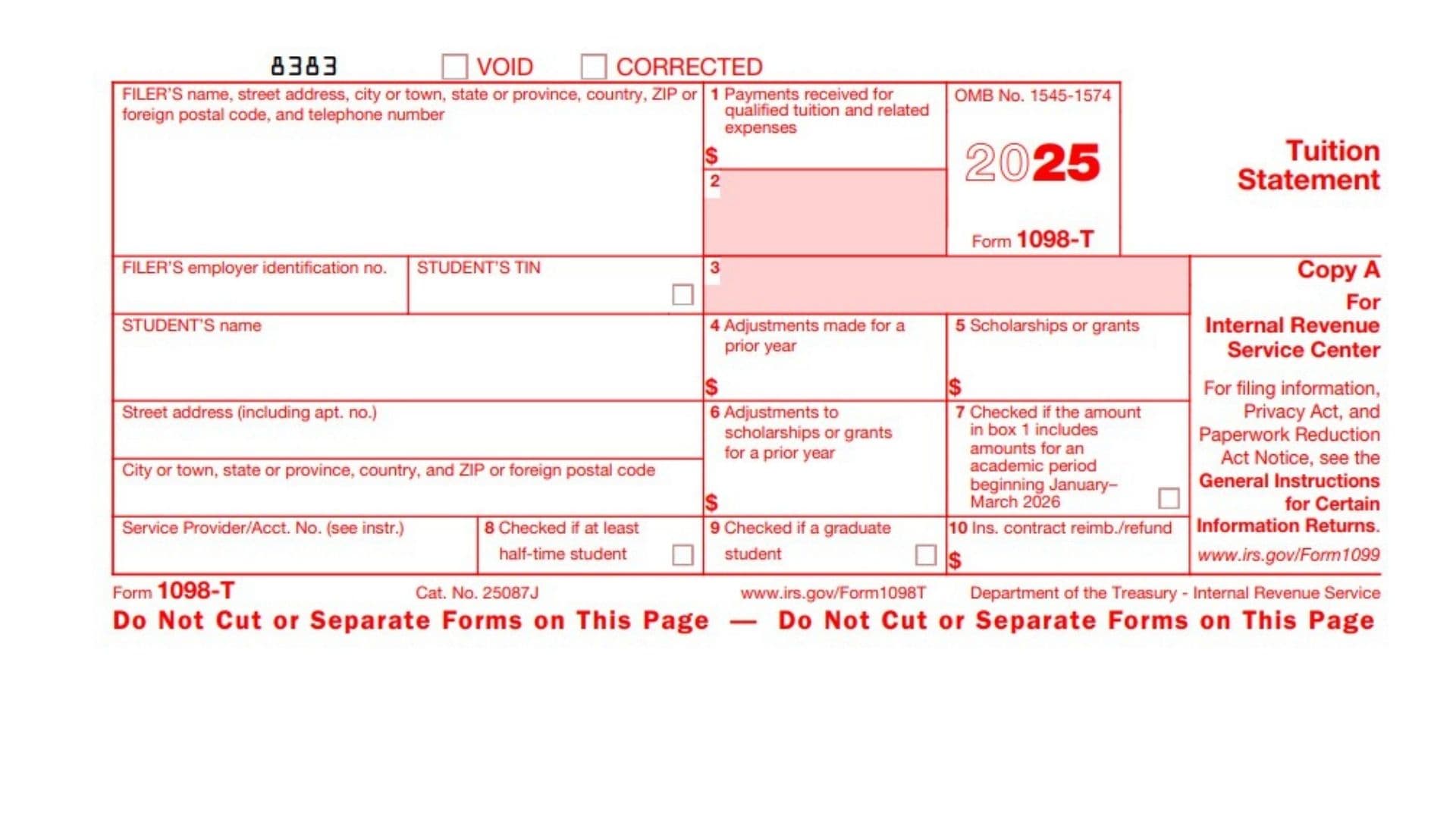

Form 1098-T, also known as the Tuition Statement, is an IRS information return issued by eligible educational institutions to report qualified tuition and related expenses paid by students during a tax year. This form helps students or their families claim education-related tax credits or deductions by providing essential financial details regarding tuition payments, scholarships, grants, and adjustments from prior years. Educational institutions send Copy A of this form to the IRS and Copy B to students or taxpayers for their records and tax filing. It includes key information like the filer’s and student’s Taxpayer Identification Numbers (TINs), addresses, payments received for qualified tuition, scholarships or grants applied, and various adjustments affecting education credits. The form also indicates the student’s enrollment status (half-time or graduate) and any insurance contract reimbursements. Understanding and accurately completing Form 1098-T is crucial to ensuring taxpayers claim eligible benefits and meet IRS reporting requirements related to education expenses.

How To File Form 1098-T

Form 1098-T is primarily the responsibility of the eligible educational institution (the filer). They must file Copy A with the IRS and provide Copy B to students or taxpayers by the due date. Filing methods vary based on the number of returns:

- Electronic filing is mandatory for filers with 250 or more returns.

- For fewer than 250 returns, paper filing is permitted, but e-filing is encouraged.

- Schools order official forms from the IRS or approved sources to comply with scannable form requirements.

- Students use Copy B or their copy of the form to claim education credits, such as the American Opportunity Tax Credit or Lifetime Learning Credit, by filling out IRS Form 8863.

How To Complete Form 1098-T

Filer’s Name, Address, and Telephone Number

Enter the full legal name, street address, city, state or province, country, ZIP or foreign postal code, and contact phone number of the eligible educational institution filing the form. This identifies the reporting entity.

Filer’s Employer Identification Number (EIN)

Fill in the educational institution’s EIN, which is the Taxpayer Identification Number used by the IRS for identification.

Student’s Taxpayer Identification Number (TIN)

This usually is the student’s Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or other TIN. For privacy, only the last four digits might be visible on the student copy, but the full TIN is reported to the IRS.

Student’s Name

Enter the student’s full legal name as registered with the educational institution.

Student’s Address

Provide the street address (including apartment or unit), city or town, state or province, country, and ZIP or foreign postal code of the student.

Service Provider or Account Number

Insert any account or unique number the filer uses to distinguish the student’s account, if applicable. This assists with internal tracking and identification; it is not mandatory.

Box 1 – Payments Received for Qualified Tuition and Related Expenses

Report the total payments the institution received for qualified tuition and related expenses during the calendar year (less any refunds or reimbursements). These payments are what the student or someone on their behalf actually paid in the year.

Box 2 – Reserved for Future Use

Leave blank or as specified; this box currently is not used.

Box 3 – Reserved for Future Use

Leave blank or as specified; this box currently is not used.

Box 4 – Adjustments Made for a Prior Year

Report any adjustments made by the institution for qualified tuition and related expenses from a prior year. These adjustments can affect the current year’s permissible education credits and might require tax return amendments.

Box 5 – Scholarships or Grants

Show the total amount of scholarships or grants processed by the institution during the calendar year. Scholarships reduce the amount of qualified expenses eligible for education credits.

Box 6 – Adjustments to Scholarships or Grants for a Prior Year

Include any changes to scholarships or grants from a prior year that affect tax claims. Corrections here can impact the previous year’s education benefits and may require amended tax returns.

Box 7 – Checkbox: Amount in Box 1 Includes Amounts for an Academic Period Beginning January–March of the Following Year

If checked, this indicates that payments in Box 1 cover an academic period that starts in the first three months of the next calendar year, affecting which tax year the deduction or credit applies to.

Box 8 – Checkbox: At Least Half-Time Student

Check this box if the student was enrolled at least half-time in any academic period during the calendar year. This status can affect eligibility for certain education credits.

Box 9 – Checkbox: Graduate Student

Mark this box if the student was enrolled in a graduate-level program, such as a master’s or doctoral degree.

Box 10 – Insurance Contract Reimbursements or Refunds

Report the total reimbursed or refunded qualified tuition and related expenses paid by an insurer on behalf of the student. These amounts reduce the educational expenses eligible for credits.

Additional Key Information

- CORRECTED: Marked if the form corrects information previously reported.

- VOID: Indicates the form should not be used for tax purposes.

General Filing Guidelines

- Submit Copy A to the IRS and provide Copy B to the student by January 31 of the year following the tax year in question.

- Keep copies for your records.

- The form is essential for students to claim education credits accurately on their tax returns.

- Institutions should refer to IRS publications including 970 and 1179 for detailed guidance on education credits and information return filing requirements.