Form 1128, Application to Adopt, Change, or Retain a Tax Year, is used by taxpayers to request IRS approval for adopting, changing, or retaining their annual tax year. Properly managing this form ensures compliance with IRS regulations and helps taxpayers align their tax year with their financial and business needs. The primary purpose of Form 1128 is to allow taxpayers to request approval from the IRS to adopt, change, or retain their annual tax year. This form is necessary because the IRS must approve such changes to ensure they comply with tax laws and regulations. Taxpayers may wish to change their tax year for various reasons, including better alignment with business cycles or changes in business structure.

Who Must File Form 1128?

Form 1128 must be filed by:

Corporations: C corporations, S corporations, and personal service corporations seeking to adopt, change, or retain their tax year.

Partnerships: Partnerships that need to change their tax year to better align with their business operations.

Individuals: Sole proprietors and individuals with specific tax situations requiring a change in their tax year.

Exempt Organizations: Tax-exempt organizations that need to change their accounting period for reporting purposes.

Estates and Trusts: Estates and trusts that require a change in their tax year.

How To Complete Form 1128?

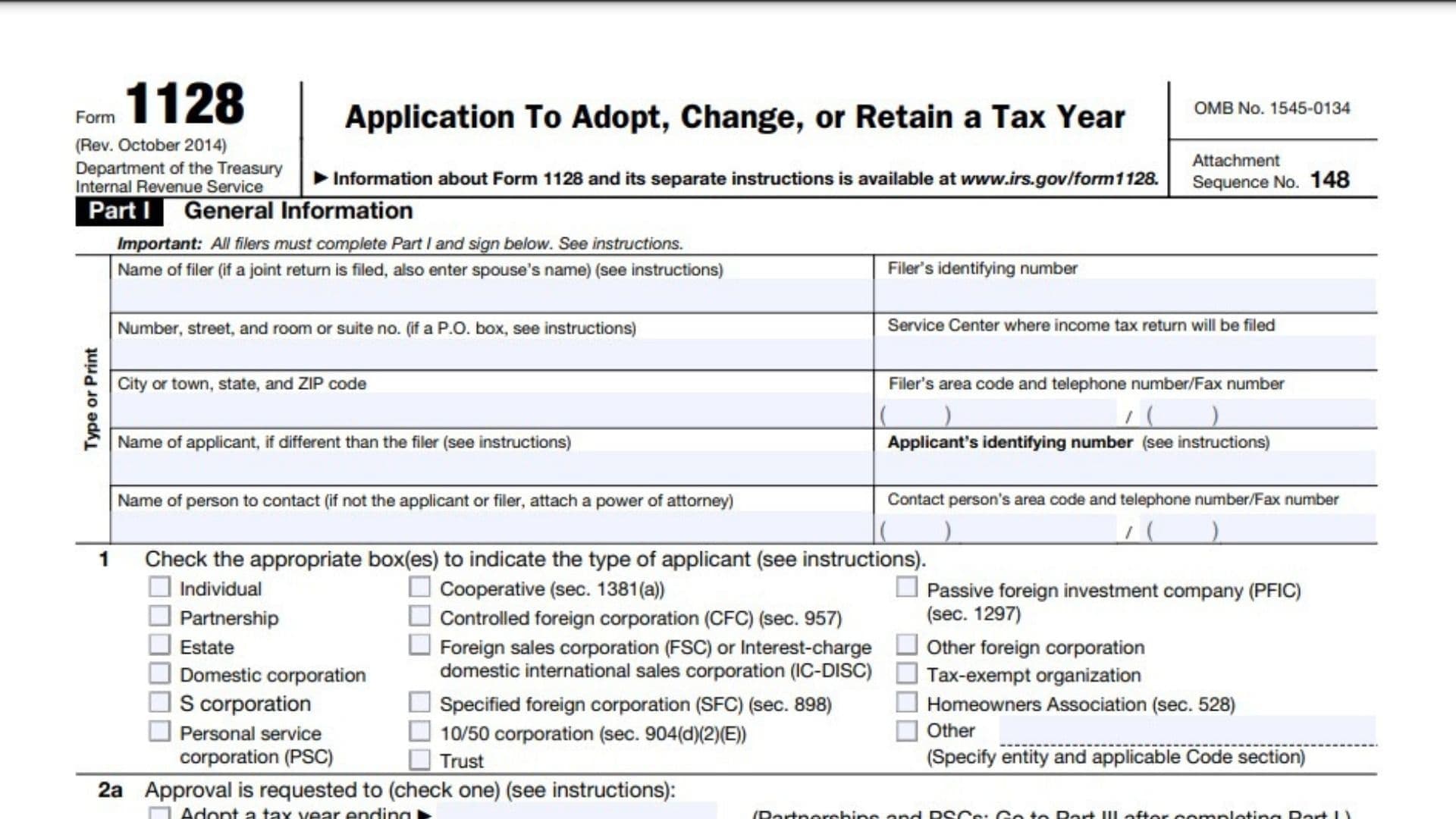

Filling out Form 1128 requires accurate and comprehensive information about the taxpayer’s current tax year, the requested tax year, and the reasons for the change. The form is divided into several parts, each addressing different aspects of the request.

- Part I – General Information:

- Lines 1-10: Provide general information about the taxpayer, including name, address, employer identification number (EIN), and the type of taxpayer (e.g., corporation, partnership, individual).

- Part II – Adoption, Change, or Retention of Tax Year:

- Lines 11-16: Specify whether the request is to adopt, change, or retain a tax year. Provide details of the current tax year and the requested tax year.

- Part III – Rulings and Administrative Procedures:

- Lines 17-25: Indicate whether the request is being made under automatic approval procedures or if a ruling is being requested. Provide additional information required for the specific procedure being used.

- Part IV – Additional Information for Certain Taxpayers:

- Lines 26-30: Provide additional information for certain types of taxpayers, such as personal service corporations, S corporations, and partnerships.

- Signature:

- Ensure the form is signed and dated by an authorized representative of the taxpayer. The signature confirms the accuracy of the information provided and the filer’s agreement to the request.

Things to Consider When Filing Form 1128

Understanding the specific rules and implications of filing Form 1128 is essential for taxpayers to ensure compliance with IRS regulations and accurately request the adoption, change, or retention of their tax year.

Accurate Reporting: Ensure that all information reported on Form 1128 is accurate and complete. Incorrect or incomplete information can lead to delays in processing and possible rejection of the request.

Supporting Documentation: Provide thorough and detailed supporting documentation to substantiate the request. This includes financial statements, records of income and expenses, and any necessary schedules.

Timely Filing: Ensure that Form 1128 is filed promptly. The IRS generally requires that the form be filed by the 15th day of the second calendar month following the close of the short tax year. Late filing can result in the rejection of the request.

Record Keeping: Maintain accurate records of all financial activities and supporting documents. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of tax regulations and the specific requirements of Form 1128, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 1128 is completed accurately and submitted on time and can provide guidance on the implications of changing the tax year.

Legal and Financial Implications: Understand the legal and financial implications of adopting, changing, or retaining a tax year. This includes the impact on financial planning, tax liability, and compliance with IRS regulations.

Eligibility Requirements

For a taxpayer to qualify to file Form 1128, they must meet the following requirements:

- Valid Reasons for Change: The taxpayer must have a valid business purpose for adopting, changing, or retaining a tax year.

- Compliance with Procedures: The taxpayer must comply with the procedures outlined by the IRS for requesting a change in tax year, including providing all necessary information and supporting documentation