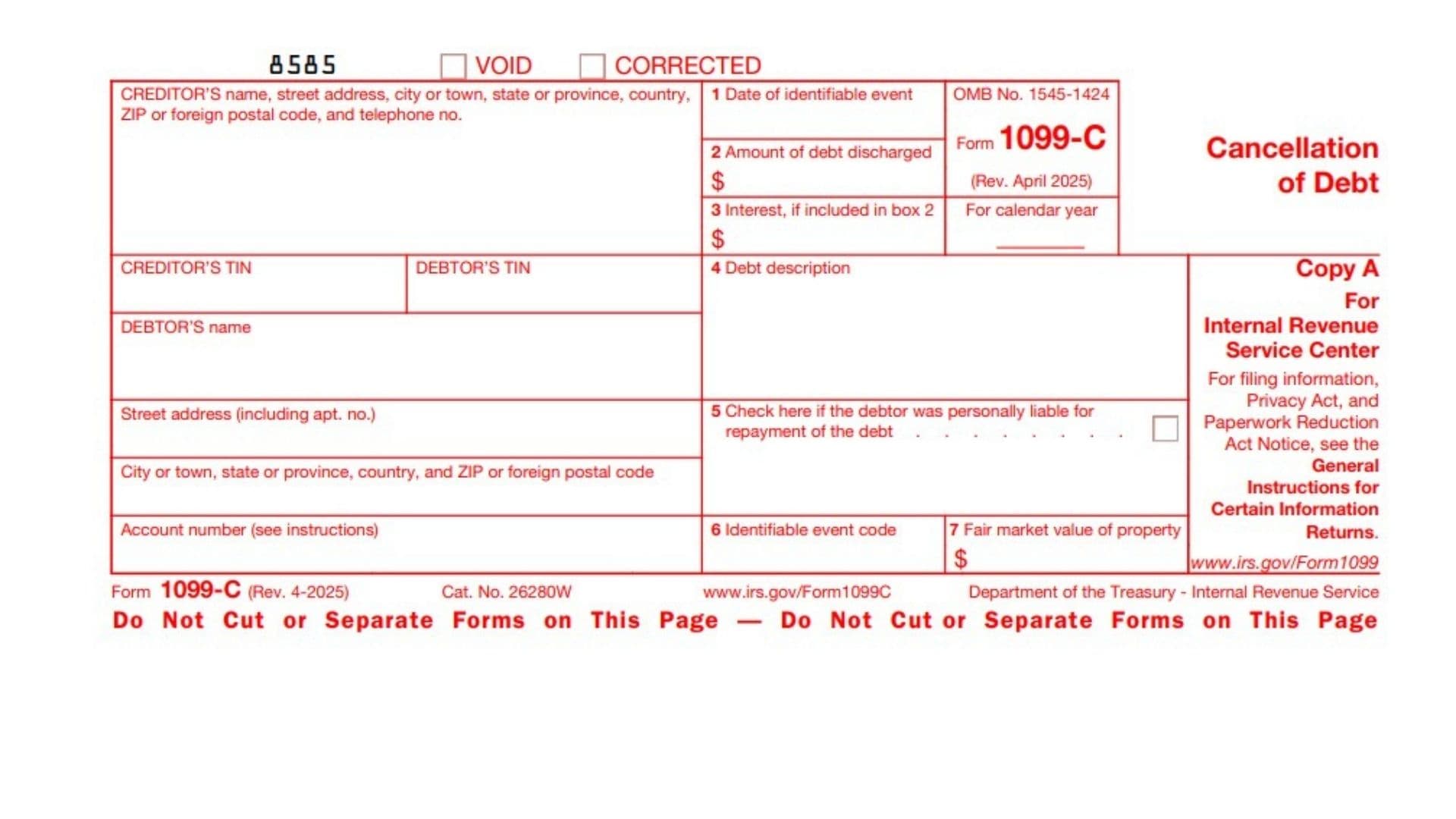

IRS Form 1099-C, Cancellation of Debt, is a federal tax document issued by lenders or financial entities to report canceled debts of $600 or more. If a bank, credit union, government agency, or credit card company forgives or cancels your debt in any way—such as through settlement, foreclosure, or reduction—the creditor must send you (the debtor) this form and file one with the IRS. This is because canceled debt is typically treated as taxable income. The form’s purpose is to ensure both you and the IRS know about this event, so it can be considered on your annual tax return. IRS Form 1099-C acts as a critical warning: failure to report the amount could result in extra tax, penalties, or an audit. Lenders are required to furnish you with a copy by January 31 of the year following the debt’s cancellation, and to file it with the IRS soon after. Always double-check the information; if there’s an error, contact the creditor to request correction.

How to File IRS Form 1099-C

- Who files: Only lenders, not debtors, file this form with the IRS. If you had your debt canceled, you’ll receive a copy for your records and tax reporting.

- Filing deadline: Furnish Copy B to the debtor by January 31; file Copy A with the IRS by February 28 (or March 31 if electronic).

- How to submit: Lenders can file forms by mail or electronically through authorized IRS e-file services. Always use original, scannable forms for Copy A if filing by mail.

- Recordkeeping: Keep Copy C for at least four years.

- Debtor’s action: Use the information to correctly report canceled debt income on your federal tax return.

How to Complete Form 1099-C

Section 1: Creditor & Debtor Details (Top Left)

- Creditor’s name, address, and telephone number: Enter the legal name, complete mailing address, and phone number of the creditor who is canceling the debt.

- Creditor’s TIN (Taxpayer Identification Number): Insert the creditor’s federal TIN.

- Debtor’s TIN: Enter the debtor’s Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN), depending on the debtor type.

- Debtor’s name: Provide the legal name of the individual or business whose debt was canceled.

- Debtor’s street address: List the last known address, including apartment number if applicable.

- City, state/province, country, ZIP/postal code: Complete with current debtor location details.

- Account number (see instructions): You must enter an account number if the creditor has multiple accounts for the recipient, or if required for identification. A unique identifying number helps IRS and debtors track the transaction.

Section 2: Financial Data & Event Details (Main Body)

- Box 1: Date of Identifiable Event

- Enter the date the “identifiable event” that triggered the cancellation occurred (e.g., date of discharge, foreclosure, or binding settlement agreement). If you canceled the debt voluntarily before such an event, provide that date instead.

- Box 2: Amount of Debt Discharged

- Record the total principal amount canceled. This is the sum the IRS will consider income, unless an exclusion applies. Do not include any amounts received in settlement (like property sale proceeds).

- Box 3: Interest if Included in Box 2

- If you included accrued but unpaid interest as part of the discharged debt in Box 2, specify the amount of interest here. If you did not include interest in Box 2, leave this box empty.

- Box 4: Debt Description

- Briefly describe the type or origin of the debt being canceled (e.g., “credit card,” “student loan,” “auto loan,” “mortgage”). Be specific. If combined with 1099-A, include property details.

- Box 5: If checked, the debtor was personally liable for repayment of the debt

- Check this box if, at the time the debt originated or was last modified, the debtor was personally liable—meaning the lender could pursue them beyond just repossessing collateral. Leave blank if it was a non-recourse loan.

- Box 6: Identifiable Event Code

- Use the event code that best describes the cancellation:

- A = Bankruptcy

- B = Court receivership/foreclosure

- C = Statute of limitations expiration

- D = Foreclosure election

- E = Debt relief in probate

- F = Agreement for cancellation

- G = Policy decision to discontinue collection

- H = Other actual discharge before identifiable event.

- Use the event code that best describes the cancellation:

- Box 7: Fair Market Value (FMV) of Property

- If property was involved (e.g., foreclosure, repossession, or short sale), enter the FMV at the time of the event. This is especially relevant for property-secured loans. If not applicable, leave blank.

Section 3: Filing and Distribution

- Copy A: Send to IRS with Form 1096 if filing by mail.

- Copy B: Mail or e-deliver to debtor by January 31.

- Copy C: Retain for creditor records (at least four years).

Section 4: Additional Notes

- Do not file for canceled debts under $600.

- Do not use for debt canceled due to identity theft; the debtor must actually owe the debt.

- Multiple 1099-Cs may be required for multiple co-debtors, but never combine debts to evade reporting.

- Penalties apply for late or incorrect filing.

FAQs

Q: Who gets a 1099-C form?

A: Any individual, business, or organization whose debt of $600 or more is canceled by a lender, financial institution, or government agency.

Q: Is canceled debt on a 1099-C always taxable?

A: Usually yes, but there are exceptions (such as insolvency or bankruptcy); always check IRS instructions or consult a tax professional.

Q: What if the 1099-C is wrong?

A: Contact the creditor immediately to request a corrected form—errors can affect your tax liability and may trigger IRS correspondence.

Q: Can more than one 1099-C be issued for the same debt?

A: No, unless there are multiple debtors; co-debtors each may receive a separate 1099-C, but the amount reported should not be doubled.