Before 2018 tax reform, the employee business expense deduction was an above-the-line deduction on your federal return and could be itemized if you were able to claim all of the miscellaneous itemized deductions that exceeded 2% of your adjusted gross income (AGI). However, after the passage of TCJA in 2018, this deduction was suspended. It is scheduled to reemerge in 2025, but until that time, the only way to claim this deduction was through Form 2106 or its simplified counterpart, 2106-EZ.

How to Complete Form 2106?

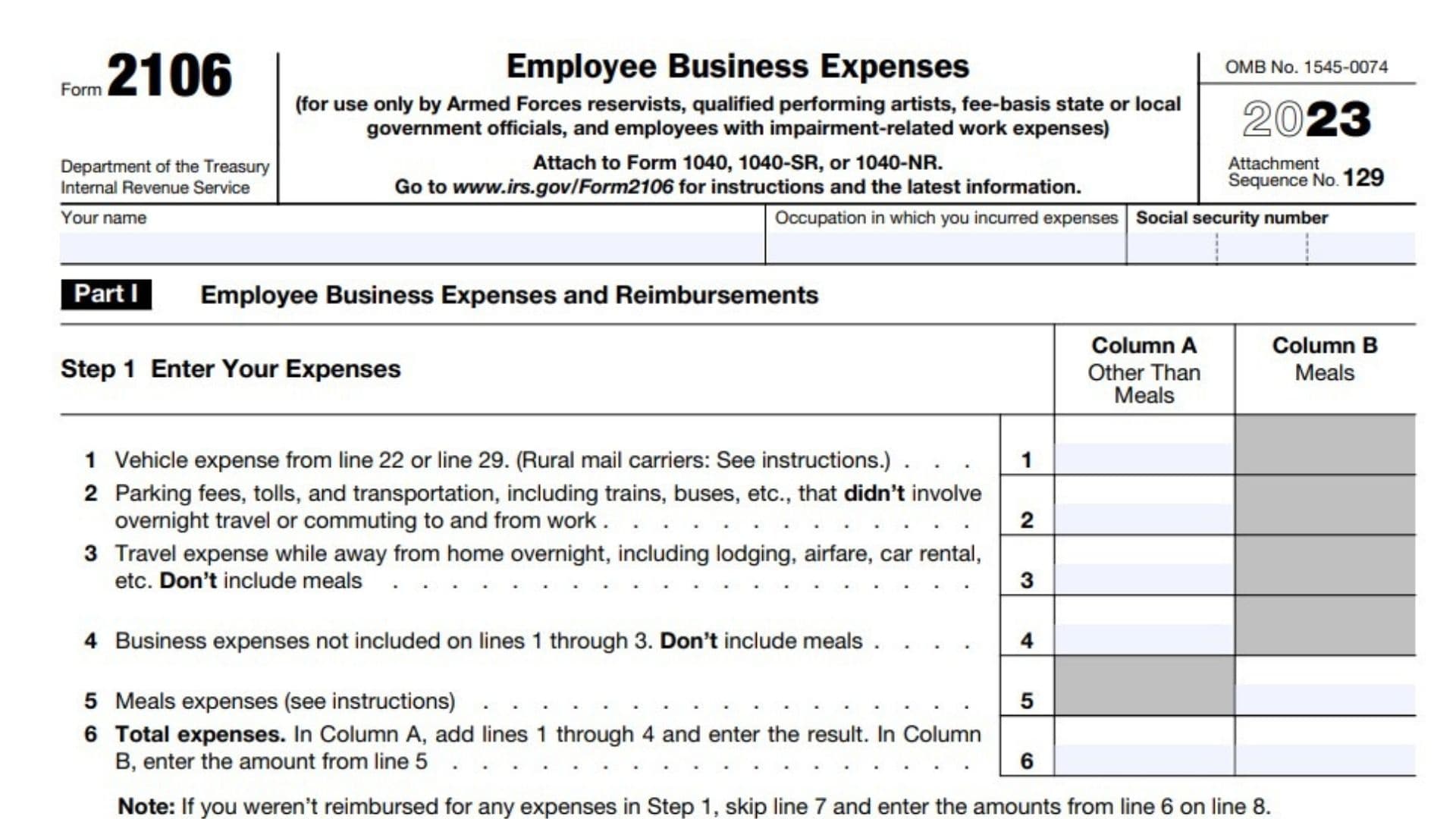

The first page of Form 2106 lists your expense categories, which are categorized as either ordinary or necessary. Ordinary expenses are those that are common and accepted in your line of work, while necessary expenses are those that are helpful or essential to the conduct of your business.

After listing your expense categories on the first page of the form, you must enter the total amount of all of your unreimbursed expenses in Step 2. You can also choose to enter the amount of any employer reimbursement you received at this point. Then, in Step 3, you must subtract the amount of employer reimbursement from the total number of expenses to determine your allowable deduction.

If you used your personal vehicle for business purposes during the year, you must complete the second page of Form 2106. You can use Section B to claim a standard mileage rate or Section C to calculate your actual vehicle expenses. You can deduct the cost of gas, oil, repairs, registration and insurance, and car depreciation using a table provided in the instructions. Regardless of which option you choose, expenses that are incurred while commuting to and from work are not eligible for deduction.

The eligibility rules for filing Form 2106 can be somewhat confusing, so it’s best to consult a professional or the official IRS guide before filling out this document. You should also check with your state tax agency to see if they have any additional requirements for filing. Online tax softwares can help you file both Form 2106 and Form 2106-EZ, and it will automatically carry your unreimbursed expenses to your Schedule A for states that accept this deduction. Such tax softwares can also track and report your vehicle expenses, mileage, and other miscellaneous itemized deductions.

Form 2106 Line-by-line Instructions

Part I: Employee Business Expenses and Reimbursements

Step 1 – Enter Your Expenses

Line 1: Enter vehicle expense from line 22 or line 29

Line 2: Enter parking fees, tolls, and transportation, including trains, buses, etc., that didn’t involve overnight travel or commuting to and from work.

Line 3: Enter travel expense while away from home overnight, including lodging, airfare, car rental, etc. (You can’t include meals here)

Line 4: Business expenses not included on lines 1 through 3. (You can’t include meals here, too.)

Line 5: You can now enter your meal expenses here.

Line 6: (see instructions) . . . . . . . . . . . . . . . . . 5 6 Total expenses. Add lines 1 through 4 in Column A and enter the result here. In Column B, enter the amount from line 5.

- Skip line 7 and enter the amounts from line 6 on line 8, if you weren’t reimbursed for any expenses in Step 1.

Step 2 – Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

Line 7: Enter reimbursements received from your employer that weren’t reported to you in box 1 of Form W-2. Include any reimbursements reported under code “L” in box 12 of your Form W-2

Step 3 – Figure Expenses To Deduct

Line 8: Subtract line 7 from line 6. If zero or less, enter -0-. However, if line 7 is greater than line 6 in Column A, report the excess as income on Form 1040 or 1040-SR, line 1 (or on Form 1040-NR, line 1a).

Line 9:

- Column A: Enter Line 8 amount.

- Column B: See the ırs instructions for the amount to enter.

Line 10:

- Add the amounts on line 9 for both columns and enter the total here

- Also, enter the total on Schedule 1 (Form 1040), line 12

- Employees with impairment-related work expenses, see the IRS instructions for rules on where to enter the total on your return.

Part II – Vehicle Expenses (Complete this section only if you are claiming vehicle expenses.)

Line 11: Enter the date the vehicle was placed in service.

Line 12: Enter total miles driven in 2022

Line 13: Enter business miles included on line 12

Line 14: Enter Average daily roundtrip commuting distance

Line 15: Enter Average daily roundtrip commuting distance

Line 16: Enter commuting miles included on line 12

Line 17:Enter other miles. Add lines 13 and 16 and subtract the total from line 12

Line 18: Yes or no. Was your vehicle available for personal use during off-duty hours?

Line 19: Yes or no. Do you (or your spouse) have another vehicle available for personal use?

Line 20: Yes or no. Do you have evidence to support your deduction?

Line 21: If “Yes,” is the evidence written?

Section B—Standard Mileage Rate

Line 22: Multiply line 13 by 58.5¢ (0.585) (January 1–June 30) and 62.5¢ (0.625) (July 1–December 31). Enter the result here and on line 1

Line 23: Enter Gasoline, oil, repairs, vehicle insurance, etc.

Line 24a: Enter vehicle rentals

Line 24b: Enter inclusion amount (see instructions)

Line 24c: Subtract line 24b from line 24a and enter the result here.

Line 25: Value of employer-provided vehicle (applies only if 100% of annual lease value was included on Form W-2 (see the IRS instructions).

Line 26: Add lines 23, 24c, and 25 and enter the result here.

Line 27: Multiply line 26 by the percentage on line 14 and enter the result here.

Line 28: Depreciation (see the IRS instructions)

Line 29: Add lines 27 and 28. Enter the total here and on line 1.

Section D—Depreciation of Vehicles (Use this section only if you owned the vehicle and are completing Section C for the vehicle.)

Line 30: Enter cost or other basis

Line 31: Enter section 179 deduction and special allowance

Line 32: Multiply line 30 by line 14 and enter the result here.

Line 33: Enter depreciation method and percentage.

Line 34: Multiply line 32 by the percentage on line 33 and enter the result here.

Line 35: Add lines 31 and 34 and enter the result here.

Line 36: Enter the applicable limit explained in the IRS instructions

Line 37: Multiply line 36 by the percentage on line 14.

Line 38: Enter the smaller of line 35 or line 37. If you skipped lines 36 and 37, enter the amount from line 35. Also, enter this amount on line 28 above