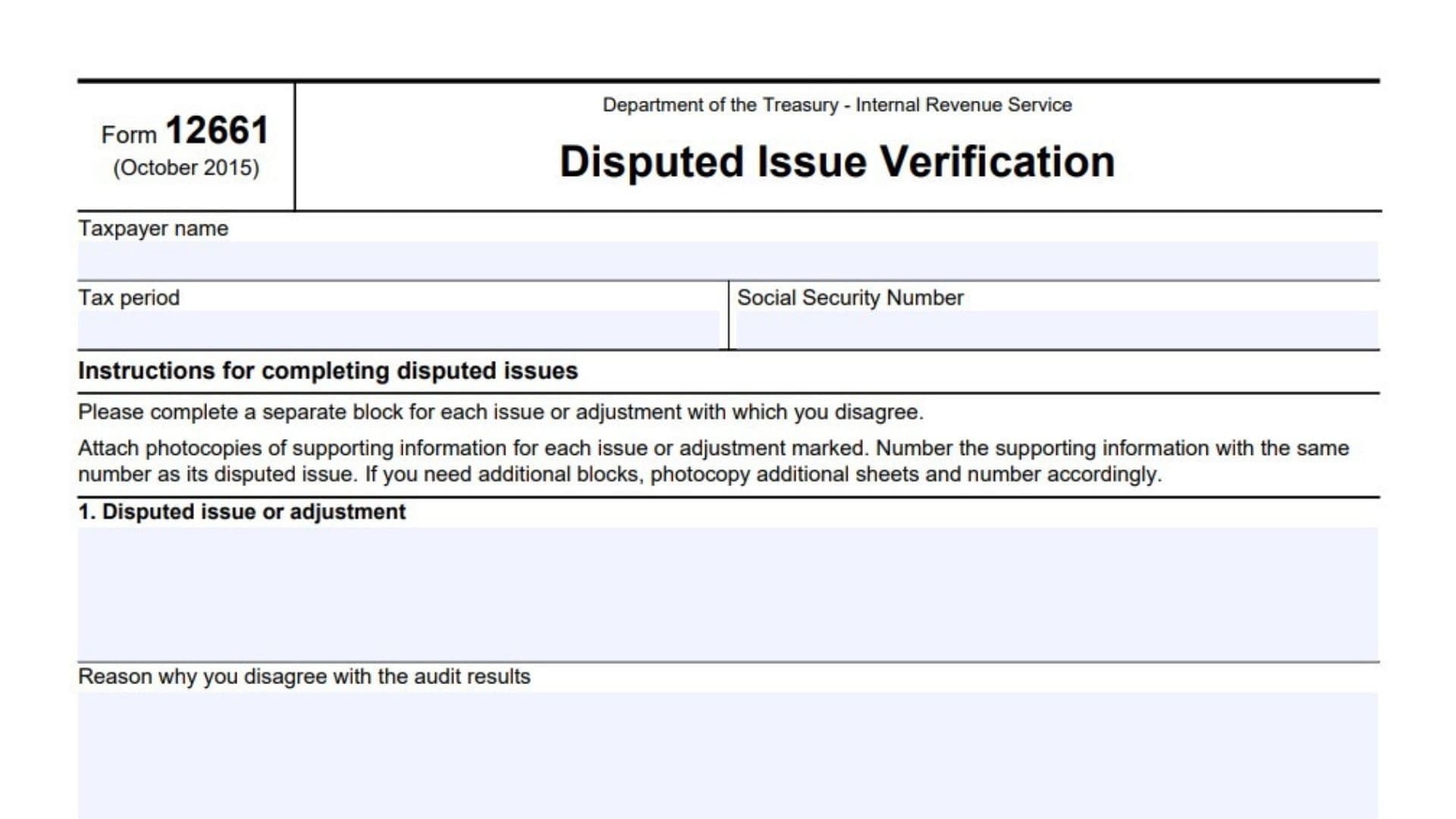

IRS Form 12661, officially titled “Disputed Issue Verification,” is used by taxpayers to formally contest specific findings of an IRS audit. If the IRS audits your tax return and you disagree with one or more issues or adjustments, you use this form to clearly explain your position on each disputed item. The main goal of Form 12661 is to give you a structured, organized way to identify each issue you contest, state why you disagree, and provide supporting documentation. This form is essential if you want your disagreements considered during the appeals process or further IRS review. Attach clear photocopies (never originals) of any backup documents supporting your case. Properly completing Form 12661 helps the IRS understand your perspective on every point of disagreement, potentially speeding up the resolution.

How to File Form 12661

- You’ll typically receive Form 12661 from the IRS during or after an audit if there are disagreements regarding adjustments.

- Fill out the form completely (type or print legibly).

- Include a separate block for each disputed issue—photocopy and number additional sheets as needed.

- Attach photocopies of your supporting documents (e.g., receipts, contracts)—never send originals.

- Number each attachment to correspond with its disputed issue.

- Return the completed form and photocopied attachments to the IRS at the address provided in your audit correspondence or as instructed by your IRS contact.

How to Complete Form 12661

Header Section

- Taxpayer Name:

Write your full legal name as shown on your tax return. - Tax Period:

List the specific tax year or period under dispute (e.g., 01/01/2023–12/31/2023). - Social Security Number:

Enter your SSN (or the primary SSN if for a joint return) exactly as on your tax return.

Disputed Issues Blocks

For each individual issue or adjustment you dispute, complete the entire block. If more than three issues, make additional copies of this section—number them for clarity.

Block 1 (Repeat for each block as needed):

- 1. Disputed issue or adjustment:

State clearly which adjustment, finding, or issue from your IRS audit you disagree with (e.g., “Disallowance of charitable deduction for $1,000 donation”). - Reason why you disagree with the audit results:

Explain, in your own words, why you believe the IRS was incorrect. Be fact-based and direct (e.g., “Donation supported by valid receipt from qualified charity dated within the tax year; documentation attached”). - Amount claimed on original return:

Enter the dollar amount you originally reported for this item on your filed tax return (e.g., $1,000). - Amounts allowed on audit report:

Enter the dollar amount the IRS audit permitted for this same item (e.g., $0 if fully disallowed; a partial amount if only some was allowed).

Block 2 & Block 3:

Follow the same structure as Block 1 for each additional disputed issue:

- State the issue/adjustment.

- Give your reason for disagreement.

- Enter the original amount claimed.

- Enter the amount allowed per the audit.

Supporting Documentation

- Attach only photocopies (not originals) of all backup information for each disputed issue.

- Clearly number each document so it matches the disputed issue it supports (e.g., “Issue 1 – Receipt,” “Issue 2 – Bank Statement”).

Privacy Act Notice

Form 12661 refers you to the instructions for your return for privacy disclosures. Always refer to current IRS guidance for any privacy-related or document submission questions.