The Internal Revenue Service (IRS) Form 3903 is a tax document that allows individuals to report moving expenses and any reimbursements they receive from their employers. Individuals who have made job-related relocations and need to file this document must ensure that they meet all of the requirements set out in the instructions. This includes the distance and time tests. In addition, the taxpayer must have been employed full-time in the new location for at least 39 weeks of the first 12 months after the move. For members of the Armed Forces, these rules do not apply.

Who Must File Form 3903?

Active-duty Armed Forces members may deduct their moving expenses regardless of employment status or whether they were employed full-time. This is because their moves are related to a permanent change of station and, thus, are considered qualified. However, civilians who relocate for a new job must be employed full-time in order to qualify for a deduction.

Eligible taxpayers must have spent money on a move’s transportation, storage, and lodging expenses. The amount incurred must be less than the amount reimbursed from their employer or included in their wages (those amounts are shown on their W-2 with code P). Taxpayers can use this form to calculate their total eligible expenses minus their reimbursements and then subtract that amount from their gross income. This will result in their moving expense deduction, which will reduce their taxable income.

Generally, the total amount of expenses a taxpayer incurs must be over 50 miles greater than the distance between their old home and their previous workplace. Those who have made multiple qualifying moves in a year must complete a separate form for each one. The IRS provides a worksheet for determining this distance test, and its instructions also explain the other requirements.

The taxpayer must also ensure that their new principal place of work is at least 50 miles from the former workplace and is located in the United States or its territories. For Armed Forces members, this requirement does not apply if the move is due to a PCS.

How to Complete Form 3903?

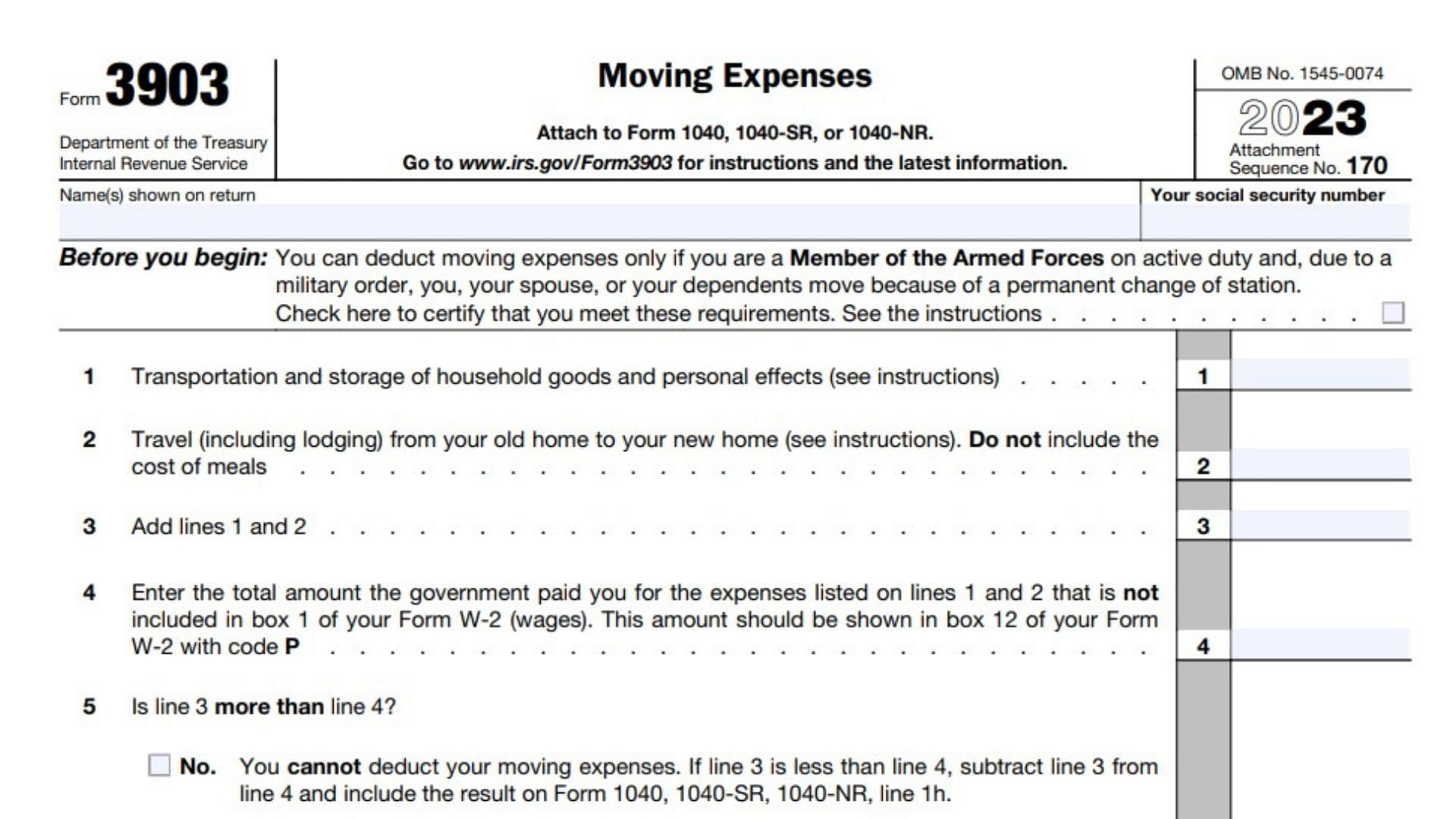

Check the box at the beginning of the form if you meet these requirements:

- You can deduct moving expenses only if you are a Member of the Armed Forces on active duty and, due to a military order, you, your spouse, or your dependents move because of a permanent change of station.

Line 1: Enter Transportation and storage of household goods and personal effects.

Line 2: Travel (including lodging) from your old home to your new home (see instructions). Do not include the cost of meals

Line 3: Add lines 1 and 2. Enter the amount here.

Line 4:

- Enter the total amount the government paid you for the expenses listed on lines 1 and 2 that are not included in box 1 of your Form W-2 (wages).

- This amount should be shown in box 12 of your Form W-2 with code P

Line 5: Is line 3 more than line 4? YES or NO.

- If NO, You cannot deduct your moving expenses. If line 3 is less than line 4, subtract line 3 from line 4 and include the result on Form 1040, 1040-SR, 1040-NR, line 1h.

- If YES, Subtract line 4 from line 3. Enter the result here and on Schedule 1 (Form 1040), line 14. This is your moving expense deduction.