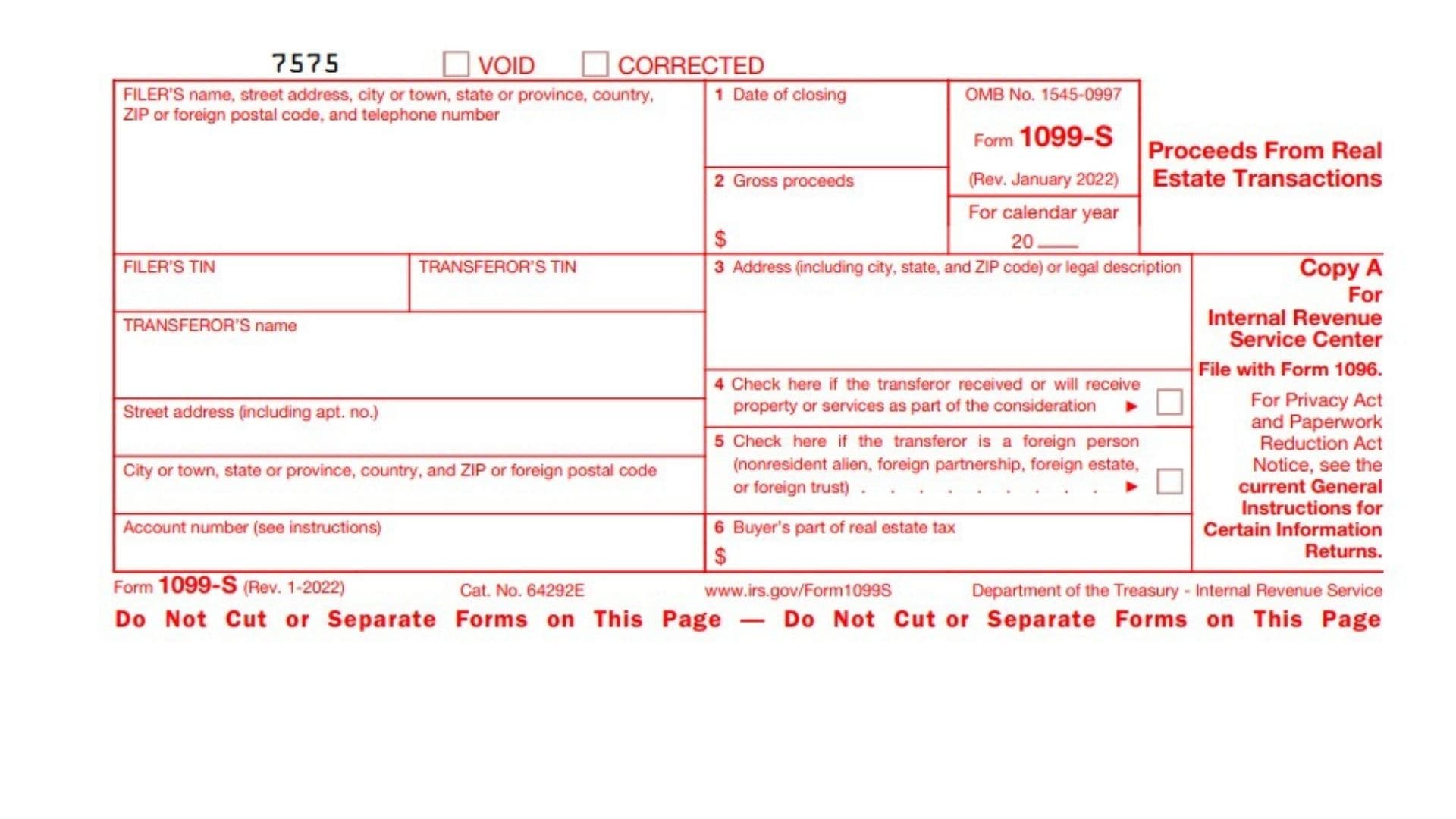

IRS Form 1099-S, titled “Proceeds From Real Estate Transactions,” is used to report the gross proceeds from the sale or exchange of real estate. This form is typically filed by the person responsible for closing the transaction, such as a title company or real estate agent, and it must be provided to both the seller (transferor) and the IRS. The information reported on Form 1099-S includes details such as the date of closing, gross proceeds from the sale, and whether any services or property were received as part of the transaction. It is important for sellers to receive this form as it helps them accurately report their income on their tax returns. Additionally, if any part of the transaction involves a foreign person or entity, specific boxes must be checked to comply with IRS requirements. Properly completing and filing Form 1099-S ensures that all parties involved in a real estate transaction meet their tax obligations.

How to File IRS Form 1099-S?

Filing IRS Form 1099-S involves several steps to ensure accurate reporting of proceeds from real estate transactions. Here’s how to proceed:

- Gather Necessary Information: Collect all relevant details about the real estate transaction, including closing statements and identification numbers for both the filer and transferor.

- Complete Each Section of Form 1099-S: Fill out the form based on the specifics of the transaction.

- Distribute Copies: Provide Copy B of Form 1099-S to the transferor (seller) and send Copy A to the IRS along with Form 1096 if filing by paper.

- File Electronically if Possible: Consider using the IRS Filing Information Returns Electronically (FIRE) system for electronic submissions.

How to Complete Form 1099-S?

Filer Information

- Filer’s Name and Address: Enter your name, street address, city or town, state or province, country, ZIP code or foreign postal code, and telephone number in the designated fields.

- Filer’s TIN: Provide your Taxpayer Identification Number (TIN).

Transferor Information

- Transferor’s Name: Enter the name of the transferor (the person selling the property).

- Transferor’s TIN: Provide the TIN of the transferor.

- Transferor’s Address: Enter street address, city or town, state or province, country, and ZIP code or foreign postal code.

Transaction Details

- Date of Closing (Box 1): Enter the date when the real estate transaction was finalized (mm/dd/yyyy).

- Gross Proceeds (Box 2): Report the total gross proceeds from the sale of real estate. This amount includes cash received plus any notes payable to you and liabilities assumed by the buyer.

- Address or Legal Description (Box 3): Provide either a legal description of the property sold or its address including city and state.

- Property or Services Received (Box 4): Check this box if the transferor received or will receive property or services as part of the consideration for this transaction.

- Foreign Person Indicator (Box 5): Check this box if the transferor is a foreign person (nonresident alien, foreign partnership, etc.).

- Buyer’s Part of Real Estate Tax (Box 6): Report any portion of real estate tax charged to the buyer at settlement.

Additional Considerations

- Ensure that you do not file Copy A downloaded from the IRS website; instead, use official printed forms that are scannable.

- If applicable, attach any additional forms that may be required based on specific circumstances related to the transaction.

- Maintain copies for your records as well as for distribution to relevant parties involved in the transaction.