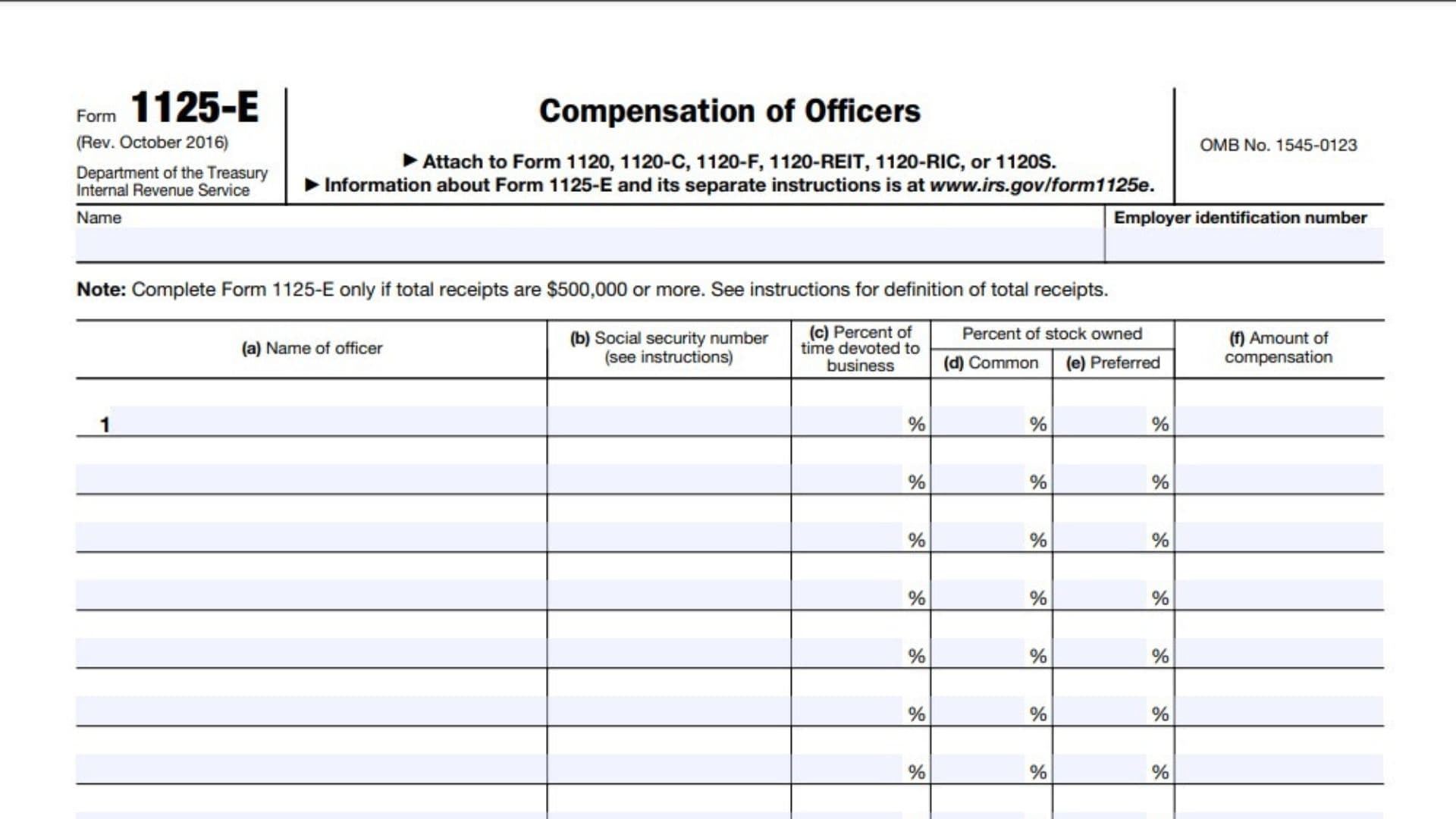

IRS Form 1125-E, “Compensation of Officers,” is a supplemental form required for corporations to report salaries, wages, and other compensation paid to officers. This form helps the IRS evaluate whether officer compensation is reasonable and in line with corporate earnings. It is mandatory for corporations with gross receipts of $500,000 or more to attach this form to their corporate tax return.

When to Use Form 1125-E?

Corporations must file Form 1125-E if:

- Their total gross receipts, as defined in the IRS instructions, are $500,000 or more.

- They file one of the following forms:

- Form 1120 (U.S. Corporation Income Tax Return)

- Form 1120-C (Cooperative Associations)

- Form 1120-F (Foreign Corporations)

- Form 1120-REIT (Real Estate Investment Trusts)

- Form 1120-RIC (Regulated Investment Companies)

- Form 1120-S (S Corporations)

How to Complete Form 1125-E?

- Header Information:

- Name: Enter the legal name of the corporation as it appears on the corporate tax return.

- Employer Identification Number (EIN): Enter the corporation’s EIN.

- Officer Compensation Details (Table):

- Column (a) Name of Officer: Provide the full legal names of all officers receiving compensation.

- Column (b) Social Security Number (SSN): Enter the SSN of each officer. Refer to the instructions for privacy guidelines.

- Column (c) Percent of Time Devoted to Business: Specify the percentage of time each officer spends working on the corporation’s business.

- Column (d) Percent of Stock Owned – Common: Indicate the percentage of common stock owned by each officer, if applicable.

- Column (e) Percent of Stock Owned – Preferred: Indicate the percentage of preferred stock owned by each officer, if applicable.

- Column (f) Amount of Compensation: Report the total compensation paid to each officer during the tax year. Include salaries, bonuses, and other taxable benefits.

- Line 2 – Total Compensation of Officers:

- Add up the amounts in Column (f) and enter the total here. This is the sum of all compensation paid to officers.

- Line 3 – Compensation Claimed on Other Forms:

- Report any officer compensation included on other forms, such as Form 1125-A (Cost of Goods Sold) or elsewhere on the return.

- Line 4 – Compensation to Report on Tax Return:

- Subtract the amount on Line 3 from Line 2. Enter the result here. This is the compensation amount reported on the corporate tax return.

- Attach to Corporate Tax Return:

- Attach Form 1125-E to the applicable corporate income tax return (e.g., Form 1120, Form 1120-S) when filing with the IRS.