Form 2555, known as the Foreign Earned Income form, is designed to help U.S. citizens and resident aliens who meet certain qualifications exclude foreign earned income and housing amounts from their gross income. This form is particularly important for expatriates and individuals who spend significant time outside the United States for work purposes. By filing Form 2555, eligible taxpayers can potentially exclude up to a specified limit of their foreign earned income, which can significantly reduce their taxable income and overall tax liability. Additionally, the form includes provisions for excluding housing costs, which can be a substantial expense for those living abroad. Properly filing Form 2555 ensures that taxpayers are taking full advantage of these benefits while maintaining compliance with U.S. tax laws.

Who Must File Form 2555?

U.S. citizens and resident aliens must file Form 2555 if they:

- Have foreign earned income.

- Meet the IRS’s tax home test, which means their tax home is in a foreign country.

- Meet either the bona fide residence test or the physical presence test.

The bona fide residence test requires that the taxpayer be a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year. The physical presence test requires that the taxpayer be physically present in a foreign country or countries for at least 330 full days during any 12-month period.

How to File Form 2555?

Filing the IRS Form 2555 involves several steps:

- Obtain the Form: Taxpayers can obtain Form 2555 from the IRS website or through tax preparation software.

- Complete the Form: Fill out the form with the required information about foreign earned income, housing expenses, and qualifications for the exclusion.

- Attach to Tax Return: Attach the completed form to your annual U.S. federal income tax return (Form 1040 or Form 1040-SR).

- Submit to the IRS: File your tax return along with Form 2555 by the regular tax filing deadline, typically April 15th, unless an extension is requested.

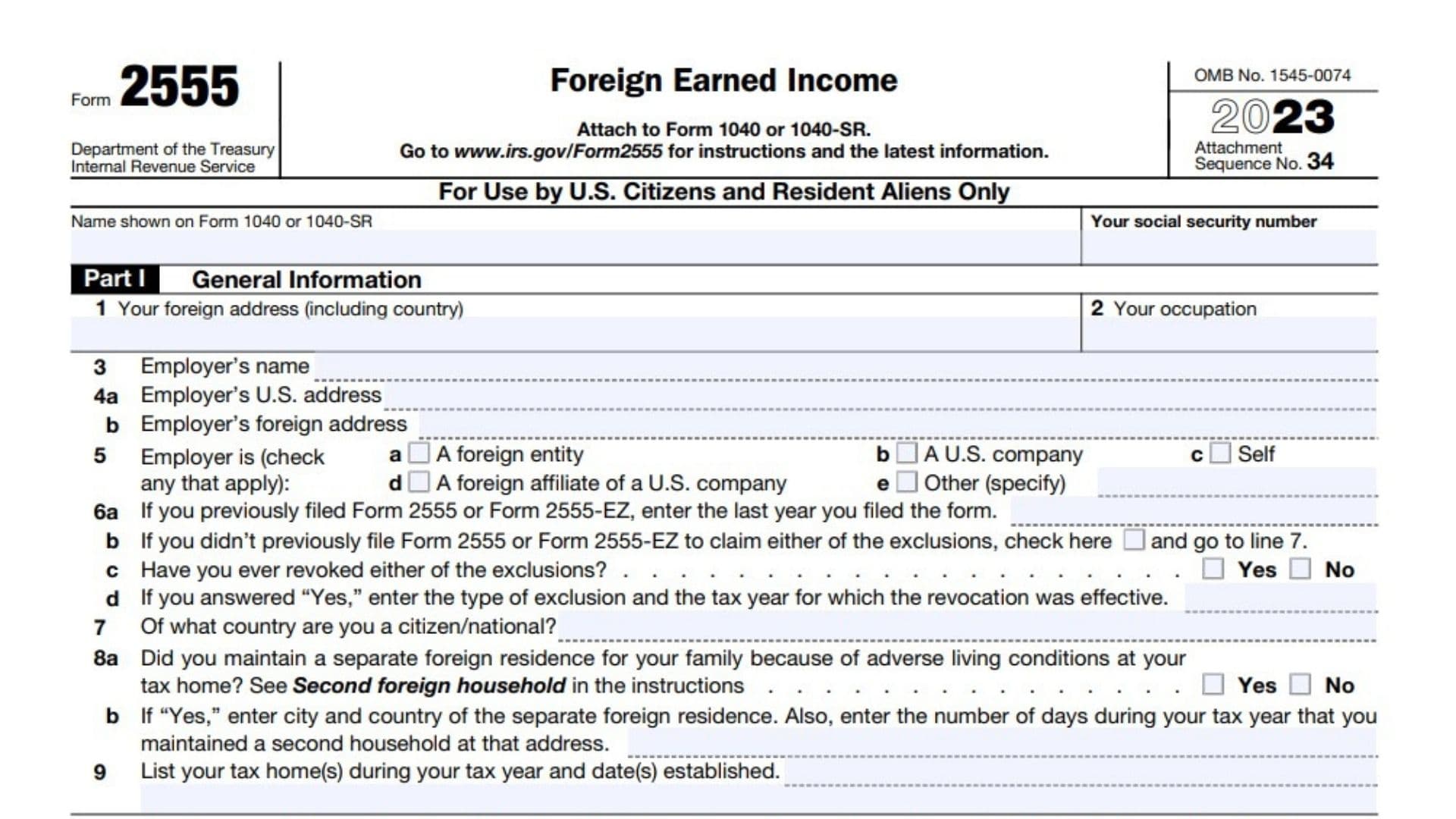

How to Complete Form 2555?

Completing the Form 2555 requires detailed information about your foreign earned income and your qualifications for the exclusion. Here’s how to do it:

- Part I: General Information:

- Enter your name, Social Security number, and address.

- Provide details about your employer, including the employer’s name and address.

- Indicate the foreign country where you have a tax home.

- Part II: Physical Presence Test:

- Complete this part if you qualify based on the physical presence test.

- Enter the dates you were physically present in a foreign country or countries.

- Part III: Bona Fide Residence Test:

- Complete this part if you qualify based on the bona fide residence test.

- Provide details about your residence in the foreign country.

- Part IV: Foreign Earned Income:

- Report your foreign earned income, including wages, salaries, and other compensation.

- Enter any business income earned abroad if you are self-employed.

- Part V: Housing Exclusion:

- Calculate your housing expenses and the housing exclusion or deduction you are claiming.

- Part VI: Tax Computation:

- Compute the total amount of foreign earned income and housing amounts that you are excluding from your gross income.

Qualifying for the Foreign Earned Income Exclusion

To qualify for the foreign earned income exclusion, taxpayers must meet the following criteria:

- Tax Home: Your tax home must be in a foreign country.

- Bona Fide Residence Test: You must be a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You must be physically present in a foreign country or countries for at least 330 full days during any 12-month period.

Where to Mail Form 2555?

Form 2555 should be attached to your annual U.S. federal income tax return (Form 1040 or Form 1040-SR) and mailed to the appropriate IRS address based on your state of residence. The IRS provides specific addresses for different regions, listed in the form’s instructions. Taxpayers can also file electronically using the IRS e-file system.

Due Dates

The Form 2555 must be filed by the regular tax filing deadline, typically April 15th. However, U.S. citizens and resident aliens living abroad are granted an automatic two-month extension to file their tax returns, making their due date June 15th. If additional time is needed, taxpayers can request an extension by filing Form 4868, which extends the filing deadline to October 15th.

Frequently Asked Questions

Can I claim the foreign-earned income exclusion and the foreign tax credit?

Yes, you can claim both the foreign earned income exclusion and the foreign tax credit, but not on the same income. You must choose to exclude or credit your foreign income.

What is the maximum foreign earned income exclusion for 2023?For the 2023 tax year, the maximum foreign earned income exclusion is $120,000 per qualifying individual. This amount is adjusted annually for inflation.

Can I use Form 2555 if I am a dual-status alien?

Dual-status aliens may use Form 2555 only for the part of the year they were a U.S. resident. They must meet all other qualifications for the foreign earned income exclusion.