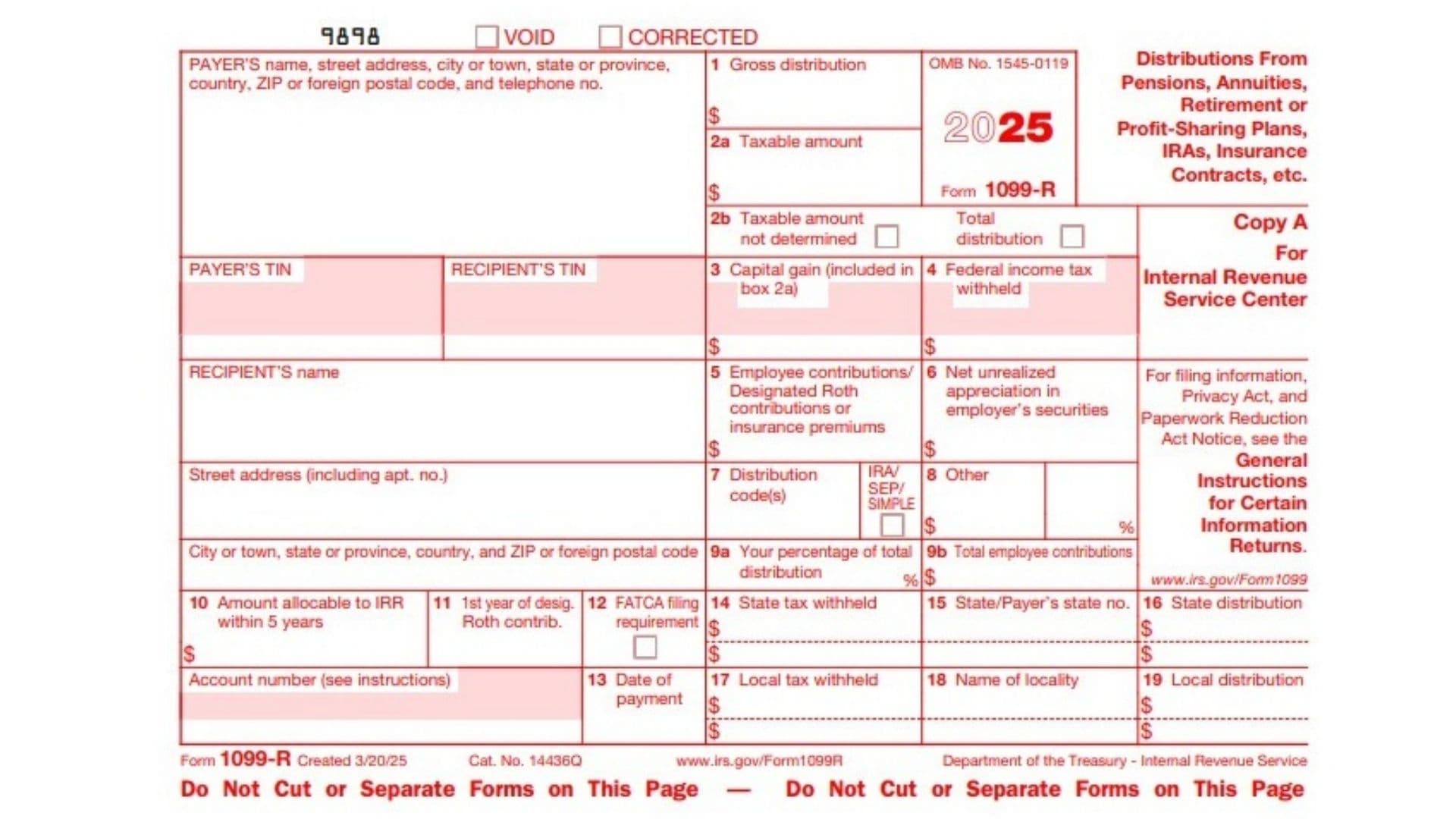

IRS Form 1099-R is a critical tax form used to report distributions from retirement accounts, pensions, annuities, profit-sharing plans, IRAs, and insurance contracts. These distributions may include rollovers, conversions to Roth accounts, or lump-sum payments. The form is issued by payers (such as financial institutions or employers) to recipients who have received taxable or non-taxable distributions during the year. It provides essential details about the gross distribution amount, taxable portion, federal income tax withheld, and other relevant information.

Form 1099-R is vital for taxpayers to accurately report income on their tax returns. It includes specific codes in Box 7 to identify the type of distribution (e.g., early withdrawal, normal distribution, rollover). Recipients use this information to determine their taxable income and comply with IRS regulations. The form also serves as a record for state and local tax reporting when applicable.

How to File Form 1099-R?

Form 1099-R can be filed electronically or on paper:

- Electronic Filing: If you have 10 or more forms to submit, e-filing is required through the IRS FIRE system.

- Paper Filing: For fewer than 10 forms, you can order scannable copies of Form 1099-R from the IRS website and mail them to the appropriate IRS processing center.

Filing Steps:

- Complete all required fields on the form.

- Provide copies to the recipient and file Copy A with the IRS.

- Retain Copy C for your records.

Ensure accuracy when entering data to avoid penalties for incorrect filings.

How to Complete Form 1099-R?

Payer’s Information

- Enter the payer’s name, address, city/state/ZIP code, and telephone number.

- Include the payer’s Taxpayer Identification Number (TIN).

Recipient’s Information

- Enter the recipient’s name and address.

- Include the recipient’s TIN (only the last four digits may be shown for privacy).

Account Number

- Provide an account number if applicable. This helps identify specific accounts for corrections or amendments.

Box 1: Gross Distribution

- Report the total amount distributed during the year. This includes rollovers, conversions to Roth accounts, periodic payments, non-periodic payments, or total distributions.

Box 2a: Taxable Amount

- Enter the taxable portion of the distribution. If blank, it indicates that the payer couldn’t determine this amount (Box 2b will be checked).

Box 2b: Taxable Amount Not Determined

- Check this box if the payer couldn’t determine the taxable amount.

- Also check if this was a total distribution that closed out the account.

Box 3: Capital Gain

- Report any capital gain included in Box 2a from a lump-sum distribution or charitable gift annuity.

Box 4: Federal Income Tax Withheld

- Enter any federal income tax withheld from the distribution.

Box 5: Employee Contributions/Designated Roth Contributions

- Report after-tax contributions recovered tax-free this year or premiums paid on insurance contracts recovered tax-free.

Box 6: Net Unrealized Appreciation (NUA) in Employer’s Securities

- Report NUA attributable to employer securities included in a lump-sum distribution.

Box 7: Distribution Codes

Use appropriate codes to identify the type of distribution:

- Early distribution (no known exception).

- Early distribution (exception applies).

- Disability.

- Death.

- Prohibited transaction.

- Section 1035 exchange.

- Normal distribution.

- Excess contributions plus earnings taxable in current year.

B. Designated Roth account distribution.

Refer to instructions for additional codes.

IRA/SEP/SIMPLE Checkbox

Check this box if it applies to traditional IRA, SEP IRA, or SIMPLE IRA distributions.

Box 8: Other Amounts

Report other amounts distributed that don’t fall under standard categories.

Box 9a: Percentage of Total Distribution

If a total distribution was shared among multiple recipients, enter your percentage here.

Box 9b: Total Employee Contributions

Enter employee contributions used to compute taxable amounts for life annuities from qualified plans or section 403(b) plans.

Box 10: Amount Allocable to IRR Within Five Years

Report amounts allocable under Internal Revenue Code rules within five years of receipt.

Box 11: First Year of Designated Roth Contributions

Enter the first year contributions were made to a designated Roth account reported on this form.

Box 12: FATCA Filing Requirement

Check if FATCA reporting applies under Internal Revenue Code chapter 4 requirements.

Box 13: Date of Payment

Enter the date of payment for reportable death benefits under section 6050Y.

Boxes 14–19: State and Local Tax Information

- Box 14: State tax withheld.

- Box 15: State/Payer’s state number.

- Box 16: State distribution amount.

- Box 17: Local tax withheld.

- Box 18: Name of locality.

- Box 19: Local distribution amount.

These boxes are used for state/local tax reporting when applicable.

Additional Notes

Form copies:

- Copy A is filed with the IRS.

- Copy B is provided to recipients for federal tax filing.

- Copy C is retained by payers for records.

For state/local filing requirements, use Copy D or Copy E as needed.