When someone dies, many things need to be handled, including their estate and any taxes that may have been withheld. One of the most important things to be aware of is that filing requirements still apply for deceased taxpayers, even if they’re not due to file their individual tax return. In some cases, a deceased person can be owed a tax refund that needs to be claimed, and this is where Form 1310 comes in.

Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, must accompany a deceased taxpayer’s final federal income tax return if the return results in a tax refund. Generally, the surviving spouse or a court-appointed personal representative is the person who files this form. However, in some situations, it may be the executor of an estate or another party authorized by state law.

How to File Form 1310?

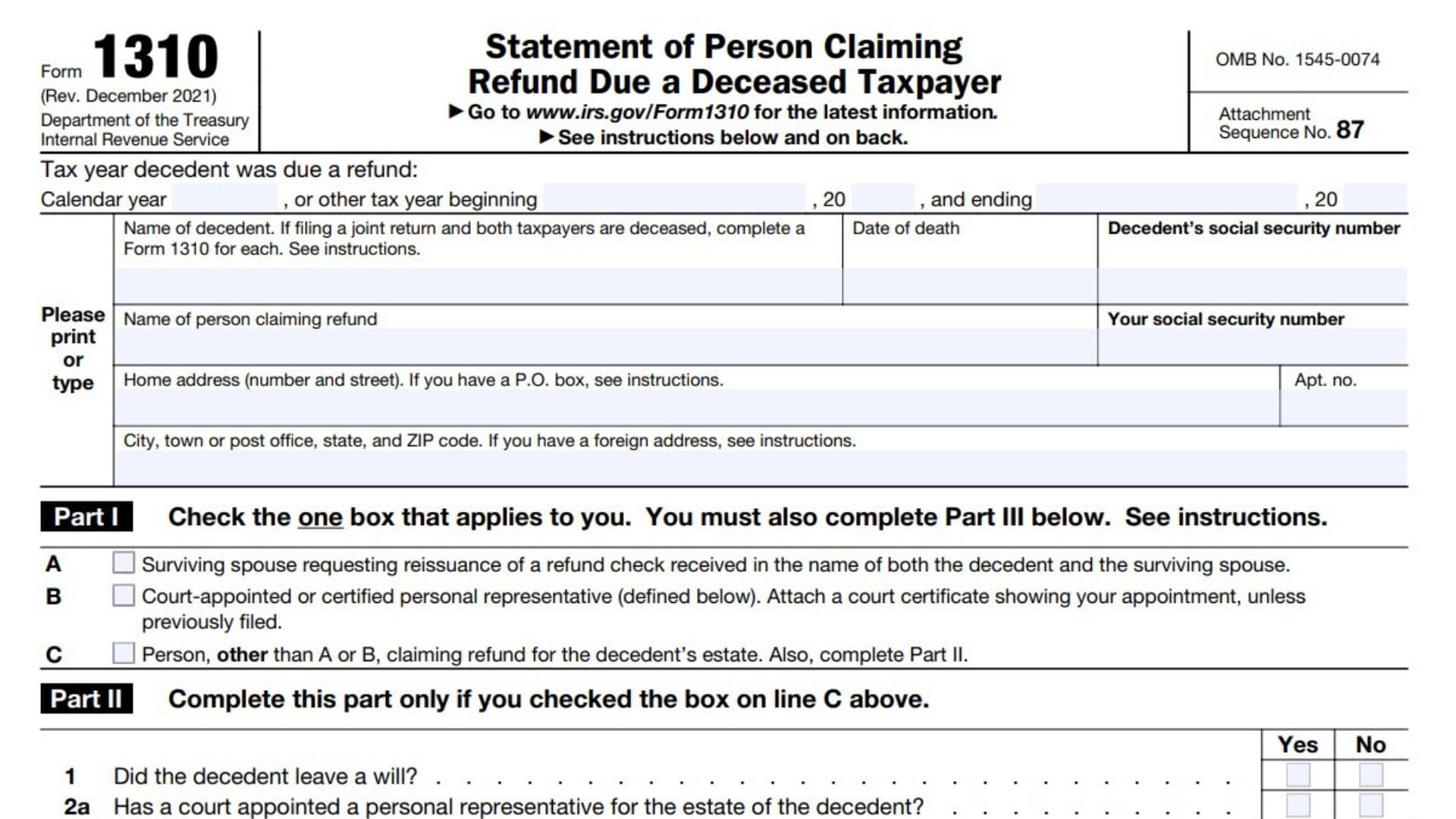

The first section of Form 1310 asks for information about the deceased taxpayer, such as their social security number and date of death. This is required in order for the IRS to process the request and issue a refund check.

The claimant must indicate their relationship to the deceased taxpayer in the next section. For example, if they are a surviving spouse, the form will ask whether they filed a joint return with the deceased or are a court-appointed personal representative of an estate. In addition to indicating their relationship, the person must also provide their mailing address and phone number.

Part II of the form is where the claimant must indicate whether there was a will and, if there was, a list of beneficiaries. If there was no will, the person claiming the refund must submit a court certificate or other evidence that they are a qualified representative of an estate.

Finally, in Part III of the form, the claimant must sign their name to confirm that they are requesting the deceased’s refund. They may also choose to provide their phone number in this section if they’d like. Finally, the person must select whether they plan to file electronically or by mail.

The IRS has created this form to help individuals and other parties navigate the often confusing world of filing tax-related forms after a loved one’s death. It’s important to be careful when submitting these documents and to ensure that they are completed correctly, especially since the errors can have serious consequences.

How to Complete Form 1310?

- Enter the name of the decedent

- Decedent’s SSN

- Enter your SSN

- Separate 1310s must be filled out for each deceased taxpayer. (if filing a joint return).

- Enter name of person claiming refund Your social security number.

- Enter your home address. Enter apt. no.

- Enter the city, town, or post office, state, and ZIP code.

Part I: Check the one box that applies to you in lines A, B, and C.

Part II: Complete part 2 only if you checked the C-box. (Yes or no questions).

Questions

- Did the decedent leave a will?

- Has a court appointed a personal representative for the estate of the decedent?

- If you answered “No” to 2a, will one be appointed?

- If you answered “Yes” to 2a or 2b, the personal representative must file for the refund

- As the person claiming the refund for the decedent’s estate, will you pay out the refund according to the state’s laws where the decedent was a legal resident?

- If you answered “No” to 3, a refund cannot be made until you submit a court certificate showing your appointment as personal representative or other evidence that you are entitled under state law to receive the refund.

Sign the Form.