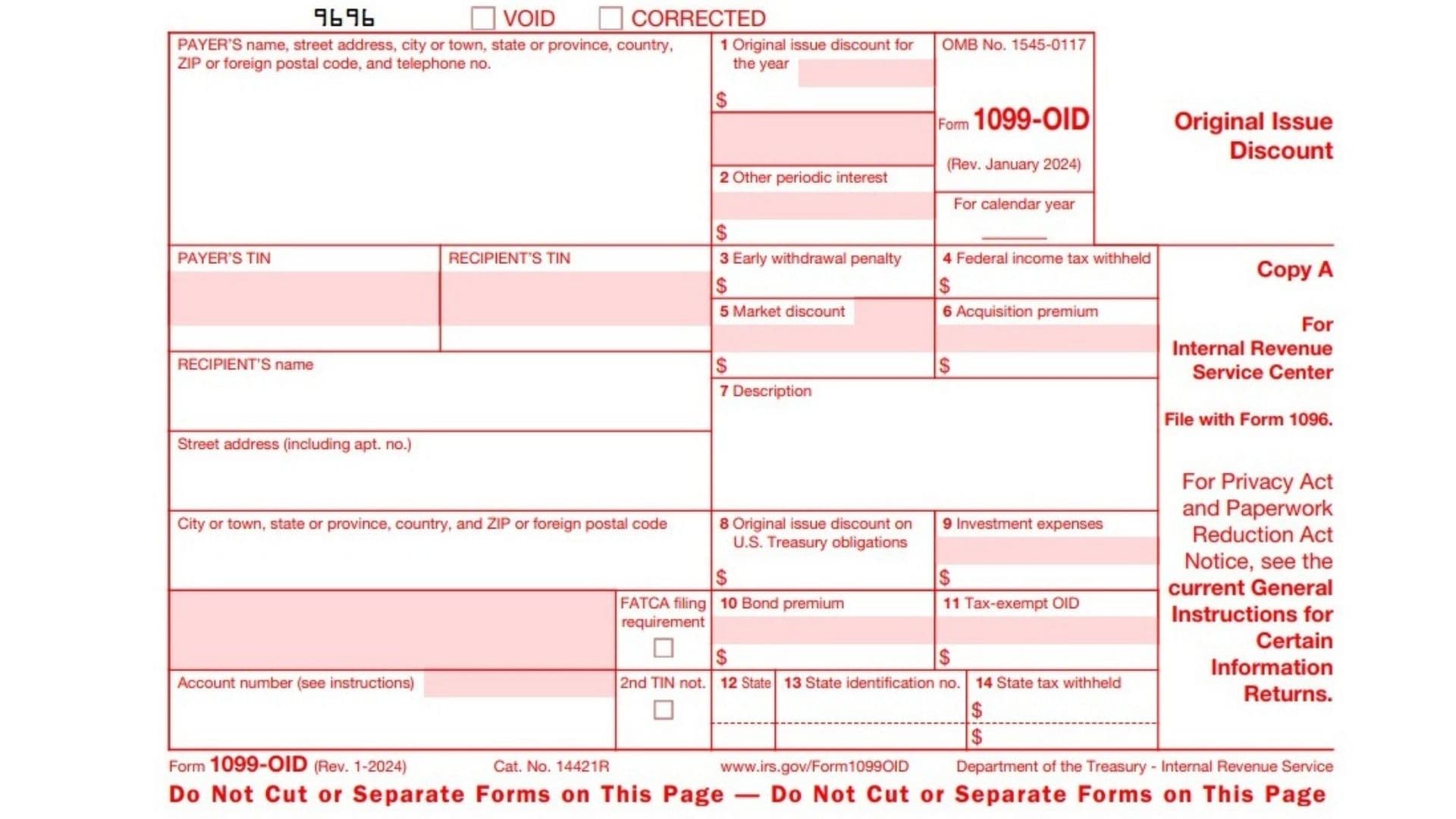

Form 1099-OID, or Original Issue Discount Statement, is an IRS information return used to report original issue discount (OID) income earned by a taxpayer during the calendar year. OID is the difference between an obligation’s stated redemption price at maturity and its issue price or acquisition price (for stripped bonds or coupons). This form reports taxable interest income that accrues annually on various debt instruments, including bonds, notes, debentures, certificates, and certain types of deposits or savings arrangements where interest is paid at maturity or over time rather than periodically. Form 1099-OID helps taxpayers accurately report this interest income on their federal tax return, avoiding underreporting and potential penalties. The form also reports other related amounts, such as early withdrawal penalties, federal income tax withheld, market discount, acquisition premium, bond premium, and tax-exempt OID. Lenders, financial institutions, or issuers furnish this form to the IRS and the income recipient, ensuring compliance with tax laws related to original issue discounts and interest income.

How To File Form 1099-OID

Form 1099-OID is generally filed by payers — the entity that paid the OID — such as financial institutions or brokers.

- Copy A is submitted to the IRS with Form 1096 if filing on paper; electronic filing is required for 250 or more returns.

- Copy B is provided to the income recipient (taxpayer) by the due date to assist with tax reporting.

- Payers must use official IRS forms or approved electronic filing methods for submission to ensure scannability and compliance.

- Income recipients use the form to accurately report OID and related items on their IRS Form 1040 income tax returns.

How To Complete Form 1099-OID

Payer’s Name, Address, and Telephone Number

Enter the legal name of the payer (the entity paying OID), complete street address, city or town, state or province, country, ZIP or foreign postal code, and a contact phone number.

Payer’s TIN

Fill in the payer’s Taxpayer Identification Number, usually an Employer Identification Number (EIN).

Recipient’s TIN

Enter the recipient’s Taxpayer Identification Number, usually their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). For privacy, only the last four digits may be shown on copies given to recipients.

Recipient’s Name

Enter the recipient’s full legal name who received the OID income.

Recipient’s Address

Provide the complete address of the recipient, including apartment or suite number if applicable, city or town, state or province, country, and ZIP or foreign postal code.

FATCA Filing Requirement Checkbox

Check this box if filing to meet requirements of the Foreign Account Tax Compliance Act (FATCA). This notifies the IRS about certain reportable accounts.

Account Number

This field may include an account or unique number assigned by the payer to distinguish the recipient’s account for internal tracking purposes.

2nd TIN Not.

Check this box if the payer received notification from the IRS that the recipient’s TIN is incorrect or missing.

Box 1 — Original Issue Discount for the Year

Report the amount of OID accrued during the calendar year that is includible in income. This amount is usually treated as interest income but may require special handling depending on the type of obligation.

Box 2 — Other Periodic Interest

Enter interest paid periodically that is separate from the OID amount. This amount is typically reported as interest income.

Box 3 — Early Withdrawal Penalty

Report penalties imposed for early withdrawal of funds (such as from a certificate of deposit). The taxpayer can deduct these penalties when calculating adjusted gross income.

Box 4 — Federal Income Tax Withheld

Enter any federal income tax withheld by backup withholding rules or other IRS requirements related to the OID income.

Box 5 — Market Discount

Report any market discount accrued on the debt instrument during the year if the recipient elected to include market discount as it accrues.

Box 6 — Acquisition Premium

Report acquisition premium amortization for taxable covered securities, which reduces the amount of OID includible in income.

Box 7 — Description

Provide identifying information about the obligation, such as the security’s CUSIP number, issuer name, coupon rate, and maturity year.

Box 8 — Original Issue Discount on U.S. Treasury Obligations

Report OID accrued on U.S. Treasury obligations owned during the year. This amount is exempt from state and local income taxes.

Box 9 — Investment Expenses

Report investment expenses related to REMIC investments included in Box 2. Note, these expenses are not deductible.

Box 10 — Bond Premium

Report premium amortization on taxable covered securities, reducing interest income reported.

Box 11 — Tax-Exempt OID

Report tax-exempt OID on covered securities owned during the year.

Boxes 12-14 — State Information

- Box 12: State name or abbreviation

- Box 13: State identification number

- Box 14: State income tax withheld

These boxes provide state income tax reporting details related to OID.

Additional Notes

- CORRECTED: Mark this box if the form is a correction to a previously filed 1099-OID.

- VOID: Marked if the form is void and should not be used for tax filing.

This line-by-line guide delivers clarity on every field of Form 1099-OID, ensuring payers file accurately and recipients understand how to report OID income properly on their tax returns. Godspeed.