting documentation are included.

How To Fill Out Form 4219?

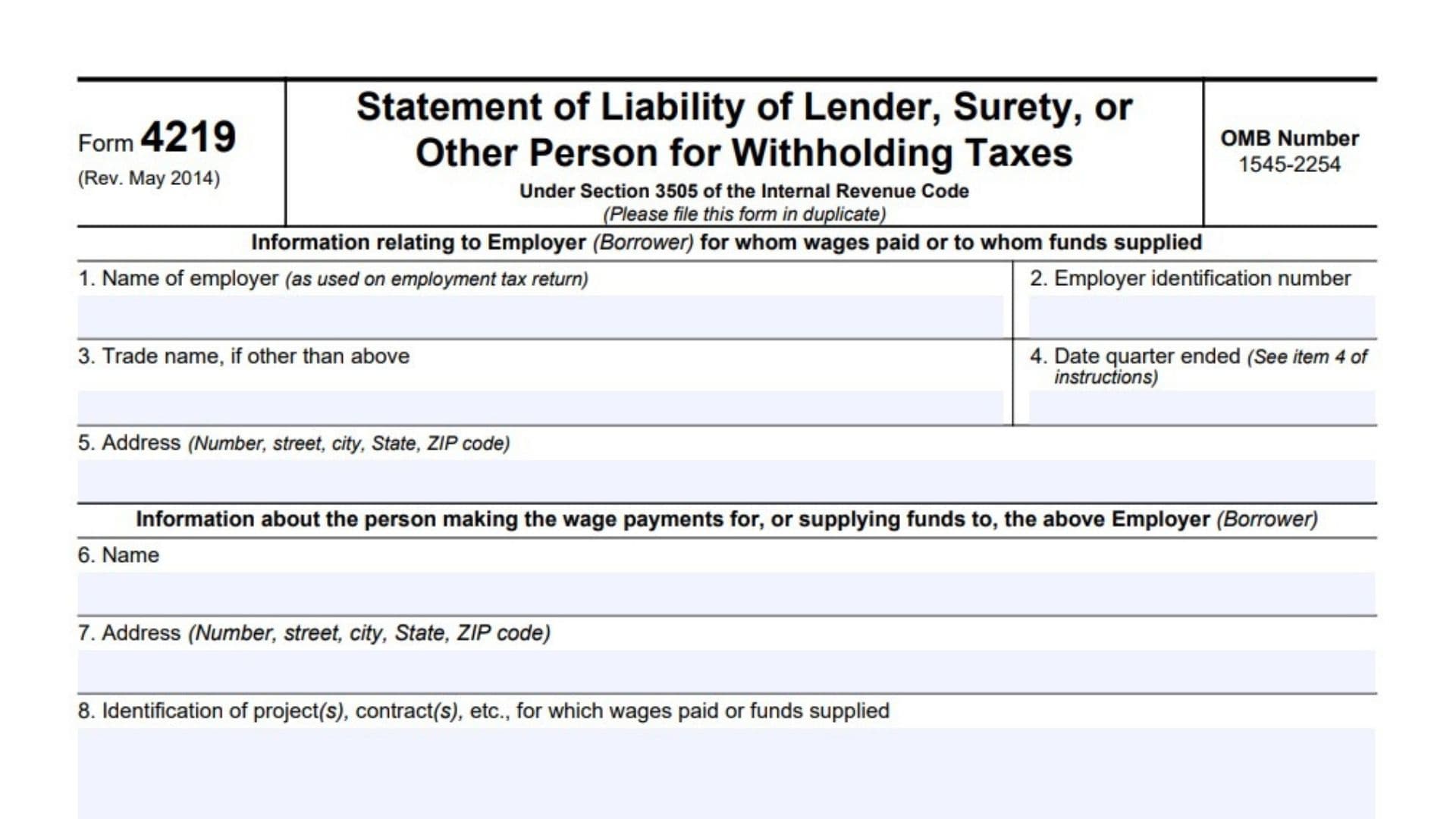

Filling out Form 4219 requires accurate and comprehensive information about the liable party, the business or assets taken control of, and the withholding taxes due. The form is divided into several parts, each addressing different aspects of the reporting requirements.

Information Relating to Employer (Borrower) for Whom Wages Paid or Funds Supplied

Line 1:

- Enter the name of the employer as shown on the employment tax return.

Line 2:

- Enter the Employer Identification Number (EIN).

Line 3:

- If the employer uses a trade name different from the one in Line 1, enter the trade name here.

Line 4:

- Enter the last day of the calendar quarter during which the wages were paid, or the funds were supplied (See specific instructions for this).

Line 5:

- Enter the employer’s address (street, city, state, and ZIP code).

Information About the Person Making the Wage Payments for, or Supplying Funds to, the Above Employer (Borrower)

Line 6:

- Enter the name of the lender, surety, or other person responsible for wage payments or providing funds to the employer.

Line 7:

- Enter the address (street, city, state, and ZIP code) of the lender, surety, or other person.

Line 8:

- Provide identification for the projects or contracts related to the wages paid or funds supplied.

Computation of Liability for Withholding Taxes on Wages Paid Directly to Employees of Borrower

Line 9:

- Enter the amount of taxes required to be withheld from wages paid to employees:

- 9a: Income tax.

- 9b: FICA tax.

- 9c: Railroad retirement tax.

Line 10:

- Add up the amounts from Lines 9a, 9b, and 9c. Enter the total here.

Line 11:

- Enter the portion of the total in Line 10 that was paid by the employer.

Line 12:

- Subtract Line 11 from Line 10. This is the liability for withholding taxes. Enter the result here and in Line 19.

Computation of Liability for Withholding Taxes on Funds Supplied for the Specific Purpose of Paying Wages

Line 13:

- Enter the total amount of funds supplied to the employer for paying wages, without reducing it for withholding taxes.

Line 14:

- Enter the employee taxes required to be withheld from wages:

- 14a: Income tax.

- 14b: FICA tax.

- 14c: Railroad retirement tax.

Line 15:

- Add the amounts from Lines 14a, 14b, and 14c. Enter the total here.

Line 16:

- Enter the portion of the total in Line 15 that was paid by the employer.

Line 17:

- Subtract Line 16 from Line 15. This is the amount of withholding taxes not paid by the employer.

Line 18:

- Enter the lesser of:

- Line 17 or

- 25% of the amount in Line 13.

- Enter the result here and in Line 20.

Total Liability

Line 19:

- Enter the amount from Line 12 (liability for withholding taxes on wages paid directly).

Line 20:

- Enter the amount from Line 18 (liability for withholding taxes on funds supplied).

Line 21:

- Add the amounts from Lines 19 and 20. This is the total liability for withholding taxes.

Line 22:

- Enter any interest liability.

Line 23:

- Add the amounts from Lines 21 and 22. This is the total liability (taxes and interest).

Signature

- The form must be signed under penalties of perjury by the lender, surety, or other person making the declaration, as well as the preparer (if different).

Things to Consider When Filing Form 4219

Understanding the specific rules and implications of filing Form 4219 is essential for lenders, sureties, or other liable persons to ensure compliance with IRS regulations and accurately report their liability for withholding taxes.

Accurate Reporting: Ensure that all information reported on Form 4219 is accurate and complete. Incorrect or incomplete information can lead to penalties and delays in processing by the IRS.

Supporting Documentation: Provide thorough and detailed supporting documentation to substantiate the reported liability. This includes records of the transaction, financial statements, and any necessary schedules.

Timely Filing: Ensure that Form 4219 is filed promptly after taking control of the business or assets. Late filing can result in penalties and additional interest charges.

Record Keeping: Maintain accurate records of all transactions, income, expenses, and supporting documents. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of tax reporting and the specific requirements of Form 4219, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 4219 is completed accurately and submitted on time and can provide guidance on the implications of assuming liability for withholding taxes.

Legal and Financial Implications: Understand the legal and financial implications of reporting liability for withholding taxes. This includes the impact on financial planning, tax liability, and compliance with IRS regulations.