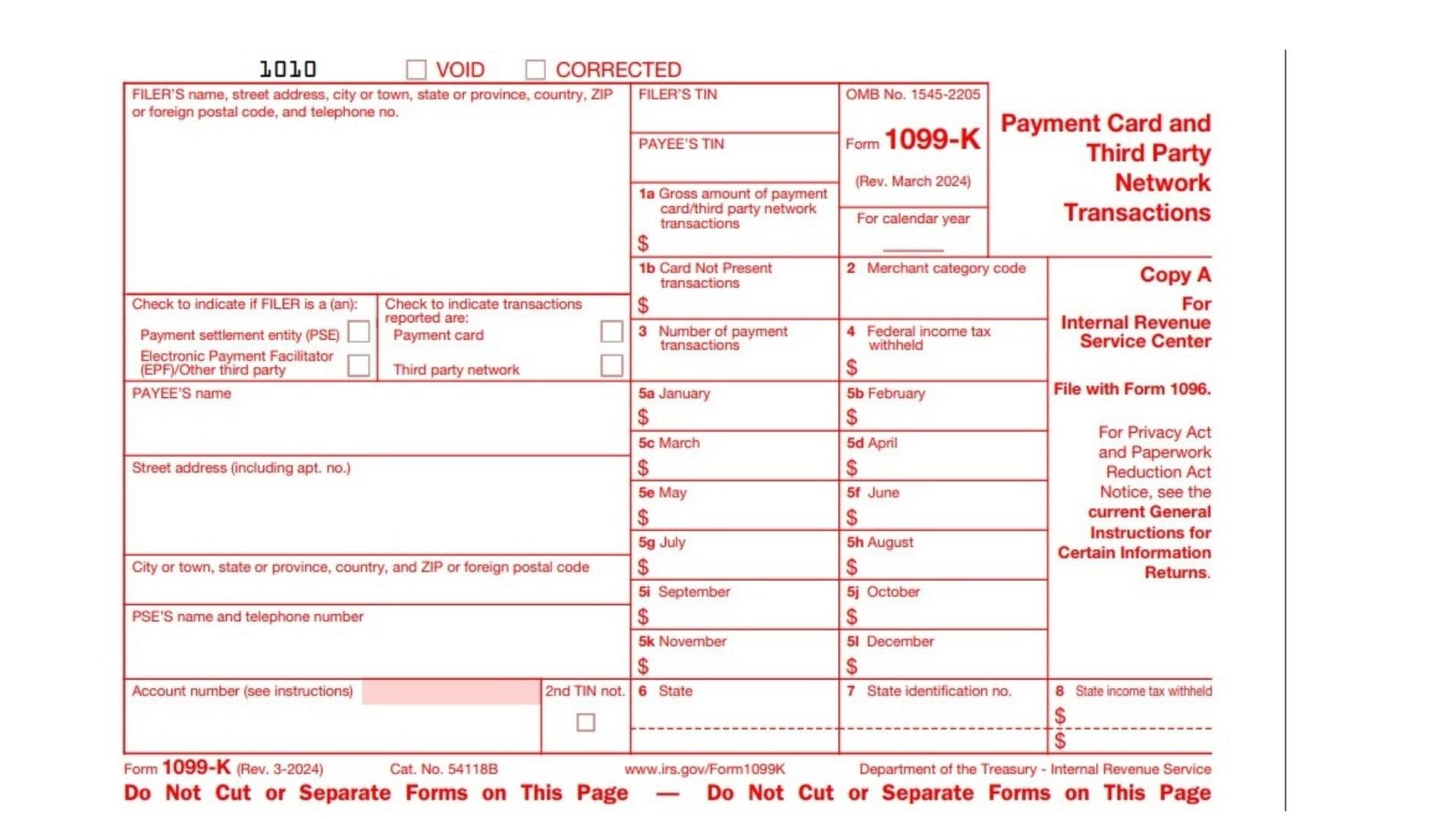

IRS Form 1099-K, Payment Card and Third Party Network Transactions, is an information return used by payment settlement entities such as merchant acquirers and third party settlement organizations, including those operating through electronic payment facilitators, to report the aggregate gross payments processed for a payee via payment cards or third party networks during the calendar year, including monthly breakdowns, card-not-present totals, merchant category codes, number of transactions, and any federal or state income tax withheld, enabling both recipients and the IRS to reconcile gross receipts with business and gig-economy income on annual returns under Internal Revenue Code section 6050W.

Filing Basics And Copies

- Copy A is filed with the IRS and must be the official red scannable form; do not print and file the online red Copy A, and include Form 1096 when filing on paper.

- Copy B is furnished to the payee for records, Copy 1 may be filed with state tax departments, and Copy 2 may be attached to the recipient’s state return when required.

- E-file may be required when filing 10 or more information returns and is encouraged otherwise; official paper forms can be ordered via IRS ordering channels if paper filing is permitted.

Who Must File

- Payment settlement entities, including merchant acquirers and third party settlement organizations, must issue Form 1099-K for payees receiving reportable payment card or third party network transactions processed during the year.

- A PSE may contract with an electronic payment facilitator or other third party payer to make payments, but the PSE is responsible for reporting; payees with questions should contact the filer shown on the form.

When To Furnish And File

- Furnish recipient copies by the standard deadline for information returns and file Copy A with the IRS by the applicable due date for the calendar year printed on the form.

- Use the “CORRECTED” indicator when issuing corrected recipient copies and follow corrected return procedures if submitting a corrected Copy A.

Header And Checkboxes

- For Calendar Year: Enter the four-digit year for which transactions are reported at the top of each copy.

- VOID: Check only to void a form issued in error so it is not processed, then reissue a correct form as needed.

- CORRECTED: Check when issuing a corrected payee copy; follow IRS correction procedures for information returns when correcting filings.

- Payment Settlement Entity Type: Check “Payment settlement entity (PSE)” or “Electronic Payment Facilitator (EPF)/Other third party” to indicate the filer’s role.

- Transaction Type: Check “Payment card” or “Third party network” to indicate the type of transactions being reported.

Filer And Payee Information

- FILER’S Name And Address: Enter the filer’s legal name, street, city or town, state or province, country, ZIP or foreign postal code, and a telephone number.

- FILER’S TIN: Enter the filer’s taxpayer identification number as used for information returns.

- PAYEE’S Name And Address: Enter the payee’s full legal name and mailing address, including apartment number if applicable, city or town, state or province, country, and ZIP or foreign postal code.

- PAYEE’S TIN: Enter the payee’s full TIN; recipient copies may display only the last four digits, but the filer reports the complete TIN to the IRS.

- PSE’S Name And Telephone Number: Enter the payment settlement entity’s name and phone number for payee inquiries, especially if different from the filer.

- Account Number (See Instructions): Include a unique account number if multiple accounts or forms are issued for the same payee, to distinguish statements.

- 2nd TIN Not.: Check this box only if the IRS has notified the filer twice within three calendar years that the payee’s TIN is incorrect, consistent with backup withholding procedures.

How To Complete Form 1099-K

- Box 1a Gross Amount Of Payment Card/Third Party Network Transactions: Report the aggregate gross dollar amount of reportable transactions without reductions for credits, fees, refunds, shipping, or other adjustments, determined by the transaction date.

- Box 1b Card Not Present Transactions: Report the aggregate gross amount where the card was not present or the card number was keyed, typically online, phone, or catalog sales; do not report Card Not Present values when the “Third party network” box is checked.

- Box 2 Merchant Category Code: Enter the merchant category code used for the transactions, if available.

- Box 3 Number Of Payment Transactions: Enter the count of reportable payment transactions processed, excluding refund transactions.

- Box 4 Federal Income Tax Withheld: Report any backup withholding withheld; payees include this as tax withheld on the income tax return.

- Boxes 5a–5l Monthly Gross Amounts: Report the gross amount of reportable transactions for each month, January through December, matching the totals that roll into Box 1a.

- Box 6 State: Enter the state abbreviation for each state to which state withholding applies, repeating lines if multiple states apply.

- Box 7 State Identification No.: Enter the state payer identification number assigned by the state revenue agency, corresponding to the state in Box 6.

- Box 8 State Income Tax Withheld: Enter the amount of state income tax withheld, if any, corresponding to the state shown, and repeat as necessary for multiple states.

Instructions For Payee

- The form shows only the last four digits of the TIN on recipient copies for protection, while the IRS receives the full TIN; contact the filer for questions about reported amounts.

- Box 1a reports gross amounts before fees and refunds, Boxes 5a–5l show monthly totals, Box 1b covers card-not-present totals when applicable, and Boxes 6–8 show any state income tax withheld to be reconciled on state returns.

E-Filing Notes And Paper Forms

- If required to e-file due to the information return threshold, use IRS e-file for information returns and follow current-year specifications for Form 1099-K.

- If eligible to file on paper, order scannable Copy A and related copies from IRS ordering services and do not submit the downloadable red Copy A printed from the website.

How To File Step By Step

- Prepare payer and payee information, determine whether transactions are payment card or third party network, and select the correct checkboxes for filer type and transaction type.

- Enter Box 1a, 1b, the merchant category code, transaction count, any backup withholding, monthly amounts, and any state details, then furnish recipient copies by the deadline and file Copy A with the IRS by the due date, e-filing if required.