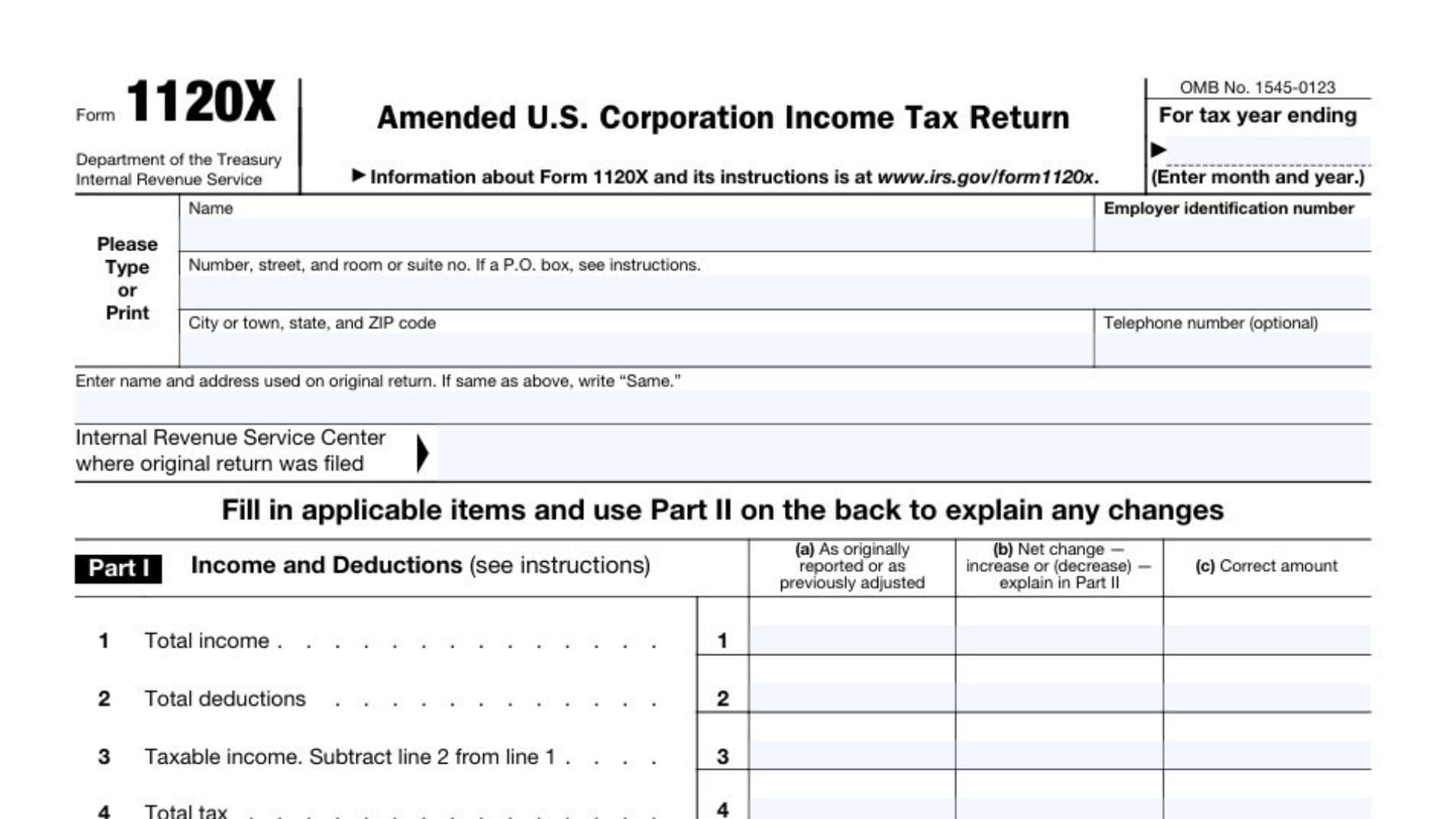

Form 1120-X is the Amended U.S. Corporation Income Tax Return, issued by the IRS. This form is used by corporations to correct any errors or omissions in their previously filed Form 1120 (U.S. Corporation Income Tax Return) or to amend adjustments made during an IRS audit. It is an essential tool for businesses that have discovered discrepancies in their original tax filings, whether those discrepancies involve income, deductions, credits, or other relevant tax matters. By submitting Form 1120-X, corporations can make changes to their originally filed return, ensuring compliance and addressing any overpayments or underpayments of taxes. This form also enables corporations to request refunds or apply credits to future tax periods. Importantly, the form must be filed within a specific timeframe: generally, three years from the original filing date or two years from when the tax was paid, whichever is later.

How to File Form 1120-X

- Obtain the Form:

- Form 1120-X can be downloaded from the IRS website or completed online through the IRS e-file system.

- Ensure You’ve Filed the Original Return:

- Form 1120-X can only be filed after the original Form 1120 has been submitted.

- Review and Amend the Original Return:

- If any errors are discovered or adjustments are needed after filing the original return, ensure that you have the correct information available before completing Form 1120-X.

- If there was an IRS audit or a previous amendment, reference the adjustments made.

- Mailing Instructions:

- File the form at the same IRS Service Center where the original return was filed.

How to Complete Form 1120-X

Part I: Income and Deductions

- Line 1: Total Income

- Enter the total income as reported on the original return or as adjusted during audits.

- Line 2: Total Deductions

- Enter the total deductions previously reported or adjusted.

- Line 3: Taxable Income

- Subtract line 2 (total deductions) from line 1 (total income) to determine the taxable income.

- Line 4: Total Tax

- Enter the total tax calculated based on taxable income (from line 3). You may need to use Schedule J from your original return to compute the tax.

Payments and Credits Section

- Line 5a: Overpayment from Prior Year

- If you applied overpayments from the prior year as a credit, enter that amount.

- Line 5b: Estimated Tax Payments

- Enter any estimated tax payments made during the current year.

- Line 5c: Refund Applied for on Form 4466

- If you applied for a refund on Form 4466, enter that amount.

- Line 5d: Subtotal

- Add lines 5a and 5b, then subtract line 5c to get the total of payments and credits.

- Line 5e: Tax Deposited with Form 7004

- If any tax deposits were made with Form 7004, enter the amount here.

- Line 5f: Credit from Form 2439

- Enter any credit from Form 2439 here.

- Line 5g: Other Credits

- Include any other credits (like credits for tax on fuels or other refundable credits).

Tax Due or Overpayment

- Line 6: Tax Deposited or Paid

- Enter the amount of tax deposited or paid after the original return was filed (from line 6).

- Line 7: Total Payments and Credits

- Add lines 5d through 6 to calculate the total payments and credits.

- Line 8: Overpayment from Original Return

- Enter the overpayment amount shown on the original return or later adjusted.

- Line 9: Calculate Overpayment or Tax Due

- Subtract line 8 from line 7 to determine if you owe tax or have an overpayment.

- Line 10: Tax Due

- If you owe tax, subtract line 9 from line 4, column (c). This is the tax due.

- Line 11: Overpayment

- If you have an overpayment, subtract line 4 from line 9. This is the total overpayment.

- Line 12: Apply Overpayment

- Decide if you want to credit your overpayment to next year’s estimated tax or receive a refund.

Signature Section

- Sign the Form:

- The corporate officer (president, vice president, or other authorized officer) must sign and date the form.

Part II: Explanation of Changes

In Part II, you’ll explain the reasons for the changes. You must provide clear details about what was changed on the original return and the reasons for those changes. If your amendment is related to a net operating loss (NOL) carryback, capital loss carryback, or general business credit carryback, indicate this and provide a detailed explanation.

- Include any computation showing the adjustment to income, deductions, or credits.

- Attach supporting forms such as Schedule J, Form 2439, and Schedule M if applicable.

Where to File

- Mail the Completed Form to the IRS Service Center where the original return was filed. Use the correct address based on your business location and the type of tax return.

When to File Form 1120-X

- File within 3 years after the original return was filed, or 2 years after the tax was paid, whichever is later.

- Carryback Claims must be filed within 3 years after the due date of the original return for that year.