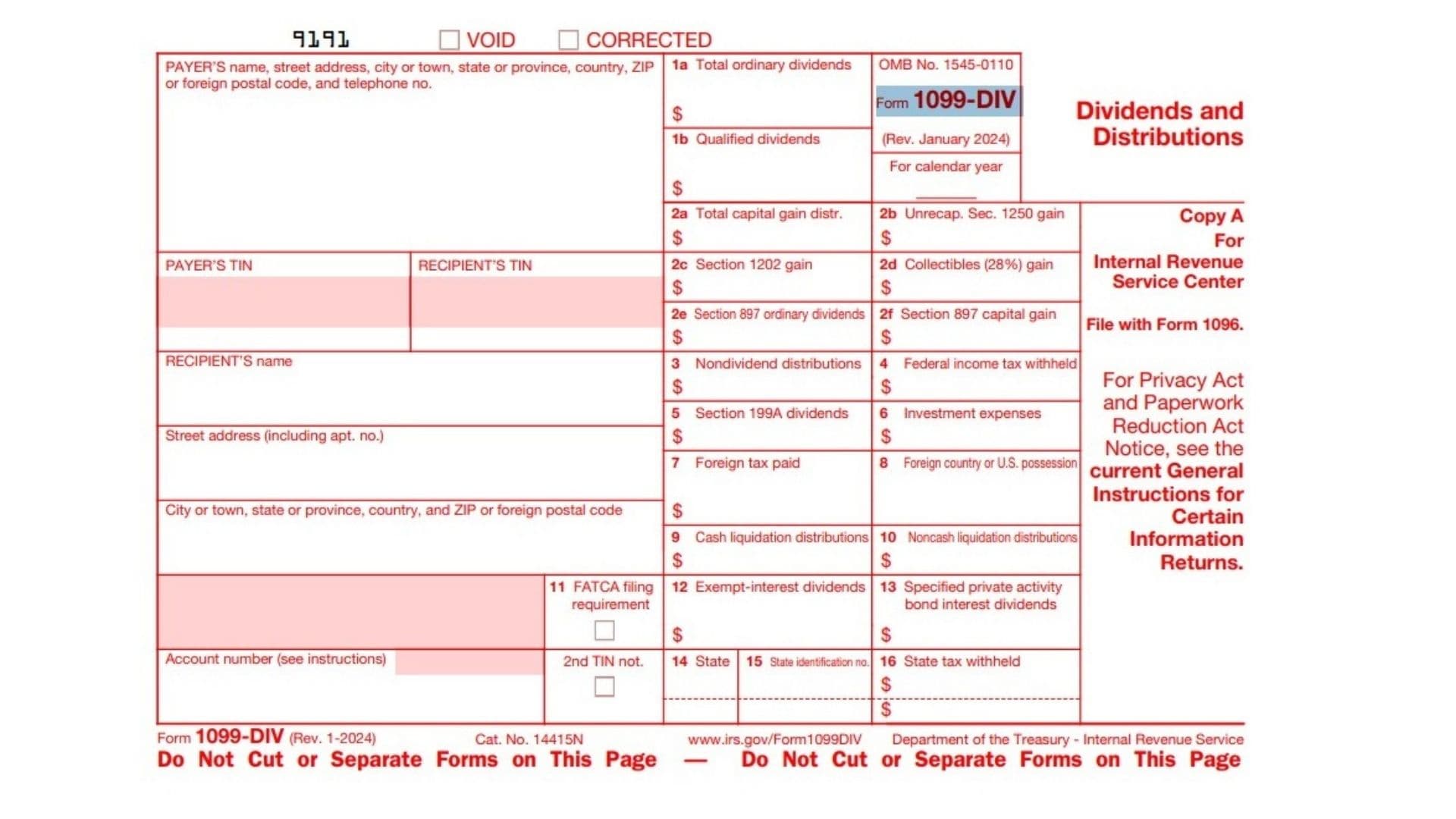

IRS Form 1099-DIV reports dividends and other distributions paid to investors, including ordinary dividends, qualified dividends, capital gain distributions, nondividend returns of capital, foreign tax paid, backup withholding, exempt-interest dividends, specified private activity bond interest dividends, and liquidation distributions, so that recipients and the IRS can properly account for taxable and nontaxable investment income on annual tax returns.

Filing Basics And Copies

- Copy A is for the IRS and is scannable only when using the official red-ink form; do not print and file the online PDF Copy A with the IRS, and file it with Form 1096 if filing on paper.

- Copy B is furnished to the recipient and should be kept for records, and Copy 1 and Copy 2 may be provided or filed with state tax departments depending on state rules.

- E-file is required if filing 10 or more information returns and is encouraged even under that threshold; official paper forms can be ordered from IRS channels if needed.

Who Must File

- A payer (such as a corporation, RIC, REIT, or broker acting as nominee) must file Form 1099-DIV for each recipient who receives distributions meeting reporting thresholds as shown on the face of the form fields for the calendar year.

- Nominee recipients who receive amounts belonging to other owners must issue their own 1099-DIV to each owner and file with the IRS along with Form 1096, while spouses are not required to issue nominee forms to each other.

When To Furnish And File

- Furnish Copy B to recipients by the standard due date and file Copy A with the IRS by the applicable due date for information returns for the calendar year shown on the form.

- Use the calendar year reporting period printed on the form and check the “CORRECTED” box if issuing a corrected recipient copy.

How To Complete Form 1099-DIV

- For Calendar Year: Enter the four-digit calendar year for which distributions are reported at the top of each copy.

- VOID: Check “VOID” if the form is voided and should not be processed, typically when issued in error, and follow normal reissuance procedures as applicable.

- CORRECTED: Check “CORRECTED” on recipient copies when issuing a corrected statement; for IRS filing follow corrected return procedures and mark appropriately.

- PAYER’S Name And Address: Enter the payer’s legal name, full mailing address including street, city or town, state or province, country, ZIP or foreign postal code, and a telephone number.f1099div.pdf

- PAYER’S TIN: Enter the payer’s taxpayer identification number as assigned for information return filing.

- RECIPIENT’S TIN: Enter the recipient’s full TIN; recipient copies may mask all but the last four digits, but the payer reports the complete TIN to the IRS.

- RECIPIENT’S Name And Address: Enter the recipient’s full name and mailing address, including apartment number, city or town, state or province, country, and ZIP or foreign postal code.

- Account Number (See Instructions): Enter an account or other unique number to distinguish the recipient’s account when necessary or if filing multiple forms for one recipient.

- 2nd TIN Not.: Check the second TIN notification box if the IRS has notified the payer twice within 3 calendar years that the recipient provided an incorrect TIN, if applicable to the payer’s compliance systems.

Line-By-Line Instructions For Form 1099-DIV

- Box 1a Total Ordinary Dividends: Enter the total taxable ordinary dividends paid; recipients generally report this on the “Ordinary dividends” line of Form 1040/1040‑SR and Schedule B if required.

- Box 1b Qualified Dividends: Enter the portion of Box 1a eligible for qualified dividend tax rates; note that ESOP dividends shown are treated as dividends on Form 1040/1040‑SR but as plan distributions for other purposes.

- Box 2a Total Capital Gain Distributions: Enter total capital gain distributions from RICs/REITs; recipients may report per Schedule D rules or directly on Form 1040/1040‑SR if eligible and if Boxes 2b, 2c, 2d, and 2f are blank.

- Box 2b Unrecaptured Section 1250 Gain: Enter the portion of Box 2a that is unrecaptured section 1250 gain from certain depreciable real property.

- Box 2c Section 1202 Gain: Enter the portion of Box 2a that is section 1202 gain from qualified small business stock potentially eligible for exclusion.

- Box 2d Collectibles (28%) Gain: Enter the portion of Box 2a that is collectibles gain taxed at 28% rate from sales or exchanges of collectibles.

- Box 2e Section 897 Ordinary Dividends: Enter the portion of Box 1a that is section 897 gain attributable to disposition of U.S. real property interests; generally applies to certain foreign persons and entities.

- Box 2f Section 897 Capital Gain: Enter the portion of Box 2a that is section 897 capital gain attributable to disposition of U.S. real property interests; generally applies to certain foreign persons and entities.

- Box 3 Nondividend Distributions: Enter return of capital amounts; these reduce the recipient’s stock basis to the extent of basis, and excess is a taxable capital gain to the recipient.

- Box 4 Federal Income Tax Withheld: Enter backup withholding withheld on dividends or distributions; recipients report this as tax withheld on their income tax return.

- Box 5 Section 199A Dividends: Enter the portion of Box 1a that is section 199A dividends potentially eligible for the qualified business income deduction.

- Box 6 Investment Expenses: Enter the recipient’s share of expenses of a nonpublicly offered RIC; this amount is also included in Box 1a.

- Box 7 Foreign Tax Paid: Enter foreign tax paid; recipients may claim a deduction or a credit on Form 1040/1040‑SR subject to applicable rules.

- Box 8 Foreign Country Or U.S. Possession: Enter the country or U.S. possession to which the foreign tax in Box 7 applies; this box should be left blank if a RIC reported the foreign tax shown in Box 7.

- Box 9 Cash Liquidation Distributions: Enter cash amounts distributed in liquidation.

- Box 10 Noncash Liquidation Distributions: Enter noncash amounts distributed in liquidation.

- Box 11 FATCA Filing Requirement: Check if reporting is being made to satisfy chapter 4 (FATCA) account reporting; recipients may also have a filing requirement such as Form 8938.

- Box 12 Exempt-Interest Dividends: Enter exempt-interest dividends from a mutual fund or other RIC paid during the year; note these can still be subject to backup withholding.

- Box 13 Specified Private Activity Bond Interest Dividends: Enter the portion of Box 12 that is subject to the alternative minimum tax for specified private activity bond interest dividends.

- Boxes 14–16 State, State Identification No., State Tax Withheld: Report state information and any state tax withholding for each applicable state as required by state reporting rules.

Instructions For Recipient (What The Recipient Sees)

- The form may mask all but the last four digits of the recipient TIN on copies furnished to the recipient, but the payer reports the full TIN to the IRS.

- Recipients use the Account Number to match the statement to their account if multiple are issued, and they report each box according to Form 1040/1040‑SR and Schedule D instructions as summarized above.

State Copies And Use

- Copy 1 is for state tax departments and Copy 2 may be attached to the recipient’s state income tax return when required by the state.

- Boxes 14–16 enable state-level reporting of state name, state identification number, and state tax withheld for state filing compliance.

E-Filing Notes And Paper Forms

- If required to e-file due to meeting or exceeding the 10-return threshold, use IRS e-file options for information returns and follow the current year’s electronic filing specifications.

- If filing on paper when eligible, order official scannable Copy A forms and accompanying copies from IRS ordering channels rather than printing the online red Copy A.