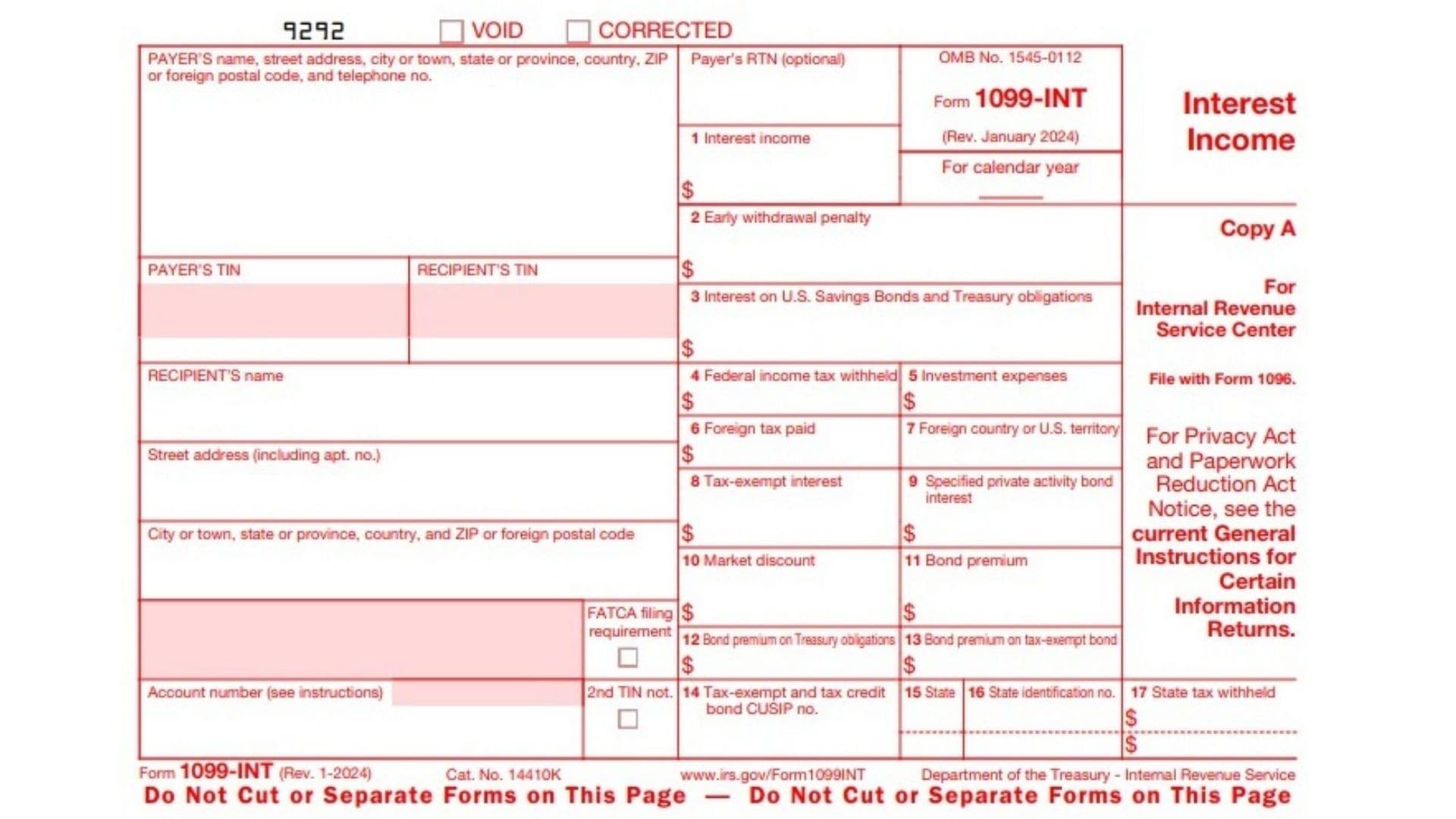

IRS Form 1099-INT, also known as the “Interest Income Form,” is issued by financial institutions to taxpayers who earn interest income exceeding $10 during the calendar year. The form details taxable interest, tax-exempt interest, and other related income categories such as penalties for early withdrawals or foreign tax paid. It is a vital document for taxpayers, as it ensures accurate reporting of all interest income to the IRS, helping you avoid penalties or discrepancies during tax filings. Form 1099-INT is typically provided to you by January 31 of the following tax year, and a copy is also sent to the IRS.

How to File Form 1099-INT?

- Obtain the Form: Download IRS Form 1099-INT from the official IRS website or request it from a financial institution.

- Verify Filing Requirements: If you are a payer issuing this form, ensure you meet the filing requirements. Typically, you must file if you’ve paid $10 or more in interest to an individual or entity.

- E-Filing or Paper Filing: If filing fewer than 10 forms, you can opt for paper filing, though e-filing is encouraged. For 10 or more forms, e-filing is mandatory.

- File with Form 1096: If filing by paper, send Copy A of Form 1099-INT along with Form 1096 to the IRS.

How to Complete Form 1099-INT?

- Payer Information:

- Fill in the payer’s name, address, and contact information. Include the Taxpayer Identification Number (TIN) for the payer.

- Recipient Information:

- Enter the recipient’s full name, address, and TIN.

- Box 1 – Interest Income:

- Report the total taxable interest income paid during the year. This includes interest from savings accounts, bonds, and other financial instruments.

- Box 2 – Early Withdrawal Penalty:

- Include any penalties charged for early withdrawal of funds from certificates of deposit (CDs) or similar accounts.

- Box 3 – Interest on U.S. Savings Bonds and Treasury Obligations:

- Record interest earned from U.S. government securities. Note that this income is exempt from state and local taxes.

- Box 4 – Federal Income Tax Withheld:

- Enter any federal tax withheld due to backup withholding. This usually occurs if the recipient failed to provide a valid TIN.

- Box 5 – Investment Expenses:

- Report any allocated investment expenses. These are typically not deductible for the recipient.

- Box 6 – Foreign Tax Paid:

- Include the total amount of foreign tax paid on interest income.

- Box 7 – Foreign Country or U.S. Territory:

- Specify the country or U.S. territory where foreign tax was paid.

- Box 8 – Tax-Exempt Interest:

- Enter the total tax-exempt interest income earned. This often includes interest from municipal bonds.

- Box 9 – Specified Private Activity Bond Interest:

- Record tax-exempt interest subject to the Alternative Minimum Tax (AMT).

- Box 10 – Market Discount:

- Indicate any market discount accrued on debt instruments during the tax year.

- Box 11 – Bond Premium:

- Report premiums paid on bonds, excluding U.S. Treasury obligations and tax-exempt bonds.

- Box 12 – Bond Premium on Treasury Obligations:

- Enter the bond premium associated with U.S. Treasury obligations.

- Box 13 – Bond Premium on Tax-Exempt Bond:

- Include the bond premium on tax-exempt bonds. This helps calculate net interest income.

- Box 14 – Tax-Exempt Bond CUSIP:

- If applicable, add the CUSIP numbers for the tax-exempt bonds.

- Boxes 15-17 – State Information:

- Complete these boxes for state tax purposes, including state tax withheld, the state identification number, and the amount.