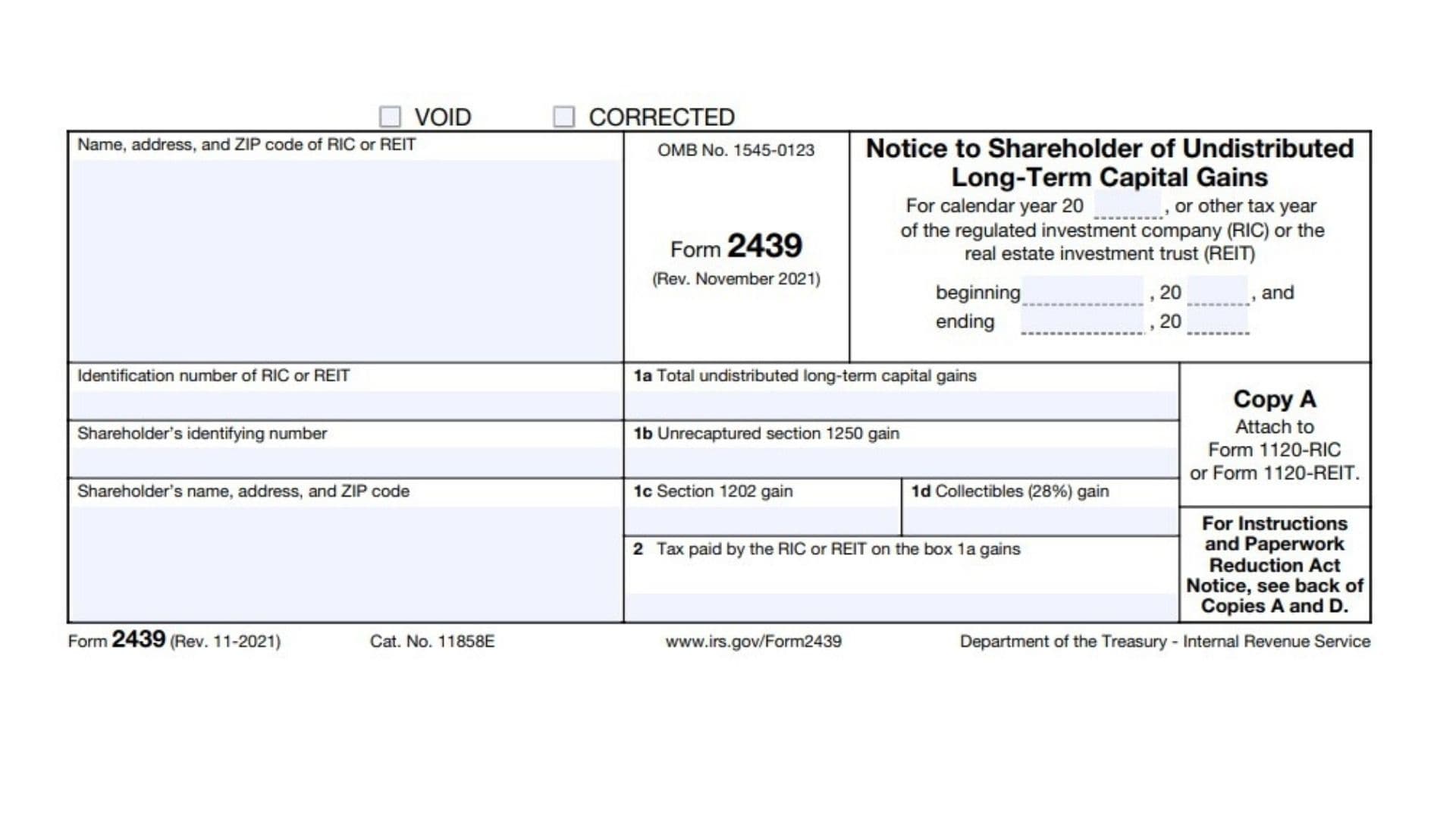

IRS Form 2439, titled Notice to Shareholder of Undistributed Long-Term Capital Gains, is a tax form used by Regulated Investment Companies (RICs) and Real Estate Investment Trusts (REITs) to report undistributed long-term capital gains to their shareholders. When a RIC or REIT pays tax on capital gains that it has not distributed to shareholders, it must notify those shareholders using Form 2439. This form details the amount of undistributed capital gains allocated to each shareholder, including special categories like unrecaptured section 1250 gain, section 1202 gain, and collectibles gain taxed at a 28% rate. The form also reports the tax paid by the RIC or REIT on those gains, which shareholders may be eligible to credit or claim as a refund on their individual tax returns. Form 2439 serves as an important document for shareholders to correctly report these gains on their income tax returns, typically on Schedule D or Form 8949, depending on their taxpayer status. The form is issued annually and includes multiple copies for filing with the IRS, providing to shareholders, and retaining for records. Understanding and accurately completing Form 2439 is crucial for RICs, REITs, and shareholders to ensure proper tax reporting and compliance with IRS regulations.

How to File IRS Form 2439

- For RICs or REITs:

- Complete all required copies (A, B, C, and D) for each shareholder who is allocated undistributed capital gains taxed under section 852(b)(3)(D) or 857(b)(3)(C).

- Attach Copy A of Form 2439 to the RIC’s or REIT’s annual tax return (Form 1120-RIC or Form 1120-REIT) filed with the IRS.

- Furnish Copies B and C to the shareholder within 60 days after the end of the RIC’s or REIT’s tax year.

- Retain Copy D for the RIC’s or REIT’s records.

- For shareholders that are IRAs, provide Copies B and C to the IRA trustee or custodian, not the IRA owner.

- For Shareholders:

- Use Copy B of Form 2439 to report undistributed long-term capital gains on your income tax return for the tax year that includes the last day of the RIC’s or REIT’s tax year.

- Report the amounts as instructed on Schedule D (Form 1040, 1041) or Form 8949, depending on your taxpayer status.

- Claim credit or refund for any tax paid by the RIC or REIT as shown in box 2 of the form.

How to Complete Form 2439?

Header Section

- Name, address, and ZIP code of RIC or REIT: Enter the full legal name, mailing address, and ZIP code of the Regulated Investment Company or Real Estate Investment Trust as shown on Form 2438.

- OMB Number: Preprinted as 1545-0123.

- Tax Year: Enter the calendar year or other tax year of the RIC or REIT, specifying the beginning and ending dates.

Identification Section

- Identification number of RIC or REIT: Enter the Employer Identification Number (EIN) of the RIC or REIT.

- Shareholder’s identifying number: Enter the shareholder’s Social Security Number (SSN), Employer Identification Number (EIN), or IRA trust identification number as applicable.

- Shareholder’s name, address, and ZIP code: Enter the shareholder’s full name and mailing address, including ZIP code.

Box 1a — Total undistributed long-term capital gains

Enter the amount of undistributed capital gains allocated to the shareholder from line 11 of Form 2438 or the applicable current form line.

Box 1b — Unrecaptured section 1250 gain

Enter the portion of box 1a attributable to unrecaptured section 1250 gain from depreciable real property dispositions allocated to the shareholder.

Box 1c — Section 1202 gain

Enter the portion of box 1a attributable to section 1202 gain (gain from qualified small business stock held more than 5 years). Attach a statement with details: amount of gain, corporation name, acquisition and sale dates, and shareholder’s portion of adjusted basis and sales price.

Box 1d — Collectibles (28%) gain

Enter the portion of box 1a attributable to collectibles gain taxed at the 28% rate. Do not include any section 1202 gain here.

Box 2 — Tax paid by the RIC or REIT on the box 1a gains

Enter the amount of tax the RIC or REIT paid on the undistributed long-term capital gains reported in box 1a.

Additional Notes and Instructions

- Truncation of Shareholder Identifying Number:

The RIC or REIT may truncate the first five digits of the shareholder’s nine-digit identifying number on copies sent to shareholders by replacing them with asterisks (*) or Xs. However, truncation is not allowed on the copy filed with the IRS. - Nominee Instructions:

If you are a nominee (not the actual owner), complete all copies for each owner, enter your name as “Nominee,” and follow specific filing and distribution procedures outlined in the instructions. - Reporting by Shareholders:

Shareholders must report the amounts on their tax returns as long-term capital gains, using Schedule D or Form 8949 as applicable. Special worksheets apply for unrecaptured section 1250 gain, section 1202 gain, and collectibles gain. - Refund or Credit of Tax Paid:

Shareholders may apply for a refund or credit of the tax paid by the RIC or REIT on undistributed gains, as indicated in box 2. - Recordkeeping:

RICs, REITs, and shareholders should retain copies of Form 2439 and supporting documents for tax recordkeeping purposes.