Government payments to individuals and businesses often have tax implications that need to be accurately reported. Form 1099-G, Certain Government Payments, is crucial for federal, state, and local government agencies in these scenarios. Properly managing this form ensures compliance with IRS regulations and helps recipients report taxable government payments correctly. Whether the payment is in the form of unemployment compensation, state or local income tax refunds, or other types of government financial assistance, Form 1099-G plays a key role in documenting and reporting these transactions.

The primary purpose of Form 1099-G is to report certain types of government payments to the IRS and the recipient. This includes unemployment compensation, state or local income tax refunds, agricultural payments, and taxable grants. By using Form 1099-G, government agencies provide detailed information about these payments, ensuring that recipients can accurately report them as income on their tax returns.

Who Must File Form 1099-G?

Form 1099-G must be filed by federal, state, and local government agencies that make certain types of payments. This includes:

- Unemployment Compensation: Payments made to individuals for unemployment benefits.

- State or Local Income Tax Refunds: Refunds of state or local income taxes.

- Agricultural Payments: Payments made to farmers under government agricultural programs.

- Taxable Grants: Government grants that are considered taxable income.

The form must be filed for each recipient who receives payments that meet the reporting thresholds.

How To File Form 1099-G?

Filing Form 1099-G involves several steps and must be done accurately to ensure compliance with IRS regulations. The form can be filed electronically or by mail, depending on the volume of forms being submitted.

- Obtain Form 1099-G: The form can be downloaded from the IRS website or obtained from a supply vendor. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out Form 1099-G with the required information, including details about the government agency, the recipient, and the payment.

- Submit the form to the IRS: File the completed Form 1099-G with the IRS by the due date. If filing electronically, use the IRS’s FIRE (Filing Information Returns Electronically) system. If filing by mail, send the form to the address provided in the instructions.

- Provide a copy to the recipient: Send Copy B of Form 1099-G to the recipient by January 31 of the year following the calendar year in which the payments were made.

How To Complete Form 1099-G?

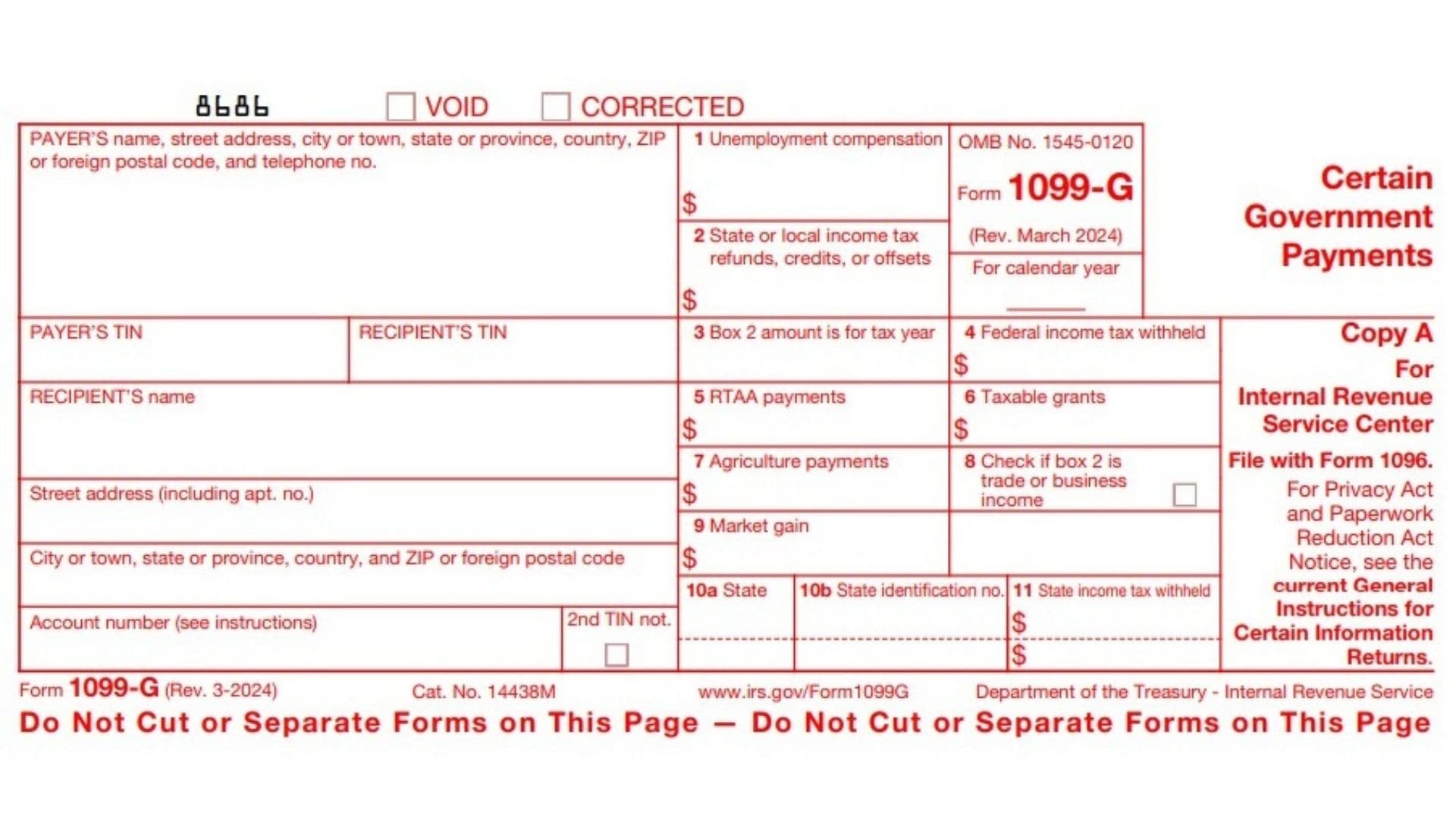

Filling out Form 1099-G requires accurate and detailed information about the payments made. The form is divided into several sections, each addressing different types of government payments. Below are the line-by-line instructions for filling out Form 1099-G, based on the form you uploaded.

Payer Information Section

This section includes information about the government entity that issued the payments reported on Form 1099-G.

- PAYER’S Name, Address, and Telephone Number: The name, address, and telephone number of the government agency that made the payment.

- PAYER’S TIN: The government agency’s Taxpayer Identification Number (TIN).

- RECIPIENT’S TIN: Your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN).

- RECIPIENT’S Name and Address: Your name and mailing address.

Box 1: Unemployment Compensation

- Box 1 reports the total unemployment compensation you received during the year.

- This amount is taxable income and should be reported on Schedule 1 (Form 1040), Line 7.

- Example: If Box 1 shows $6,000, this is the amount of unemployment compensation you must report as income on your federal tax return.

Box 2: State or Local Income Tax Refunds, Credits, or Offsets

- Box 2 reports the amount of state or local income tax refunds, credits, or offsets you received during the tax year.

- This amount may be taxable if you claimed itemized deductions for state and local taxes on Schedule A (Form 1040) for the previous year.

- If you did not itemize deductions, this amount is generally not taxable.

- Example: If Box 2 shows $500, and you claimed a deduction for state and local taxes last year, you may need to report this amount as income.

Box 3: Box 2 Amount is for Tax Year

- Box 3 identifies the tax year for which the state or local tax refund shown in Box 2 was received.

- For example, if Box 3 shows 2022, it means the refund, credit, or offset relates to taxes paid for the 2022 tax year.

Box 4: Federal Income Tax Withheld

- Box 4 shows any federal income tax that was withheld from your payments, such as unemployment compensation.

- If any amount is reported in Box 4, you can claim it as a credit for taxes paid when you file your federal tax return.

- Example: If $200 is shown in Box 4, you can enter this as federal income tax withheld on your return.

Box 5: RTAA Payments

- Box 5 reports any Reemployment Trade Adjustment Assistance (RTAA) payments you received.

- These payments are considered taxable income and should be reported on the Other Income line of Schedule 1 (Form 1040), Line 8.

Box 6: Taxable Grants

- Box 6 shows any taxable grants you received from a federal, state, or local government during the tax year.

- These grants are taxable and should be reported as income on your federal tax return. The amount should be entered on Schedule 1 (Form 1040), Line 8.

Box 7: Agriculture Payments

- Box 7 reports any agricultural payments you received.

- This income is taxable and should be reported on Schedule F (Form 1040) for farmers or as income on your tax return if you are not a farmer.

Box 8: Trade or Business Income

- If Box 8 is checked, the amount in Box 2 (state or local tax refunds, credits, or offsets) is income from a trade or business and not personal income.

- This means you may need to report it on Schedule C (Form 1040) (for sole proprietors) or Schedule F (Form 1040) (for farmers), depending on your situation.

Box 9: Market Gain

- Box 9 reports any market gain on Commodity Credit Corporation (CCC) loans.

- This amount is taxable and should be reported on Schedule F (Form 1040) for farmers or Schedule 1 (Form 1040) for others.

Boxes 10a-11: State Information

These boxes report information related to state taxes.

- Box 10a: State: The state abbreviation.

- Box 10b: State Identification Number: The state’s identification number assigned to the payer.

- Box 11: State Income Tax Withheld: If any state income tax was withheld from your payment, it will be shown here. You can claim this as a credit for state income taxes paid when you file your state tax return.

Instructions for Recipient

The Instructions for Recipient on the back of Form 1099-G explain how to report the income on your federal tax return, along with guidance on how to handle various situations (such as identity theft, backup withholding, and taxable grants). Be sure to read the instructions thoroughly to ensure that you report the income correctly and understand whether it is taxable based on your circumstances.

When to File Form 1099-G?

Form 1099-G must be filed with the IRS by February 28 if filing by paper, or by March 31 if filing electronically, following the year in which the payments were made. Providing a copy to the recipient by January 31 is also required to ensure they have the necessary information for their tax return.