The main function of Form 1127 is to provide a taxpayer additional time to pay taxes, avoiding the usual late payment penalties. However, interest on the unpaid taxes will still accumulate. The IRS only grants this extension in cases of proven undue hardship, which is defined as a financial condition where paying the tax immediately would result in significant financial difficulties or force the taxpayer to sell assets at a loss.

Eligibility Criteria

To qualify for an extension of time to pay taxes using Form 1127, you must demonstrate:

- Undue hardship: You need to show that paying the tax by the due date would cause severe financial strain. This could include being forced to liquidate assets at a loss or impacting your ability to meet necessary living expenses.

- Inability to obtain loans or financing: You must prove that you are unable to obtain funds through loans or other means to satisfy your tax liability.

Merely claiming that it would be inconvenient or burdensome does not qualify as “undue hardship.” The IRS evaluates each case individually based on the evidence provided.

When filing Form 1127, you must submit detailed financial information that proves undue hardship. This can include:

- A statement of your current assets and liabilities

- A statement of income and expenses for the last three months

- Any other relevant financial data (such as loan applications or bank rejections)

The IRS may require these documents to evaluate the true extent of the taxpayer’s financial situation.

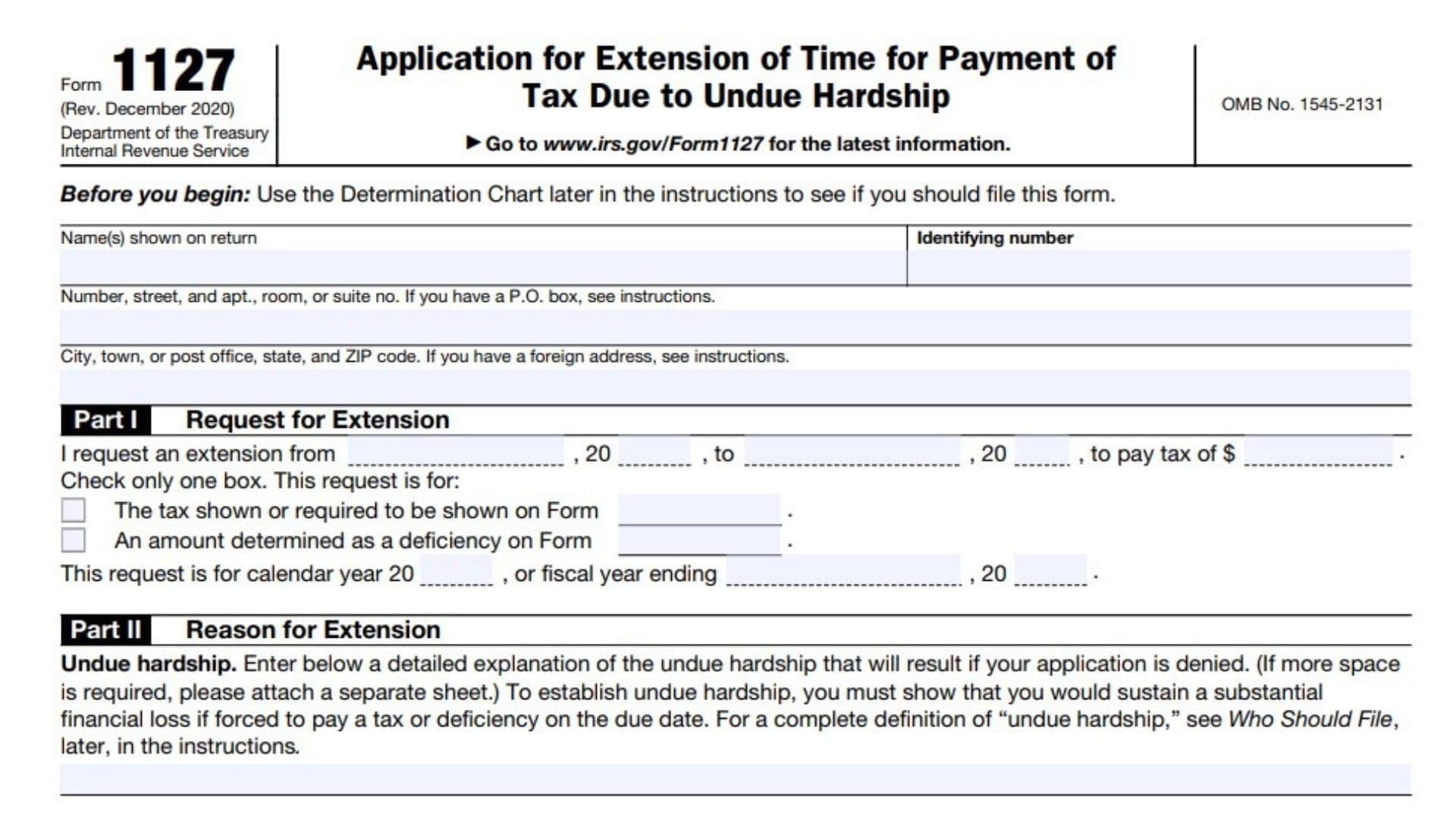

How to Complete Form 1127?

- Enter the name on your return

- Enter ID Number

- Enter address

Part I Request for Extension

- Enter the tax tears and tax amount

- Also, check the appropriate boxes that apply to you.

Part II Reason for Extension

Enter a detailed explanation of the undue hardship that will result if your application is denied.

Part III Supporting Documentation

Attach all supporting documents. Check the boxes to certify the documents you have attached.

Sign the Form.